Euro, Europe and ECB Could Benefit from QTQE Approach to Fragmentation

- Written by: James Skinner

"I will argue that the vulnerability to such fragmentation risks will only disappear with fundamental changes to the euro area’s institutional architecture. Therefore, monetary policy needs, at times, to respond to market developments that undermine the smooth transmission of monetary policy," Isabel Schnabel, European Central Bank.

© European Central Bank, reproduced under CC licensing

The Euro could benefit if the European Central Bank (ECB) turns the European continent's fragmented economic landscape to its advantage by combining quantitative tightening (QT) with quantitative easing (QE) in order to normalise its monetary policy without upset.

There is currently no such thing as QTQE but it at least appears as if it would solve a problem that ECB staff have been hurriedly attempting to resolve since the Governing Council's unscheduled meeting last week and is a solution that could offer other benefits to the ECB, Euro and Europe's economies too.

The ECB could use its Pandemic Emergency Purchase Programme (PEPP) assets to carry out both quantitative easing and quantitative tightening in a way that augments the market form of monetary tightening where it is needed most while at the same time limiting that taking place in parts of the bloc where it's already more than sufficient.

"The pandemic has left lasting vulnerabilities in the euro area economy which are indeed contributing to the uneven transmission of the normalisation of our monetary policy across jurisdictions," the ECB said following its unscheduled meeting last Wednesday.

ECB policymakers acknowledged following their ad-hoc meeting that some action of the above nature is necessary to prevent a ruinous, if not entirely speculative run on the bond markets of some Euro area members.

This, if taken to the extreme, could force the bank to choose between allowing a financial crisis in Southern Europe or fulfilling its core mandate to restrain inflation at levels around the 2% target.

Above: Spread or gap between Italian and German 10-year government bond yields with prices of 10-year Italian and German government bond yields shown separately.

Above: Spread or gap between Italian and German 10-year government bond yields with prices of 10-year Italian and German government bond yields shown separately.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The ECB asked staff last week to "accelerate the completion of the design of a new anti-fragmentation instrument for consideration by the Governing Council," after the difference between Italian and German 10-year government bond yields widened to levels that were a cause for concern at the bank.

This outcome reflected mostly a self-fulfilling prophecy of market concerns about what might become of government finances and financial systems in places like Italy once the ECB begins raising its interest rate in July.

"Even before the European Central Bank (ECB) has hiked rates, Italian, Greek, Spanish and Portuguese spreads versus German bunds are widening amid a broad-based tightening of financial conditions across the Eurozone," says Holger Schmieding, chief economist at Berenberg.

Some analysts now expect the ECB to revive one of its crisis era initiatives such as the Securities Market Programme (SMP) of May 2010 or the Outright Monetary Transactions Programme (OMT) of August 2012 to ease financial conditions in parts of the bloc while tightening in other parts.

“Higher rates and the loss of QE as a backstop have allowed doubts to creep back in about the political commitment required to secure debt sustainability,” says Giovanni Zanni, chief Euro Area economist at Natwest Markets, who says the ECB will likely adopt a new OMT programme.

Both of the previously used programmes would, however, involve a complex process of "sterilisation" and in order to merely address the problem at hand.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

A QTQE approach could, on the other hand, enable the ECB to solve this problem using the existing resources of its PEPP programme and would provide an opportunity to better fight inflation in the parts of Europe where its ECB policy has been - possibly - too loose and for too long.

This would entail the ECB beginning to sell from its PEPP programme portfolio any bonds of Euro area members where there is a pressing need for monetary tightening and in order to fund purchases that would be intended to prevent excessive tightening in bond markets across other parts of the bloc where conditions are already sufficient.

"The euro area consists of 19 – soon 20 – different countries, each with its own economic structure, societal governance and fiscal policy. The natural consequence is that shocks that hit the euro area, be it a financial crisis, a pandemic or a war, affect each euro area country differently," says Isabel Schnabel, a member of the ECB's executive board and Governing Council.

