Euro in Sharp Drop against Dollar, Pound Sterling as Russia Turns the Gas Taps Off

- Written by: Gary Howes

Image © Adobe Images

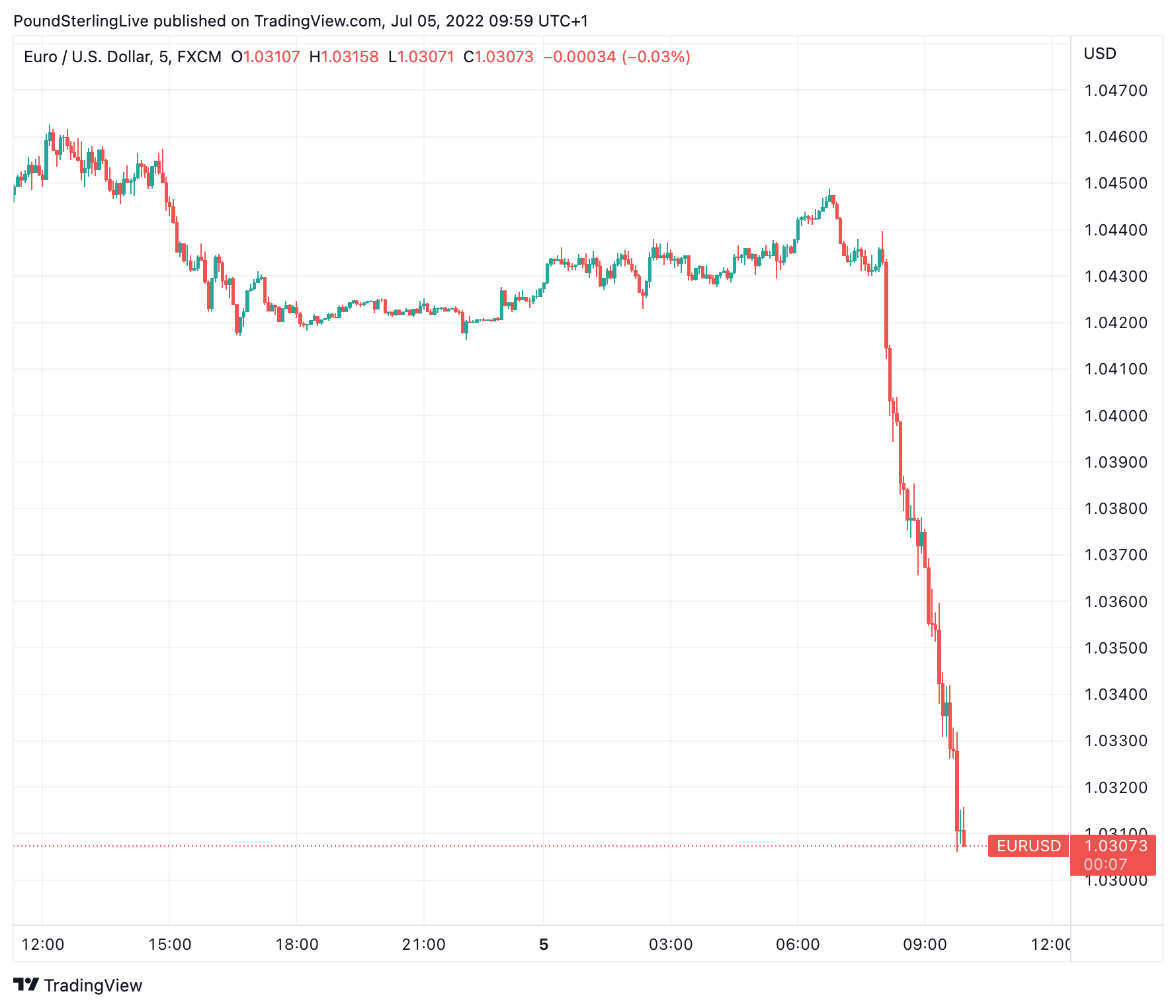

The Euro has fallen to its lowest level since 2003 against the Dollar and is on the back foot against the Pound and other majors as Eurozone energy prices surge following reports Russia has shut a key gas transit pipeline.

The Euro was sold aggressively from 8:00 AM London time, which is when the opening bell in London rings. The declines in the single currency against the Dollar means some banks are now charging rates below parity for some international payments.

"The slide lower in EUR/USD is reflective of the proximity of a recession in the Eurozone as the price for gas soars in the EU," says Bipan Rai, Head of North American FX Strategy at CIBC Capital Markets. "EUR/USD test of parity is now within reach. That’s bullish USD across everything else as well."

Above: EUR/USD at five-minute intervals.

Headlines out just ahead of the London open confirmed European gas imports were squeezed further this morning with the Yamal-Europe pipeline being stopped.

German gas transportation operator Gascade said exit flows at the Mallnow metering point on the German border dropped to zero after earlier flowing at 2,190,136 kilowatt-hours per hour (kWh/h), the data showed.

The International Energy Agency says in their latest gas market review the share of Russian gas (including LNG) meeting total EU demand rose from 30% in 2009 to 47% in 2019.

The strong LNG inflow in 2020, amid global oversupply, depressed the share of Russian gas to around 40%, says the report, adding it stayed at a similar level in 2021, driven by Gazprom’s own strategy of reducing short-term sales to the bloc, despite spare supply capacity being available and high revenue potential on the export markets.

This strategy appears to be in play once more: the Yamal shutoff comes a day after gas prices spiked on news of industrial action due to take place in Norwegian gas fields.

