French Election: Best and Worst-case Scenarios for the Euro

- Written by: Gary Howes

File image of Jean-Luc Mélenchon. Should his left-wing coalition win, markets will come under pressure. Image: Pound Sterling Live / Jean-Luc Mélenchon.

The Euro playbook:

Upside (near-0%): Macron's party wins. Chances are near 0%

Base case: hung parliament, RN wins most votes

Downside case (20%): majority for RN

Notable downside: far-left wins the vote

Significant downside: far-left wins a majority

France will vote on Sunday in the first of two elections to decide who holds the legislature. Investors will vote on the outcome in the Euro and bond markets.

French bond yields will give a clear indication of how markets are thinking when French markets open on Monday morning. But before that, foreign exchange markets would have already had a say and all eyes will be on the Euro to Dollar exchange rate when Asian markets open.

"President Macron's alliance holding a majority (a very unlikely scenario looking at the latest polls) will likely lift EUR-USD back above 1.09," says Roberto Mialich, FX Strategist at UniCredit.

The market's base case expectation is that Marine Le Pen's RN will win the two-round vote but not secure a majority.

According to analysts we follow, the Euro's outcomes in this base-case scenario range from negative to softly positive. There are no outright bullish calls under such a scenario, but the Euro could claw back some recently lost ground.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"If the French election results in a cohabitation with a hung parliament, our base case economic outlook for the eurozone remains on track. That should see French equities recover after the second round of the elections, offering a potential entry point for investors," says Dr. Nannette Hechler-Fayd’herbe, an economist at Lombard Odiear.

However, Mialich says Euro-Dollar "might fall again to 1.06 and below if a hung parliament emerges from the French vote.

Chris Turner, head of FX research at ING Bank, says the Euro has stabilised over recent days as RN has been saying "the right things" to placate markets, realising a negative market reaction would torpedo their chances of success.

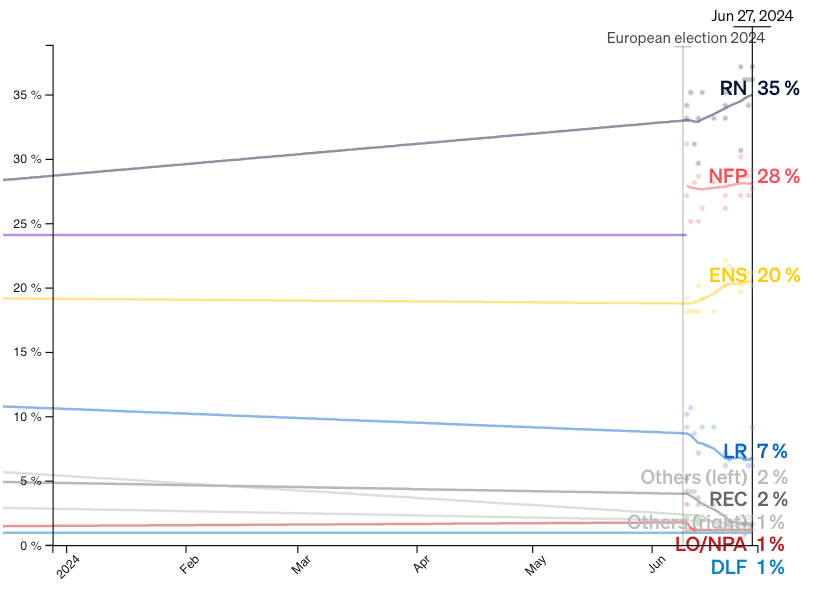

The Economist's survey of polls.

Nevertheless, RN plans to cut €7BN in taxes, which will only be partially funded by slashing France's contribution to the EU budget.

"Our eurozone macro team sees continued stress here, and we would therefore warn against chasing EUR/USD back to and over 1.08, since there are still many possibly bearish chapters to play out here," says Turner.

ING expects that the euro will struggle to sustain a rally over the coming weeks. "EUR/USD may therefore struggle to break to the topside of its 1.0660-1.0760 range," says Turner.