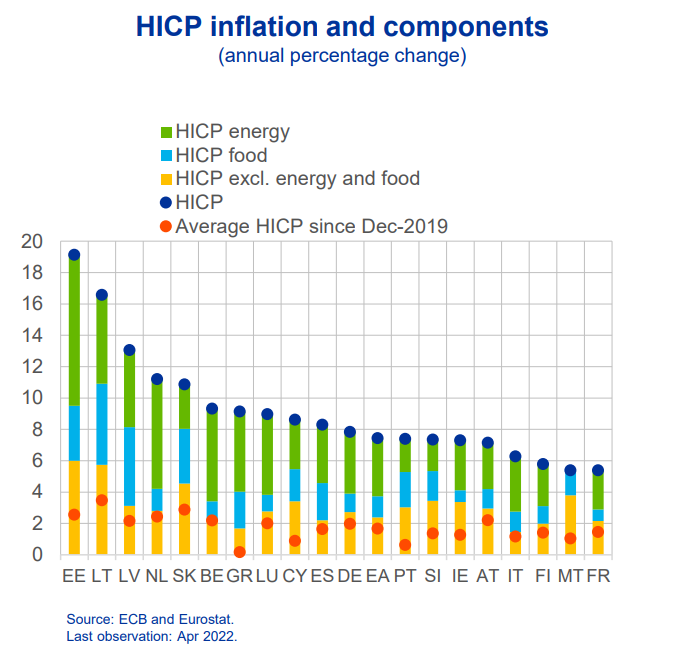

"Today’s inflation is a case in point. Harmonised consumer price inflation in the euro area as a whole is at a record high, reaching 8.1% in May according to the most recent flash estimate. But there are large and unprecedented differences across countries [image above]. In Estonia, for example, inflation stood at 20% in May, while it was less than 6% in Malta and France," Schnabel told graduates of the Panthéon-Sorbonne University in a speech last week.

There are many parts of the bloc that might benefit from this approach including some where the constraints imposed by the more fragile state of other members' finances has long been a source of political concern, if not some controversy.

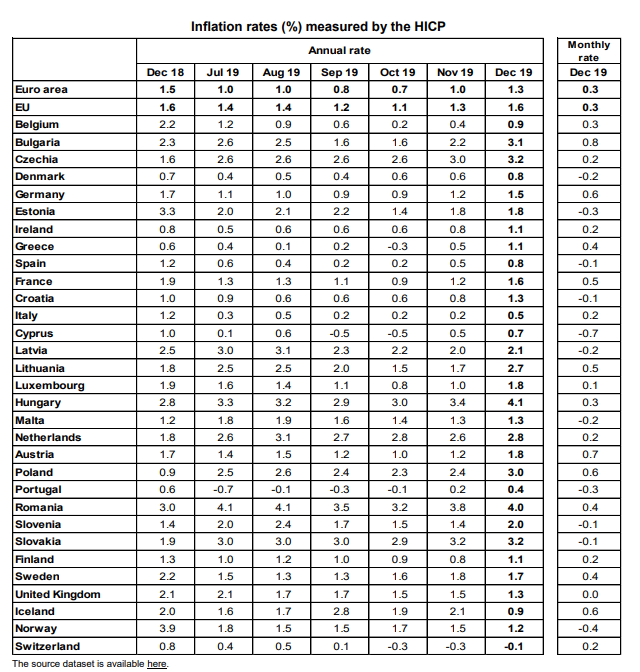

Above: Euro area inflation rates in December 2019. Source: Eurostat.

Above: Euro area inflation rates in December 2019. Source: Eurostat.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Southern Europe garnered the lion's share of market and media attention in recent weeks and could ye, conceivably see the inflation challenge in some parts of Central and Eastern Europe going underappreciated despite that it has been building in those parts since before the pandemic.

Countries like Estonia, Lithuania, Latvia, the Netherlands, Slovenia, Belgium and Luxembourg all already had inflation rates that were above the ECB's 2% target way back in December 2019, before the pandemic began, and some of them now have inflation rates that have reached double digit percentages.

In addition, some inflation rates are at multiples of the 2% target even when imported energy and food prices are overlooked.

"How countries produce and use energy accounts for a large part of these differences. But energy is only part of the story. The war, like the pandemic, has had differential effects on consumption, investment and fiscal policy, and hence on underlying price pressures. The pandemic was a stark reminder that such differences can seriously impede the conduct of monetary policy," the ECB's Schnabel said last week.

"I will argue that the vulnerability to such fragmentation risks will only disappear with fundamental changes to the euro area’s institutional architecture. Therefore, monetary policy needs, at times, to respond to market developments that undermine the smooth transmission of monetary policy," she added.

It's for all of these reasons that some national central bank chiefs on the ECB's Governing Council may even welcome the prospect of quantitative tightening coming so soon in the monetary policy normalisation process for them.