Euro-Dollar Forecast Lowered, But No Parity: Nordea

- Written by: Gary Howes

Image © Adobe Images

Nordea Bank anticipates that the Dollar will maintain its strength against the Euro throughout 2025 due to the economic divergence between the US and the Euro area; however, it says not to bet on parity just yet.

Announcing a forecast downgrade for the Euro to Dollar exchange rate (EUR/USD) for 2025, Nordea says risks that favour downside include political instability, trade wars, and a lack of improvement in economies outside of the U.S.

According to Nordea Markets' research, the Dollar is expected to remain strong in 2025, possibly even becoming much stronger.

"There is also the potential for an even stronger dollar in the scenario of an aggressive trade war between the US and the rest of the world. Potential tariffs could put downward pressure on already weak economies outside the US and put upward pressure on US inflation, which would increase the odds that the Fed will adopt a hawkish stance," says Philip Maldia Madsen, Macro strategist at Nordea.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Here's a breakdown of their forecasts and the factors influencing them:

Diverging Economies: The primary driver for the strong dollar is the divergence between the US economy and the Euro area.

The U.S. economy has remained strong, while the Euro area and most other economies have slowed down. This trend is expected to continue, favouring the Dollar.

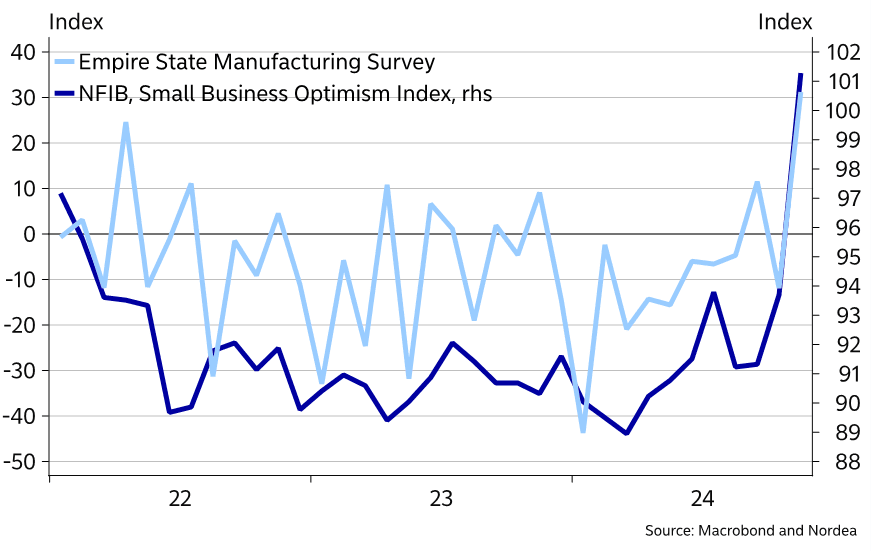

Above: "Several US sentiment indicators have skyrocketed since the election" - Nordea Markets.

Central Bank Policy: The Federal Reserve (Fed) is expected to cut its policy rate to 4.25%, while the European Central Bank (ECB) is expected to cut its policy rate to 2.25%.

This difference in policy rates is not expected to weaken or strengthen the foreign exchange rate significantly.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Political Risks: Political instability in Germany and France could further depress the European economy. In contrast, tax cuts in the US could increase demand and potentially reverse progress on inflation.

Trade War: An aggressive trade war between the US and the rest of the world could put downward pressure on already weak economies outside the US, and could push the dollar below parity versus the euro.

It is anticipated that tariffs could increase the odds of the Fed adopting a hawkish stance.

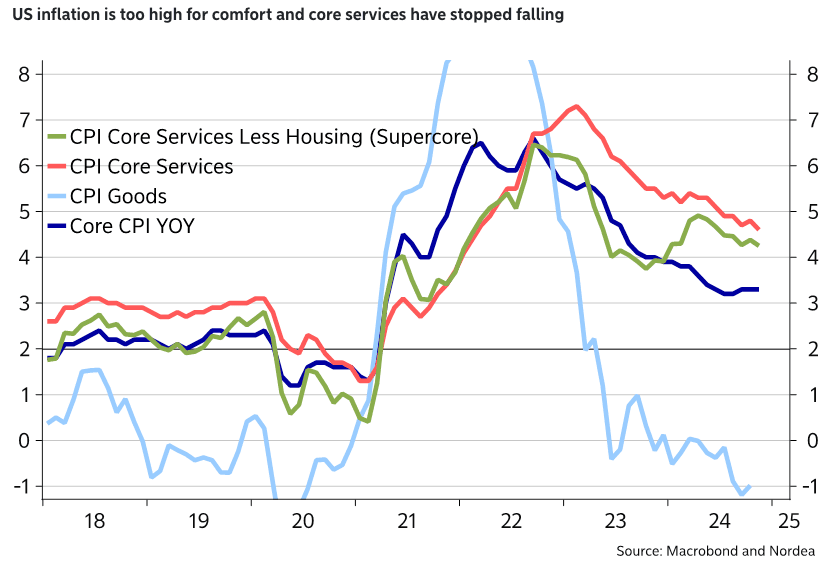

Above: "US inflation is too high for comfort and core services have stopped falling" - Nordea Markets.

Capital Flows: Despite the possibility of capital outflows due to expensive US assets, a substantial weakening of the dollar is unlikely without a clear and meaningful economic improvement in foreign economies.

The strength of the US economy is likely to continue attracting capital to dollar-denominated assets, reinforcing its dominance.

Rate Cuts: The Fed is expected to cut rates by 25 basis points this week but is expected to slow the pace of cuts.

The ECB is expected to continue cutting rates by 25 basis points at every meeting until April of next year.

Inflation: US inflation is too high for comfort.

There are concerns that the US economy may already be operating at full capacity and that further rate cuts could create a new inflation problem. The ECB is still aiming to bring rates back to neutral territory.

EUR/USD Forecast: Nordea Markets is lowering its mid-2025 EUR/USD forecast to 1.02 from 1.03 and its end-2025 forecast to 1.05 from 1.07.

"We would not be surprised if tariffs would push the dollar below parity versus the euro," says Madsen.