RN Majority

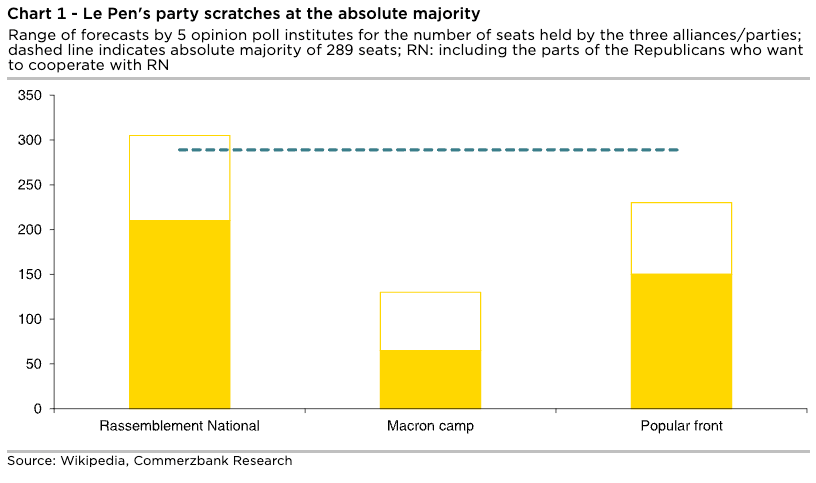

Pollsters are coy about calling the final outcome of the vote based on existing polls, as the two rounds of votes present difficulties. However, Elabe's polling for BFM TV said RN could potentially cross the 289-seat bar for an absolute majority, placing the party and its allies in a 260 - 295-seat range.

UniCredit's Mialich says the exchange rate might break through 1.05 if RN gets a clear-cut majority after the second round on July 07.

"If a new parliament emerges with a governing majority, we expect a more uncertain economic outlook for the eurozone. This would create the greatest risks for other European assets such as eurozone sovereign bonds and the euro. We would expect French equities to continue selling off, especially in the case of a left-wing majority French government," says Hechler-Fayd’herbe.

Worst-case for the Euro

Currency strategists agree the worst-case outcome for the Euro is if the far-left coalition (New Popular Front) wins the vote, something that is not out of the realms of reality given the uncertainties posed by France's two-stage election process.

"The two-round voting system disproportionately favours the largest parliamentary groups, which means that either RN or NFP could get enough seats to form an outright majority," says Ingvild Borgen, Senior Economist at DNB.

Pound Sterling Live reported earlier today that under such an outcome, Pound-Euro could even go as high as 1.22 as the Euro takes a cold bath.

"A majority for the left-wing alliance could result in a soaring government deficit in view of its election program and therefore scare the markets even more," says Antje Praefcke, FX Analyst at Commerzbank.

"The market has a choice between plague or cholera, as a majority for Macron's camp seems unlikely," adds Praefcke.

HSBC says the risks of "fiscal slippage" (a spending boom without the required increase in income) would be significant in the event of the New Popular Front's election victory.

The New Popular Front's manifesto includes several costly pledges, such as reducing the legal retirement age to 60 (from 64), increasing the minimum wage and civil servants’ compensation, or indexing wages and pensions to inflation.

"A fiscal slippage would also raise the risk of clashes with the European Commission, which has opened an Excessive Deficit Procedure (EDP) against the country. There could also be consequences for the rest of the EU: if France were to clash with Brussels and seek special treatment or drag its heels on deficit reduction, then other countries might feel they could do the same, which would hurt the credibility of the new EU fiscal rules," says Chantana Sam, Economist at HSBC.

The NFP is a coalition of left-wing parties that includes Jean-Luc Mélenchon’s France Unbowed, the Socialist Party, the French Communist Party and the Greens. It plans to raise the monthly minimum wage to €1,600, impose price ceilings on essential foods, electricity, gas and petrol, repeal Macron’s deeply unpopular decision to raise the retirement age to 64 and invest massively in the green transition and public services.

Prime Minister Gabriel Attal said their agenda would present France with a "fiscal drubbing".

"It seems like the risk of a left-wing majority is seen as a tail risk for now," says Evelyne Gomez-Liechti, Rates Strategist at Mizuho.