Pound-to-Euro Exchange Rate at Technical Cross-Roads this "Super Thursday"

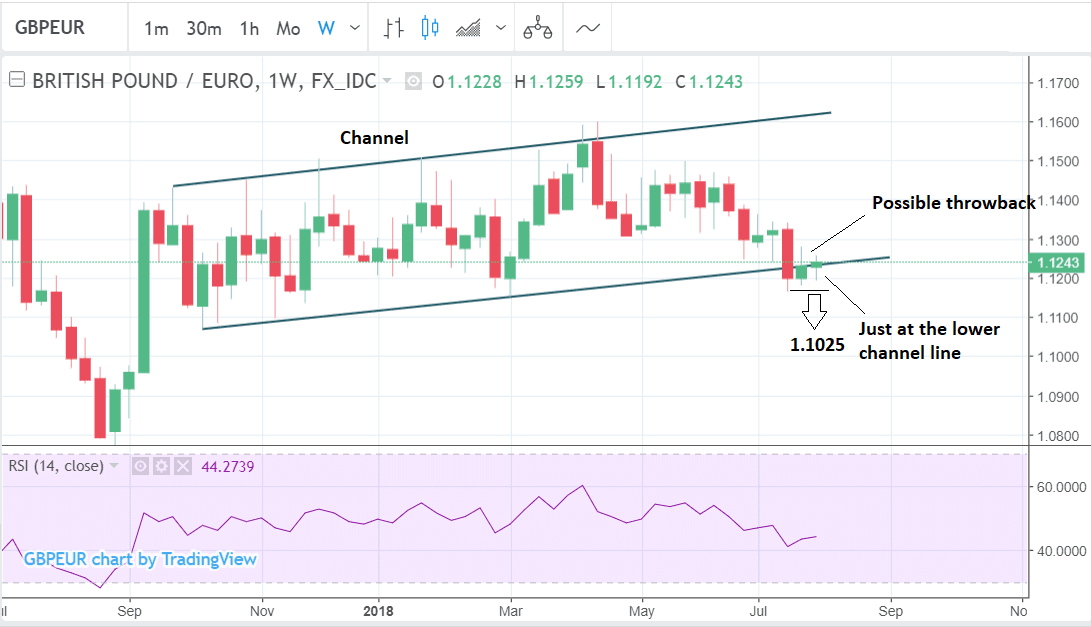

- GBP/EUR is poised precariously on the lower line of a long-term channel

- Thursday's Bank of England meeting raises the risk of volatility

- A break below 1.11 lows could see a sell-off down to the 1.10s

Pound Sterling has dropped to within an arm's reach of its 2018 lows against the Euro as we approach the Bank of England's August interest rate meeting and quarterly inflation report; aka Super Thursday.

GBP/EUR has recovered to 1.1243 at time of writing which whilst marginally higher than Tuesday's close, is, nevertheless, still precariously on the lower border line of the rising channel if not quite under it anymore.

With the spot exchange rate at 1.1243 we can see the exchange rate lying between 1.0850 and 1.0931 for bank-based money transfers, meanwhile independent FX providers are offering in the region of 1.1140.

The exchange rate has managed to claw its way back up from July's multi-month lows ahead of the Bank of England event, but there is still a risk it could break down again, precipitating a collapse, probably down to the 1.10s initially, and maybe even the 2017 lows at 1.0746.

If meeting takes a dovish turn and the BOE rescinds on its promise to raise interest rates, 'shattering the dream', as it were, Sterling will probably fall back out of the channel and tumble towards the next bearish target at 1.1025.

Indeed, this is the outcome expected by strategists with Nordea Markets who are recommending the Pound as a "sell" ahead of the event.

Ultimately for confirmation of a breakdown we would be looking for a re-break below the 1.1164 July lows.

