Euro-to-Dollar Rate Week Ahead Forecast: Short-Term Strength seen in the Charts

- Short-term technicals are bullish

- EU summit key for the Euro re. Merkel's need for agreement on asylum seekers

- Key for EUR/USD will be whether broader Dollar bull run extends next week

Image © ARTENS, Adobe Stock

The Euro could well enjoy some gains against the Dollar over the coming week according to a set of technical studies of the EUR/USD exchange rate are correct and if the broader Dollar rally takes a breather over coming days.

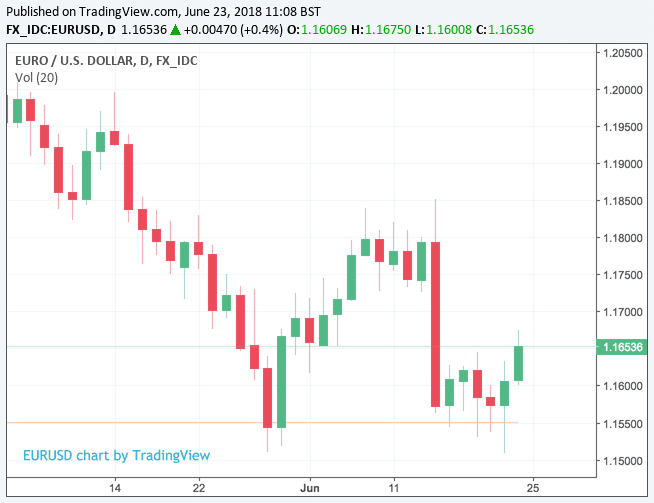

In the previous week we saw EUR/USD recover from a weekly low at 1.1532 and record a close at 1.1653; the price action was reflected in other USD-based exchange rates, particularly the GBP/USD.

Analyst Shaun Osborne at Scotiabank says the US Dollar index - a broad measure of overall Dollar performance against a basket of currencies - is said to have experienced "a significant turnaround".

"After having made a new high for the current move up Thursday, DXY price action formed a key reversal day signal on the charts (similar price signals were generated in USD trading versus the EUR and GBP), suggesting strongly that the recent rally in the USD has largely run its course for now," says Osborne in a recent client briefing.

His assessment of EUR/USD shows the exchange rate is now bullish in the short-term timeframe that would broadly cover the coming week.

"Short- and medium-term price signals turned bullish for EURUSD," says Osborne, referencing price action on Thursday, June 21 that witnessed an outside range signal forming intraday, and a bullish key reversal showing on the daily chart.

The signals reverse "the weak technical tone in the market that has persisted over the past week," says Osborne. "Follow-through EUR buying has moderated somewhat through the upper 1.16s and we should be under no illusion that the EUR still has a lot of work to do in order to gain materially."

"However, the bounce from the 1.15 point—again—does firm up support for EUR and opens the door for spot to retest the topside of the range (1.1800/50) in the next week or two perhaps. 1.1850 is now key resistance," adds the analyst.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

The Dollar's Week Ahead

What has been driving the Dollar higher of late?

The difference in policy settings between the US Federal Reserve and other central banks is key - where the Fed is raising rates, the rest of the world are either doing so at a much slower pace, or not at all.

This creates a divergence that has been playing in favour of the Dollar as investor capital flows from areas where interest rates are low to where they are higher as investors seek better returns.

US trade policy is now also a big factor that appears to be working in favour of the Greenback - as US President Trump ups the ante on trade tariffs, so markets have been seen running scared in anticipation of slowing global growth rates and investors have been seen liquidating a portion of their holdings; often they are liquidated into Dollars. Hence, trade war rhetoric is playing positive for the Dollar for the time being.

In the week ahead keep an eye on the headlines and Trump's next moves, there is a good chance he will turn his guns on Europe having focussed on China over recent days. Indeed, threats of tariffs on European cars are now being reported.

We would expect the broader topic of investor risk appetite to be the main driver for the currency.

On the US economic docket, we are watching new home sales on Monday, due for release at 15:00 B.S.T. The reading for May is forecast to read at 667K. A beat on this figure could aid the USD which has drawn strength of late from the economy's strong performance.

Household confidence is key to the economy's ongoing strong performance.

Watch pending home sales on Wednesday, June 27 at 15:00 for a continuation of the above theme, markets are forecasting a 0.6% increase for May.

On the same day, but out at 13:30 we have durable goods orders for May due, this should also provide evidence of how the economy is performing. Markets are forecasting a reading of -0.6% on a month-on-month basis and a 0.4% for the core durable goods figure.

A beat or miss on the above could sway the USD in the short-term.

Thursday, June 28 sees a revision to the Q1 GDP numbers released, will the 2.2% figure be confirmed? As this is a revision we doubt it will have a sizeable impact on currency markets.

The Euro's Week Ahead

The European Council meeting set to run from June 28-29 could offer some intrigue for the Euro.

The key topic to monitor is that of migration as Germany will be seeking to form a new consensus concerning the matter at this week's meeting.

Migration has shot to the top of the political risk board for the Eurozone over recent days thanks to a disagreement in Angela Merkel's ruling coalition. Long-time partners the CSU are pushing for a more robust stance to be adopted by Germany with regards to taking in asylum seekers.

At issue are those asylum seekers arriving at German borders having already registered for asylum in other EU countries. The CSU believe they should not be granted entry into Germany and the head of the CSU - who serves as interior minister - has threatened to unilaterally block their entry in the future.

This would likely force a breakdown in the coalition and draw questions on Merkel's leadership.

Merkel will therefore be seeking agreement with other EU leaders to allow her to send asylum seekers back to the country they originally registered in; if she succeeds we would expect the political risk factor to quickly fade which could be a positive for the Euro.

However, migration is an incredibly tricky and destabilising topic for Europe at present, and we believe Merkel will find the route forward a difficult one to navigate.

Turning to the data docket, watch preliminary inflation numbers on Friday, June 29.

Annualised CPI inflation is forecast to read at 2.0% in June, a smidgen higher than the 1.9% recorded in May.

A 2.0% reading would put inflation on the European Central Bank's target, suggesting their ongoing policy of monetary stimulus is paying dividends.

However, the ECB recently warned it would delay the raising of interest rates until after the summer of 2019 owing to signs inflationary pressures are still lacklustre.

The Euro promptly fell on the news.

Could a surprisingly strong CPI reading this week help reverse some of those losses?

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.