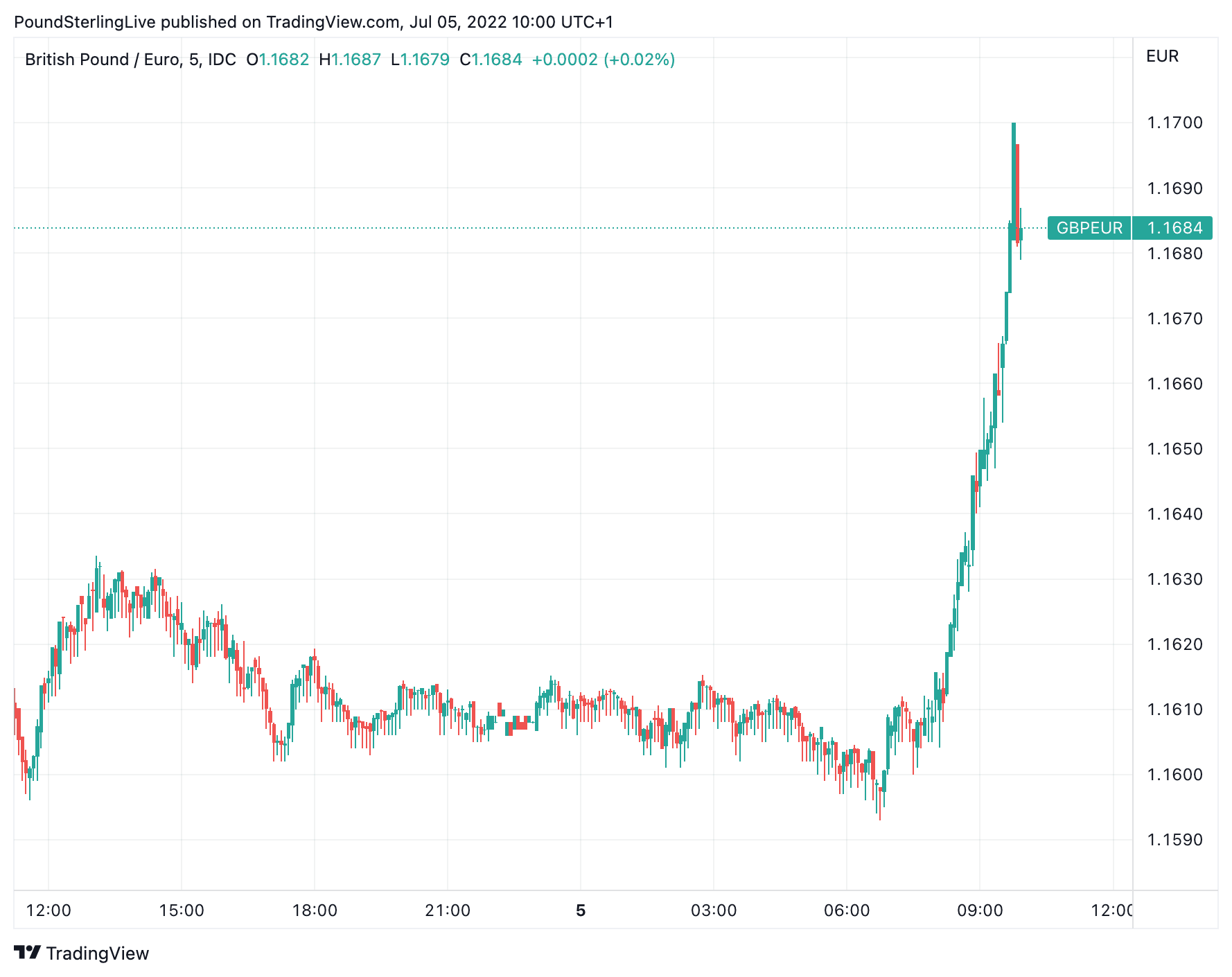

For now this appears to be a Euro-specific issue given the market has not punished Pound Sterling to the same degree:

Above: GBP/EUR at five minute intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The UK is also facing eye watering gas price hikes but it must be noted that foreign exchange markets have been trading the narrative of the UK being the biggest victim of this energy crisis for some time. It is well within the price of the Pound by now.

Adding some pro-GBP sentiment was the revision higher of the final June PMI data for the UK, according to a scheduled data release by S&P Global.

This underscores how there currently appears to be a sentiment shift against the Euro amongst investors.

"A gas supply crisis would be a Europe-specific problem. If things turn out as badly as that, it would only affect Europe, would only affect the ECB’s monetary policy and would therefore constitute a reason for idiosyncratic EUR weakness," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

At the time of writing the Euro to Dollar exchange rate is quoted at 1.0312 on the spot market, but some banks are now providing rates below parity although specialist money transfer providers are offering rates closer to 1.02.

The Pound to Euro exchange rate is meanwhile two-thirds of a percent higher at 1.1687, which gives bank account rates of 1.1360 and specialist payment rates at around 1.1650.

Money markets are meanwhile showing a rapid reappraisal of the number of interest rate hikes the European Central Bank will deliver over coming months.

German ten year bond yields have fallen sharply amidst this recalibration.

The decline in yields mechanically draws support away from the Euro as investors look for better returns in other markets.

Eurozone bond yields had risen sharply over the spring period as the ECB performed a 'hawkish' shift in guidance and confirmed it will hike rates in July and then again in September.

This proved supportive of Euro exchange rates.

However, given the scale of the pressures facing the Eurozone economy the market is betting the first hike will be of 25 basis points and not 50.

The total number of hikes the ECB will be able to deliver are also coming down.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes