Euro-Dollar Falling to Parity Would Ignite Fireworks: ING

- Written by: Gary Howes

Image © Adobe Images

The probability of the Euro falling to parity against the Dollar have risen says ING, adding that when it happens the foreign exchange market will likely witness fireworks.

This is according to a new currency research note from the Dutch based international lender and investment bank which comes as the Euro to Dollar exchange rate (EUR/USD) records a 1.50% decline this week.

It is down from an open of 1.0416 to record a low of 1.0161, a fall which adds to the declines of 1.24% recorded in the week prior. This means those making international payments are already seeing levels below parity in their bank accounts, but independent FX providers are still able to offer around 1.0140 at the time of writing.

The exchange rate is in a concerted downtrend and has raised expectations for a monumentus test of the psychologically significant 1.0.

Analysts at ING say clients of their commercial and investment banking arm have been questioning them as to what such a development means for the outlook of the exchange rate.

"1.00 is probably the biggest psychological level around in FX and fireworks look likely," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank.

Fears of a global recession have hit the pro-cyclical currencies such as the Pound and Euro but has favoured the safe-haven and ultra-liquid Dollar.

For the Euro the outlook has been made all the more difficult by the energy shock that has resulted from Russia's invasion of Ukraine.

The Dollar's strength is meanwhile aided further by the Federal Reserve's confident stance on interest rates that leaves markets anticipating a further 165 basis points of hikes over the remainder of 2022.

This contrasts to the 130 points expected to come from the European Central Bank, an ask that looks increasingly unlikely given the rapidly deteriorating economic outlook facing the bloc.

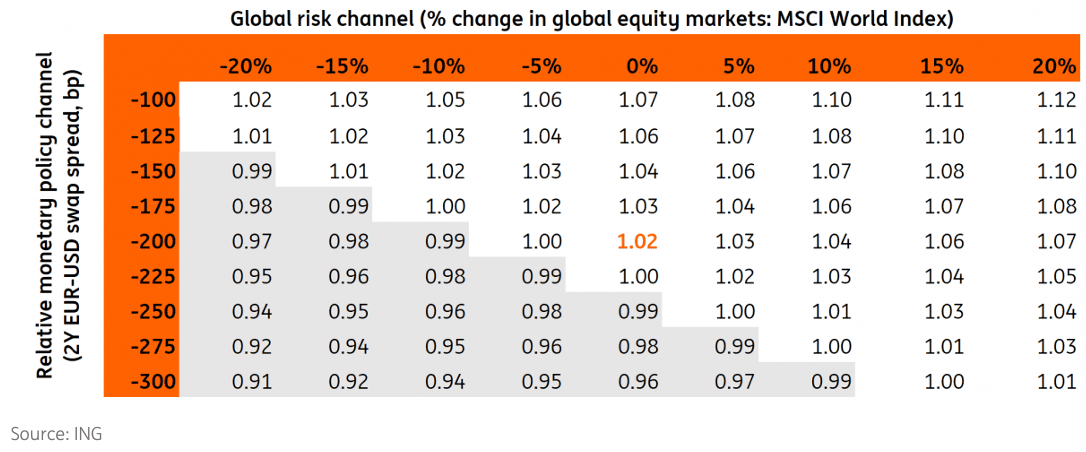

The resulting ECB-Fed interest rate differential would be expected to favour the Dollar over the Euro in a dynamic encapsulated in the below grid created by ING.

It offers a guide to potential EUR/USD levels going forward:

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The bottom-left grey area shows under what circumstances ING believe could see EUR/USD trade below parity in the near term.

"Even assuming that markets price in/out the same amount of tightening off the Fed and the ECB curves – so that the 2Y EUR-USD swap rates remains around the current 200bp - a further drop in global equities by 10% (not an extreme scenario given growing recession fears) would be sufficient to bring EUR/USD below 1.00," says Turner. (Set your FX rate alert here).

But a stabilisation in global risk sentiment would mean that EUR/USD should hold above parity unless more ECB tightening is priced out of the swap curve.