It is quite possible that the pull-back since the July lows is actually what traders call a 'throwback' which is temporary recovery after a break when the exchange rate pulls back momentarily to retouch the just-broken level and 'air-kiss' it 'goodbye' before finally resuming its downwards trajectory with renewed vigour.

Traders love throwbacks because they offer the ideal low risk entry point for shorting the downtrend.

The worst that can happen for these short-holders is that the Bank strikes an optimistic tone on the outlook and hints at further interest rate rises leading to a rally in Sterling. But I believe the risk of loss is so small they don't stand to lose much if they are wrong.

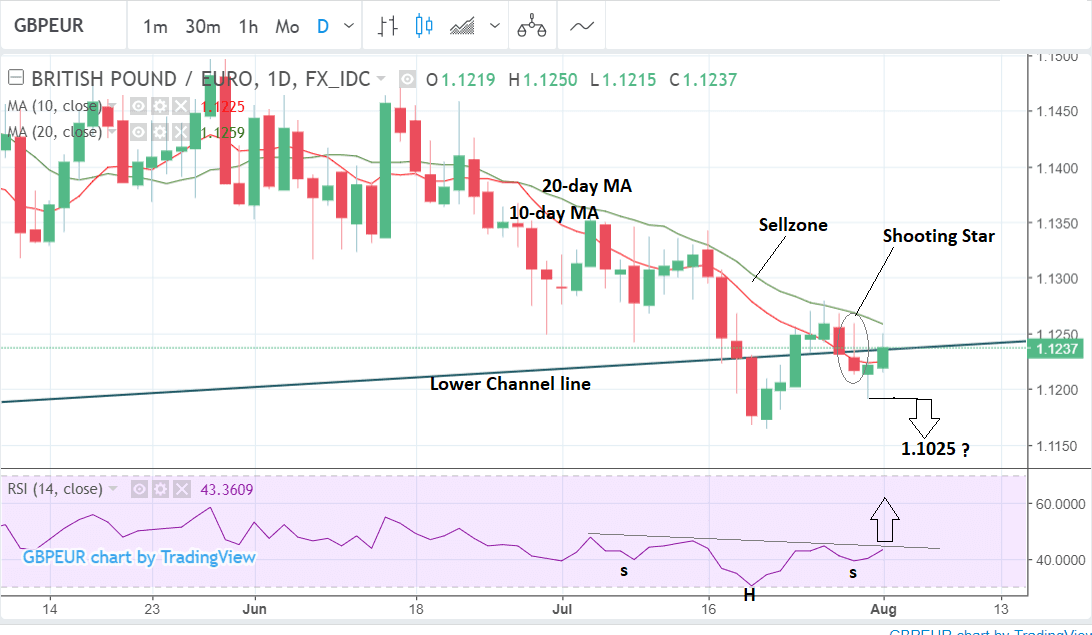

If the weekly chart looks bearish, the daily chart raises more questions than it answers.

There are both bearish and bullish indicators, making it difficult to decide in which direction the pair might go.

Adding to the bearish story is that the pair has pulled back into the 'sellzone' and formed a bearish signal.

The 'sellzone' is the space between the 10 and 20 moving averages (MAs). It is the optimum point at which to short the downtrend.

On Monday the pair formed a very bearish 'shooting star' Japanese candlestick pattern in the sellzone which augured ill for the exchange rate.

The exchange rate then failed to follow-through lower convincingly on Tuesday. Since then the price has recovered further bringing into doubt the bearish signal. A break above the 1.1260 highs of the shooting star would cancel out the signal altogether.

A break below Tuesday's 1.1192 lows would reinvigorate the downtrend and suggest the bearish sellzone signal was accurate and timely.

The RSI indicator in the lower pane, however, is arguing for bears to exercise caution. It is possible to read an inverse head and shoulders pattern (H&S) in the RSI indicator which would be bullish for the pair.

If the RSI breaks above its 'neckline' at roughly 44.38, momentum is likely to surge higher. A move up in RSI is likely to lead to a similarly strong rally in the underlying asset.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here