Euro-Pound Rate Tipped to Channel Lower by Autochartist

The EUR/GBP pair is looks vulnerable to a technical dip, according to analysis from Autochartist, an independent technical analysis provider.

The pair has established a descending channel on the hourly chart which now has a high probability of continuing to evolve, down to a potential target at circa 0.8840 (1.1310 GBP/EUR).

The channel is likely to extend because it is of 'high' quality.

The channel is of a '9-bar level', and is the result of the strong Initial Trend (10 bars), above-average Uniformity (7 bars) and strong Clarity (9 bars)," says Autochartist.

"EUR/GBP is expected to fall further inside this Down Channel – in line with the earlier downward reversal from the powerful resistance area shown below."

Graphic courtesy of Autochartist

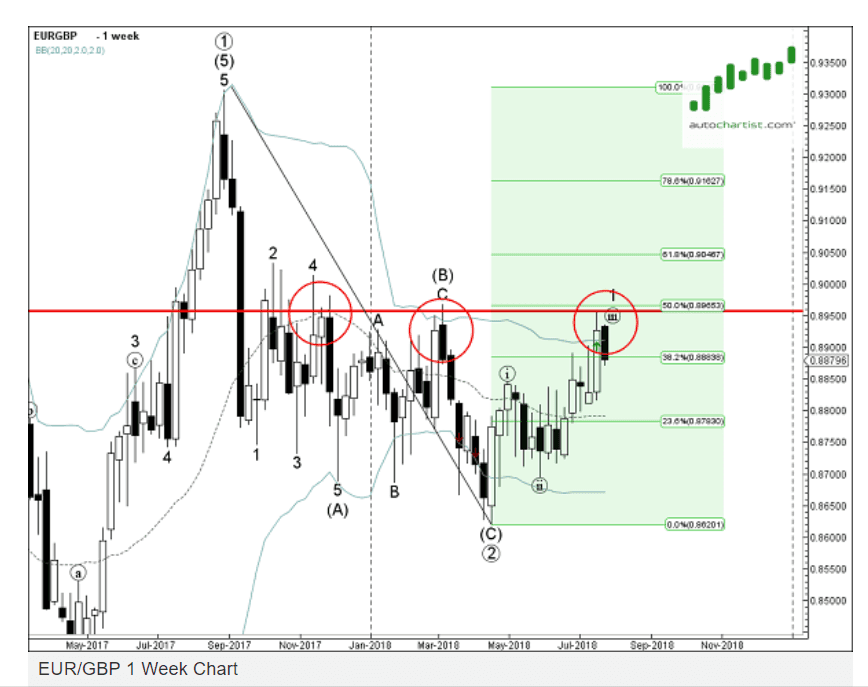

The view from the weekly chart is further backing up the bearish tenor of the hourly chart as the exchange rate appears to have reached a confluence of resistance levels which are simultaneously exerting a depressing effect on the exchange rate.

Image courtesy of Autochartist

These resistance levels include the midpoint of a previous rally from 2017 - a level which is often the site of reversals, the upper weekly Bollinger Band - another level where reversals often occur, and the long-term resistance ceiling at 0.8950 (1.1175 GBP/EUR).

"The pair recently reversed down from the major resistance area... The proximity of this resistance area increases the probability EUR/GBP will continue to fall inside this Down Channel," says Autochartist.

The pair weakened on Thursday after the European Central Bank (ECB) failed to provide more details about their plans to reduce stimulus and then raise interest rates at their policy meeting, when they had been widely been expected to. Stimulus, also known as quantitative easing (QE), or making asset purchases, has a depressing effect on the currency so Euro-bulls were hoping the ECB would explain when they will be concluding it.

"The Euro fell on Thursday as the European Central Bank clung to its easy monetary policy and signalled no change in its timetable to move away from its ultra low rate policy and to end its asset bond purchase program," said a report from the currency commentary desk at Thomson Reuters.

ECB President Mario Draghi cited risks to growth from rising tariffs and other obstacles to trade on the 19-country bloc as the reason for the central bank's cautious stance.

This came despit him seeing signs inflation was rising towards the ECB's 2.0% target on a regional basis. A rise in inflation would be a sign of growth and prompt the ECB to end stimulus more quickly so it could raise interest rates.

The Euro reversed earlier gains made after President Trump said he expected the US and EU to agree a free-trade deal following a meeting with Jean-Claude Juncker, the president of the European Commission.

Trump had threatened to slap a 25% tariff on European cars entering the US, however, he appeared to backtrack on this threat following the meeting with Juncker.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here