Euro's Strong Start to 2018 Underpinned by Record Manufacturing Data

The Euro is off to a strong start in 2018 as the Eurozone's economic growth story continues with both Eurozone and German Manufacturing data confirming the Eurozone's expansion continues.

The Euro marches higher at the start of 2018, moving back up above the key 1.20 bar versus the Dollar (current market rate 1.2058) and approaching the key September highs at 1.2094, which were also the all-time highs for 2017.

With traders returning to their desks after the Christmas break, expect volumes to pick up once more which could provide more volatility in Euro exchange rates which could in turn trigger fresh highs.

Determining direction at the start of the new year is manufacturing data with German manufacturing PMI reading a record high at 63.3 in December - in line with economist forecasts.

The reading confirms strong expansion in the Eurozone's largest economy and will likely underpin the Euro's advance.

"Production growth reached a level not seen since early-2011, buoyed by one of the fastest rises in new export orders ever recorded in the survey’s near 22-year history," says a note from IHS Markit who compile the report.

Production of goods rose sharply at the end of the fourth quarter, with the rate of growth having accelerated for the second month running to the fastest seen for almost seven years.

“The goods-producing economy carries strong momentum into 2018, with new order growth at its highest for almost eight years and rising backlogs of work pointing to the need for further expansion in capacity. Business confidence rebounded back up to an elevated level by historical standards in December, further adding to the positive outlook," says Phil Smith, Principal Economist at IHS Markit.

Yet the positive data was not confined to Germany as the whole of the Eurozone also recorded record-breaking Manufacturing growth too in December.

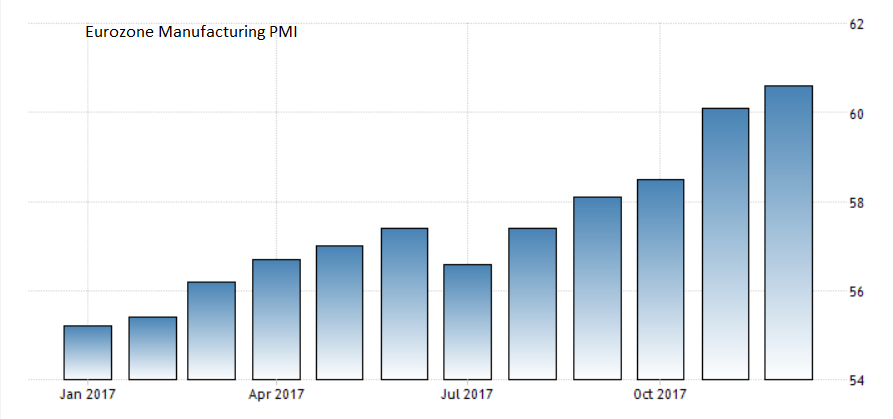

Eurozone-wide manufacturing PMI in December came out at 60.6 - inline with the preliminary reading.

"The eurozone manufacturing sector ended 2017 on a high note. Strong rates of expansion in output, new orders and employment pushed the final IHS Markit Eurozone Manufacturing PMI® to 60.6 in December, its best level since the survey began in mid-1997," said the official report from survey compilers Markit.

Forward looking indicators in the survey such as 'New Orders' were particularly positive, whilst 'Purchasing Growth' and 'Jobs' components also held up well as companies readied themselves for higher production, commented IHS Markit's Chief Business Economist, Chris Williamson.

The main growth area was manufactruing of what are called 'investment goods; which are things like plant and machinary.

“Perhaps most encouraging of all is the extent to which the strongest upturn is being recorded for producers of investment goods such as plant and machinery, which highlights the upswing in business investment," said Willamson.

Manufacturing PMI is a survey-based indicator which quantifies the results of interviews with key managers in the Manufacturing sector.

A result above 50 indicates expansion and below contraction; a result above 60 is a rare occurrence and is a particularly positive sign.

(Image courtesy of tradingeconomics.com)

Despite only being a survey-based data-set PMI's are considered quite accurate leading indicators so the market takes them seriously.

Coming back to EUR/USD, we now see he exchnage rate pushing up towards the September highs.

A clear break above them would open the way higher, although ideally, we would want to see a clearance above 1.2140 for confirmation of a substantial extension to the next target at 1.2220, as outlined in our week-ahead analysis published at the weekend.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.