Norwegian Krone Leads the Pack After Norge Bank Kicks the Can Further Down the Road

- Written by: Gary Howes

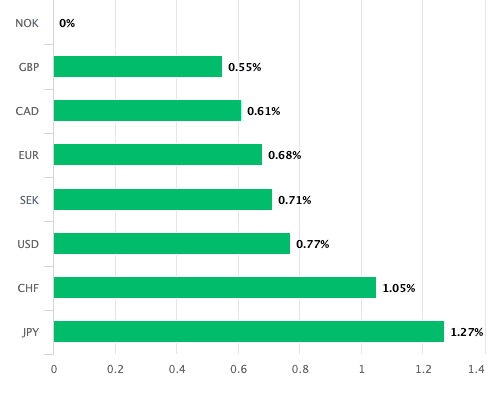

Above: NOK advances against its main peers on Sept.19.

The Norwegian Krone is the top-performing major currency on the day its central bank says it won't cut interest rates until 2025.

This would mean the Norges Bank will likely join the Reserve Bank of Australia as being the last to arrive at the central bank cutting party (the Bank of Japan wasn't invited).

In a world where relative interest rates matter, this is, on balance, supportive of the Krone and Australian Dollar.

"The NOK is the outperformer following somewhat less dovish guidance from the Norges Bank," says Daragh Maher, Head of FX Research at the Americas for HSBC.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound to Krone exchange rate is trading 0.33% lower on the day at 13.92, the Euro to Krone is 0.63% lower at 11.69 and the Dollar to Krone is down 0.75% at 10.50.

Norges Bank’s announcement that it is leaving its policy rate unchanged at 4.5% was anticipated by all the analysts polled by Reuters. This left the currency watching updates to the central bank's guidance and projections.

Here, the message is to expect the first cut in Q1 of 2025. The central bank says "the time to ease monetary policy is approaching," but is still concerned with weakness in the NOK and this appears to be a driving factor behind the decision to project a message that interest rates willl remain here for some time.

"This is the key factor keeping them in hawkish mode," says Andrew Kenningham, Chief Europe Economist at Capital Economics. "The currency is still 4.5% weaker against the euro than it was at the beginning of the year. It has also weakened against the pound, euro and Swedish krona since Norges Bank’s June meeting."

NOK strength following the September policy meeting also confirms that markets don't see a rapid pace of interest rate cuts once the first cut is delivered early next year.

The Bank did say it expects a faster pace of easing next year, but the downward revision was small, as it now thinks the policy rate will be at 3.7% in by the fourth quarter of 2025 as opposed to 3.8%, which was previously projected.

"Overall, we maintain our constructive view on the NOK," says HSBC's Maher.

However, Capital Economics thinks Norges Bank is underlaying the extent of rate cuts to come and that it is likely cut for the first time in December and deliver a "fairly rapid" sequence of cuts next year.

"With the other major central banks likely to press on with their easing cycle next year it should become easier for Norges Bank to follow suit without triggering a further slide in the krone," says Kenningham.