The Pound-to-Euro Rate's 5-Day Forecast: Hints of Relief

Image © John Gomez, Adobe Stock

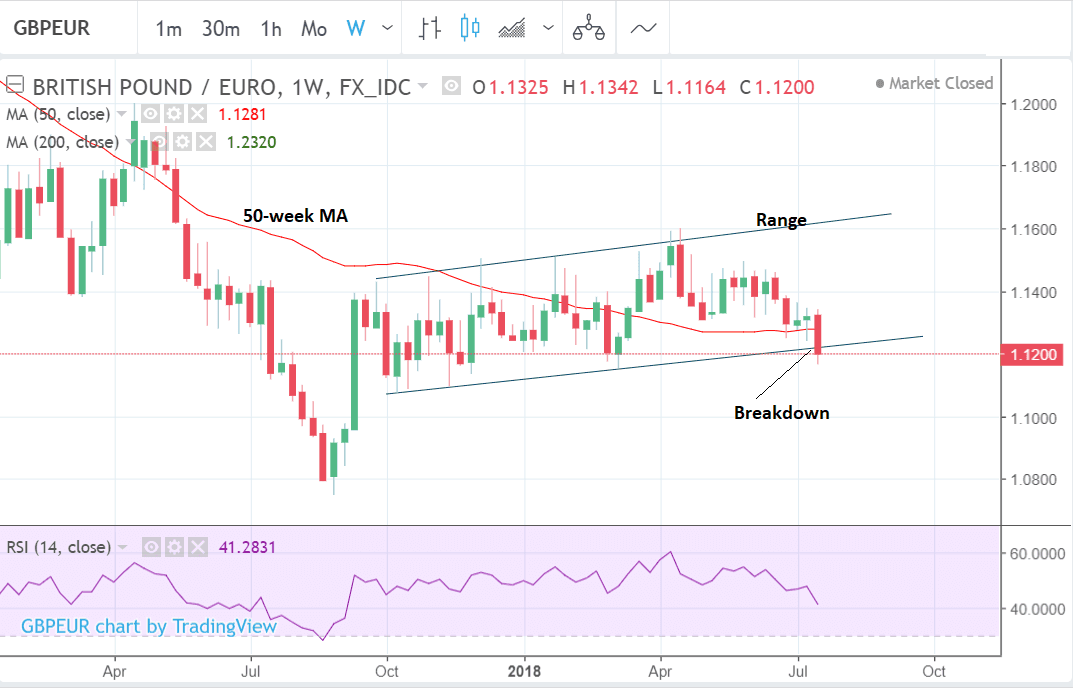

- GBP/EUR threatens breakdown of a multi-month range

- More weakness is possible in the week ahead subject to confirmation

- Brexit politics continues to dominate Sterling, whilst for the Euro the ECB policy meeting and latest PMI's are major event.

Sterling starts the new week on a firmer footing against the Euro with one Pound buying 1.1205 Euros on the inter-bank market, having suffered hefty declines in the previous week that saw the exchange rate go as low as 1.1164.

Increased 'no-deal' Brexit fears caused weakness for Sterling which resulted in GBP/EUR breaking marginally below the bottom of the long-term range which it has been oscillating within since the autumn of 2017:

The move also saw meant the exchange rate pierced through a formidable support level in the guise of the 50-week Moving Average (MA), a level prices normally stall or even reverse at. Taken together these are bearish signs - at least from from a purely technical perspective.

The breakout of the range gives us cause to expect a strong, continuation lower, potentially to a downside target at 1.1025.

This target is calculated using the normal method of taking the height of the range and extrapolating it lower by a ratio of 0.618, as we discussed in last week's article. 0.618 is the 'golden ratio' - a mathematical constant which is said to govern proportionality in nature and financial markets.

A break below last week's lows of 1.1164, however, would be required as confirmation before expecting a continuation lower.

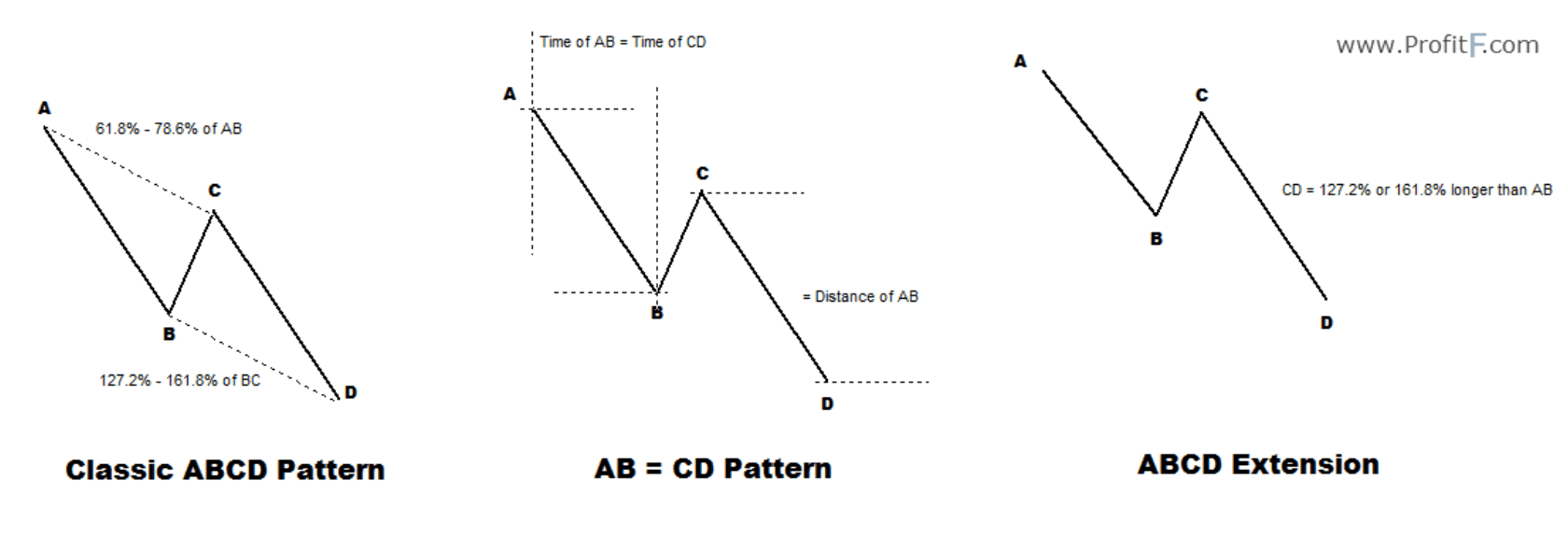

A proviso to the bearish forecast is that the pair appears to have just completed a three wave ABCD pattern down from the May highs (see daily chart above), and this would seem to suggest the wave of selling is now finished, and a recovery is possible.

Image courtesy of profitf.com

The pair could recover - probably to the level of range floor at 1.1225, initially, at which point it is likely to encounter resistance and stall. Such a move could also be classed as a 'throwback' which is a brief pull-back following a major line-break.

Following the throwback, if there is one, the pair will probably resume its move south given that is the path of least resistance now the range has been breached.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What's on the Calendar for the Pound this Week

The bearish prognosis painted thus far is based on our technical studies which aim to cut out the noise posed by economic data, politics etc.

Of course, the picture is significantly more complicated than this and in our opinion there could be some relief for the Pound as market focus shifts to 1) Bank of England interest rate pricing and 2) thinning Brexit-related headlines.

The week ahead for UK data kicks off on Monday with a speech from Deputy Governor of the Bank of England Ben Broadbent to the Society of Professional Economists in London at 18:00 GMT.

Analysts will be listening out for any comments in relation to Broadbent's stance on hiking rates in August. Current probabilities favour a hike from 0.25% to 0.75%.

The Consortium of British Industry (CBI) Industrial Trends Survey is released at 11.00 GMT on Tuesday, July 24, and is forecast to come out at 10 from 13 previously.

The result is the balance between positive and negative survey answers. Data from the CBI often gives a timely indication of economic trends and is closely watched by the market.