"A more realistic scenario could see a more moderate widening in the Fed-ECB policy differential (25bp in the 2Y swap spread) as markets price one hike off the ECB rate path and a relatively contained drop in equities (-5%) from current levels. That combination would also be sufficient to press EUR/USD below parity, according to our calculations," says Turner.

Should the Euro-Dollar reach parity it could be technical and strategic investor behaviour on options markets that could dictate moves.

"Psychological levels play a major role in FX markets – and no doubt amongst policymakers and the electorate alike. Just look at the way USD/CHF fell 5% within a week of touching highs of 1.00 both in May and June. Equally big psychological levels play a major role in the FX options market, where barriers or triggers can effectively either nullify or bring to life option structures once a particular level is hit," says Turner.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Turner offers a useful example of a speculator wanting to position for a lower EUR/USD, but wanting to cheapen the structure by having a ‘Knock-out’ at 1.00.

"Should 1.00 trade, the speculator’s position evaporates and questions whether he/she wants to re-apply bearish EUR/USD strategies down at these levels. Were 1.00 to break we would expect volatility to pick up sharply and most likely EUR/USD to gap lower," says Turner.

How low could EUR/USD go over the next four weeks?

ING has looked at the FX option markets for expected ranges.

"Based on the current pricing of EUR/USD implied volatility, a one standard deviation move could see EUR/USD as low as 0.9873, while perhaps a worst case, two standard deviation outcome could see EUR/USD as low as 0.9545," says Turner.

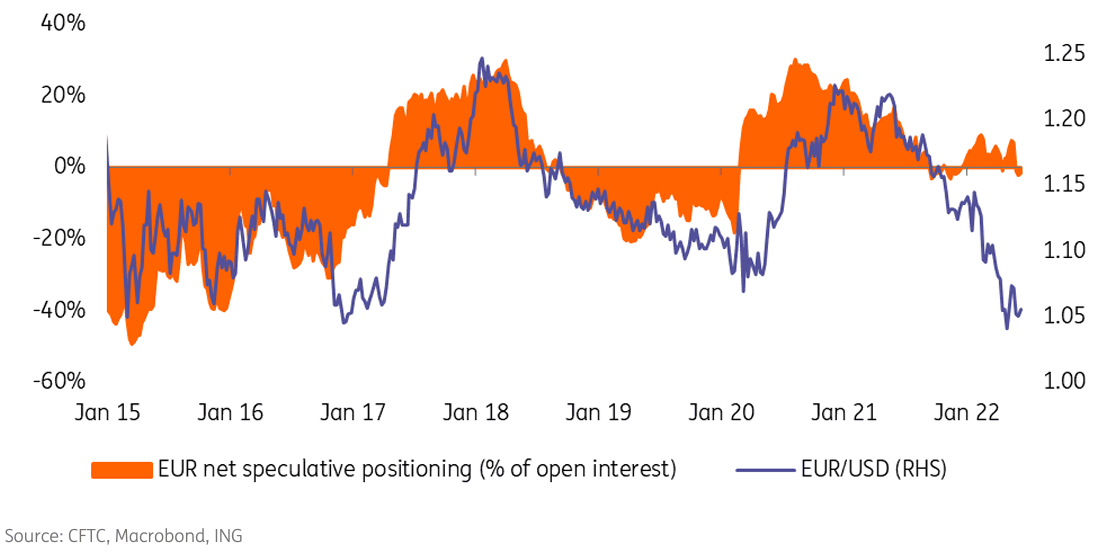

Above: "EUR/USD doesn't look oversold" - ING.

Taking the latest developments ING now sees a lower range of trade in Euro-Dollar.

"Our point forecasts have favoured EUR/USD trading a highly volatile range around 1.05 over the summer, before turning slightly higher in year-end as conviction grows over the Fed easing cycle. Downward adjustments to Eurozone (especially German) growth forecasts on the back of the energy shock warns that this highly volatile range may centre on 1.00 rather than 1.05," says Turner.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes