Euro-to-Dollar Rate in the Week Ahead: Breaking Lower as Turkey Crisis Jilts Markets

- EUR/USD breaks lower out of triangle pattern, in volatile descent.

- EUR/USD pair is forecast to reach target between 1.1200 and 1.1320.

- Contagion from Turkey crisis, USD data the main events for EUR/USD.

© Pound Sterling Live

The Euro-to-Dollar rate fell sharply at the end of last week due to fears that contagion from the Turkish currency crisis could undermine financial stability across the Eurozone.

The pair broke below the key 1.1500 level, previously seen as a hard floor, and in the process broke out of the bottom of a triangle pattern on the charts.

Above: EUR/USD rate shown at daily intervals.

Although the pair fell to lows of 1.1388 during the initial thrust lower, the pair will probably fall further, eventually reaching a target at approximately 1.1310.

This is calculated by taking the height of the triangle and extrapolating it lower by a ratio of 0.618, which is the 'golden ratio'. According to Elliot Wave analysis, the currency is in the final 5th wave lower of a down-cycle that began at the 1.25 February highs.

After this final 5th wave completes, the market will probably turn around quite forcefully as the new up-cycle begins. The final wave lower is headed for a target in the 1.1200-1.1320 area, according to analysis by Alex Geuta, an Elliot Wave analyst at FX broker liteforex.com.

Above: EUR/USD shown at daily intervals.

The Euro: What to Watch

Probably the most important factor for the Euro in the week ahead will be how the Turkey drama pans out - will it end with a feast and 'goodwill to all men' or the proverbial 'shoot'.

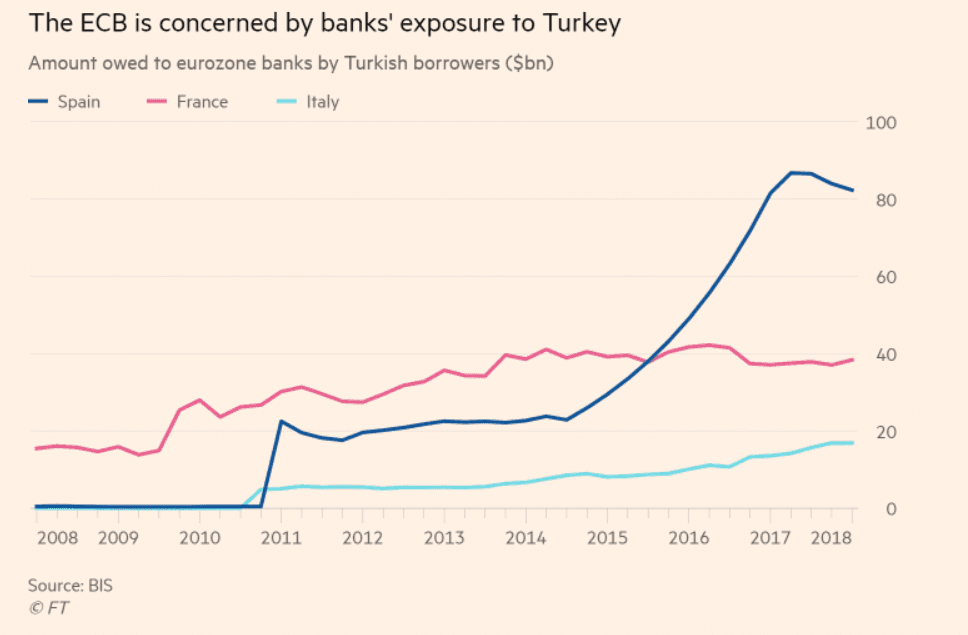

The Euro sank on Friday after the Lira lost yet over 15% of value taking its overall damage toll to 35% since the start of the year, amidst fears raised by the European banking watchdog about the exposure of European banks, especially those in Spain, France and Italy to Turkish debt.

The lenders most exposed are Spanish banking giant BBVA, French lender BNP Paribas, Italian bank Unicredit and Dutch lender ING.

Above: Source: Financial Times.

"The European Supervisory Mechanism", the body set up by the European Central Bank (ECB) to oversea Europe's biggest banks, "does not yet view the situation as critical. But it sees Spain’s BBVA, Italy’s UniCredit and France’s BNP Paribas, which all have significant operations in Turkey, as particularly exposed, according to two people familiar with the matter," say Claire Jones, Ayla Jean Yackley and Martin Arnold, all correspondents for the Financial Times.

The Euro weakened as fresh contagion concerns led investors to speculate the ECB may slowdown its tightening programme - a move which would be negative for the currency. The ECB is concerned borrowers may not be hedged against the weak Lira.

Turkey's own banks are also exposed and in a recent note by Goldman Sachs, a move to 7.10 in the USD/TRY would largely erode all their excess capital, raising the possibility of Turkey's banks going under. So there is risk from Turkey, but what of hard data releases in the region?

There are no major numbers out in the week ahead but there are revisions to second quarter GDP and inflation. Also, the ZEW economic sentiment survey, which is a leading indicator of activity in the Eurozone's largest economy.

On Tuesday the 2nd estimate for Euro-area GDP is expected to show the region grew by a slightly slower 0.3% in the second quarter, down from 0.4% previously, when it is released at 10.00 am London time. This is expected to translate into a slower 2.1% rise on an annualised basis, down from 2.5% previously.

Slower growth in line with these revisions could weigh on the Euro. The final estimate for inflation in July is also forecast to show a -0.3% fall from 0.1% in the previous estimate, when it is released at 10.00 am on Friday, August 17. The yearly figure is expected to show a 2.1% rise, up from 2.0% previous estimate.

Core inflation is forecast to be revised up to 1.1%, from 0.9% previously. The Eurozone Current Account is forecast to show a reduction in the surplus to €4.6bn in June when the number is released at 9.00 am on Friday, from €36bn previously.

The ZEW economic sentiment index is forecast to show a -16.4 result from -18.7 in the previous month. The survey asks financial professionals for their opinion on the outlook for the Eurozone economy. A deeper decline might weigh on the single currency as this highly respected survey is taken quite seriously as a barometer by the markets.

The US Dollar: What to Watch this Week

There is a high number or economic data releases out of the US in the week ahead but most of them are unlikely to be market moving unless they disappoint.

The Dollar has grown used to a period of solid US economic outperformance relative to the rest of the world, and we reckon the currency might be vulnerable to any disappointments going forward.

The US-initiated trade war and sanctions (Iran, Russia, Turkey) have raised tensions," says Michael Gapen with Barclays in New York. "While data look set to remain resilient in the short term, we expect the constant threat of escalation to gradually and increasingly weigh on H2 18 activity."

The first big release is retail sales on Wednesday at 13.30 B.S.T, which is forecast to show a 0.1% rise in July compared to the previous month. Core retail sales, which excludes autos and fuel, is expected to show a 0.3% rise in July.

"Revision to US national accounts suggests a reduced propensity to spend extra income consistent with higher future saving rates," warns Gapen. "We are a little less optimistic than consensus regarding data forecasts and expect US production to contract."

Industrial Production, out at 14.15 on Wednesday is forecast to show a 0.3% increase. The next important release is building permits, which is expected to show a 1.4% rise in July compared to the previous month, when released at 13.30 on Thursday.

Housing starts, which showed such a massive -12.4% decline in the month before, are out at the same time and expected to reveal a 7.4% rebound in July. The Philadelphia Fed Manufacturing Index is out at the same time and expected to come out at 22.3 from 25.7 previously.

The big release on Friday is the University of Michigan sentiment gauge for August, which is expected to come out at 98.1 when it is released at 15.00, a rise from 97.9 previously. There is a also a fair amount of oil related data, including an OPEC report on Monday, Crude Oil Inventories on Wednesday and API weekly stock on Tuesday.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here