Mortgage Approvals are due for release on Wednesday at 9.30 and forecast to show a rise of 39k in June from 39.4k in the previous month of May.

Friday sees the release of Nationwide Housing Prices in July, which are expected to show a 0.5% rise from June and a 2.0% rise since July 2017.

The other main driver of the Pound in the week ahead will be the ongoing debate over Brexit.

Sterling weakened last week as fears resurfaced of a hard Brexit following Brussels's mixed response to Theresa May's Chequer's proposal, which itself was a hard-won compromise.

EU Chief negotiator, Michel Barnier was overall positive about the plan which he said had elements that were "very useful" however he was concerned it undermined the "integrity of the European Union" as a free trade region.

The reaction was seen by many as a sign the EU would want further compromises.

Given the negative response from many Brexiteers over the current proposal further compromises are seen as unrealistic, hence markets started to price in a 'no deal' Brexit which ultimately reflected in a weaker Pound.

Barnier's most recent comments on the nature of the border with Ireland did show some signs the EU was willing to show flexibility on its previous backstop solution.

This kept the border between Northern and Southern Ireland open and for the 'de facto' actual border between the UK and EU to shift to between Northern Ireland and the rest of Britain via a set of "control points" across the Irish sea.

The EU's backstop has been seen as unacceptable to Ulster Unionists, Theresa May's allies in parliament, who demand Northern Ireland and the rest of the UK remain intact after Brexit, and to the wider Conservative party.

We believe there was something of a breakthrough on Friday following the EU General Affairs Council meeting when Barnier said the EU was in fact willing to search for a compromise on the question of the Irish border and revise its backstop.

A possibility of a no-deal has weighed on the Pound since the referendum and risks pushing the currency even lower in the week ahead. Likewise, relief is possible too, especially if Theresa May's proposal gains favour in Brussels.

What's on the Calendar for the Euro this Week

For the Euro, we will be very interested in hearing what analysts and markets make of Donald Trump's attack on Europe on Friday, July 22 where he accused policy-makers of deliberately manipulating the value of the Euro to boost the region's competitiveness in international trade.

The move is widely touted as part of a broader 'weak Dollar' policy Trump intends to pursue in order to boost US exports relative to imports. Following the comments, the Dollar sank sharply while the Euro rose.

The US President has proven he does not follow the established rule books when it comes to international diplomacy therefore markets will continue to expect the unexpected. This will keep us on edge for further FX market volatility over coming days.

The main calendar event in the week ahead for the Euro is the meeting of the European Central Bank (ECB), with the release of the governing council's decision scheduled for 11.45 GMT, on Thursday, July 26.

Analysts will be looking for further confirmation that the monetary policy strategy outlined in the June meeting, which included ending the ECB's stimulus programme by the end of 2018, and raising rates after the summer of 2019, remains intact.

Yet beyond a possible clarification of timings no change in policy is forecast by the market on Thursday.

"The clouded outlook for businesses is almost certain to keep the ECB on a cautious course even as the central bank readies to pull out of its bond buying programme," says broker XM in their week-ahead note.

"Following last month’s landmark decision to call an end to four years of quantitative easing, investors will be hoping for more clarity on the ECB’s forward guidance to keep rates on hold “at least through the summer of 2019”, with some reports suggesting that Governing Council members had their own differing interpretations of what this meant," continues the broker.

"The unexpectedly dovish rate path forecast has been weighing on the euro ever since. But the single currency could benefit from any hint that a rate hike could come before the end of 2019, which is the current market pricing," add XM.

On the hard data front the Euro could also me moved by PMI data on Tuesday at 9.00 GMT.

The PMI for the manufacturing sector is forecast to come out at 54.7 in July from 54.9 previously, and for Services at 55.0 from 55.2 in the previous month of June.

PMIs are surveys of purchasing managers, who occupy key positions in firms which are thought to give them enhanced insight into general business conditions.

PMI's are a useful forward indicator for economic growth, and closely watched by the market. A result above 50 is expansionary and below contractionary.

The other main release in the week ahead is Eurozone Consumer Confidence, out on Monday at 14.00, which is forecast to show a -0.7% drop in July from -0.5% previously.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here