EUR/USD Week Ahead Forecast: U.S. CPI Poses Risk ahead of ECB

- Written by: James Skinner

- EUR/USD stalled by resistance near 1.06 on charts

- U.S. CPI data could prompt setback ahead of ECB

- If surprise increase invites 'hawkish' Fed forecasts

- Uncertainty over size of ECB's latest rate increase

- ECB's QE unwind potentially a risk for EUR/USD

© European Central Bank, reproduced under CC licensing

The Euro to Dollar exchange rate has held onto much of November's gain in early December trade but technical resistances continue to frustrate its path above 1.06 and Tuesday's U.S. inflation data is likely to be decisive of whether it can overcome those obstacles on the charts in the week ahead.

Europe's single currency was bought with Dollars being sold heavily in November as financial markets bet that inflation in the U.S. and elsewhere is on the cusp of a protracted decline and data out this Tuesday will either confirm or beg to differ over that notion, with implications for the Euro-Dollar rate.

The implications for Federal Reserve (Fed) interest rates will determine the Dollar trend into year-end and could potentially pull the Euro low enough to place the currently-nearby 1.06 handle beyond reach even in the event of a hawkish surprise from the European Central Bank (ECB) this Thursday.

"We note there is still a slight risk of the ECB doing 75bp rather than 50bp - which would probably help the euro. But this of course comes after the US CPI/FOMC risk," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"Given the 10% EUR/USD correction off the late September lows, our preference would be that EUR/USD struggles to hold any gains over 1.06 this week and could end the week lower should US events oblige," Turner adds while writing in a Monday market commentary.

Above: Euro to Dollar rate shown at 4-hour intervals with Fibonacci retracements of November's post-CPI rally indicating possible areas of technical support for Euro. Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The economist consensus looks for U.S. inflation to have risen by 0.3% in November following a 0.4% increase in October and by 7.3% for the year to the end of November, following a 7.7% increase in the year to the end of October with similar declines anticipated for the more important core inflation rate.

Core inflation is expected to rise by 0.3% following a 0.3% increase in October and by 6.1% for the year to the end of November following a 6.3% increase in the year to the end of October and whether these expectations turn out to be correct will have a significant bearing on Wednesday's Fed decision.

Wednesday's Fed decision is widely expected to see the top end of the Fed Funds interest rate range lifted by half a percentage point to 4.5% but more important will be policymakers' judgement about whether rates will need to be lifted above the 4.75% peak suggested back in September's forecasts.

This detail will be communicated through new forecasts out on Wednesday and that will have scope to impact significantly on U.S. bond yields and the Dollar less than 24 hours out from the ECB's final interest rate decision for this year over which there is uncertainty in financial markets.

"In our view, EUR can lift if the USD falls and if the ECB is more hawkish than markets expect," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

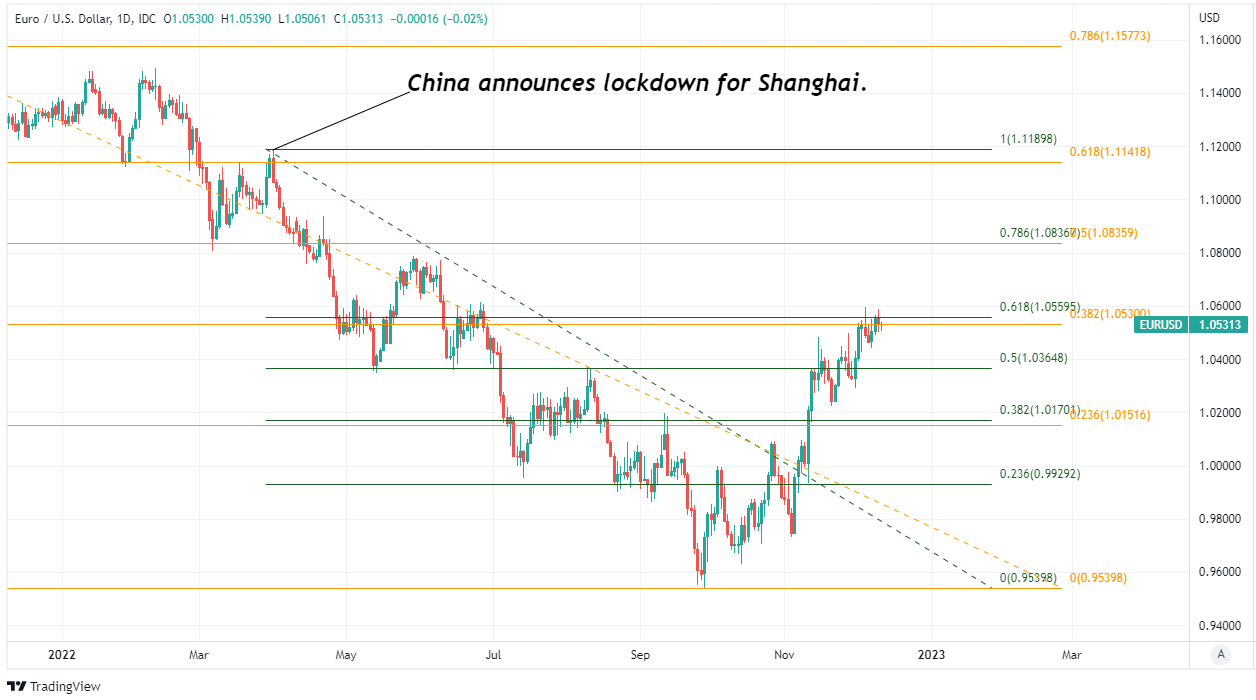

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of March 2022 and June 2021 declines indicating possible areas of technical resistance for Euro. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

"Market pricing has settled closer to a 50bp rate hike than a 75bp hike, in part because of the dip in headline inflation in November. We judge ECB policymakers do not think the inflation outlook has necessarily improved," Capurso and colleagues write in a Monday look at the week ahead.

Thursday's ECB decision is widely expected to culminate in its fourth increase in interest rates since July but with uncertainty over the size of the increase as well as the Governing Council's stance on the outlook for the months ahead.

This week's policy decision is also expected to contain details about the ECB's plan to begin shrinking a balance sheet that has been significantly enlarged by the various quantitative easing programmes announced since January 2015 and there is further uncertainty over how the markets are likely to respond to that.

"In the Euro area, sovereign purchases primarily act to ease credit conditions. As a result, ECB QE supports the Euro, and unwinding the balance sheet should weigh on the currency at the margin," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"To be clear, our economists expect monthly caps to allow only a gradual portfolio runoff, but there are still potential pitfalls in this process and it is important to keep in mind that ECB tightening is starting to turn towards less FX-positive instrument," Cahill and colleagues write in a Friday research briefing.

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of March 2022 and June 2021 declines indicating possible areas of technical resistance for Euro. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.