Unlikely GBP/EUR Rate will Fall to 1.00 say Nordea

- Written by: Gary Howes

“A complete meltdown of UK key figures is already priced into EUR/GBP.”

Pound Sterling looks set to record its fourth consecutive weekly loss against the Euro with a chunky 0.80% loss coming in mid-week trade alone.

The falls to a fresh eight-month low have invited fresh scrutiny on just how low the currency can go.

The declines keep alive the great debate on the British Pound which is whether the Pound to Euro exchange rate will actually fall to 1.00.

Forecasts for such an eventuality capture our attention as the Pound falling to, and below, 1.00 Euro represents a great psychological milestone for the people of the UK; an outcome given heightened prominence by the raging and often bitter Brexit debate.

Whatever side of the debate you sit, such a decline is nevertheless a clear message from a market delivering its own judgement on the matter.

But, markets can be fickle.

Currencies are unpredictable and the GBP/EUR exchange rate still remains some way off from parity. While forecasts for such an eventuality are prominent, they are in the minority as most institutional forecasters see the decline ending before 1.0.

“The story of the potential historical event of 1 EUR equalling 1 GBP has gained a lot of traction lately. And even though the Brexit negotiations are a millstone around the neck of the GBP, we see several reasons why 1 EUR = 1 GBP is unlikely,” says Andreas Steno Larsen, who is art of the FX analysis team at Nordea Markets.

- Pound to Euro Exchange Rate to Reach Parity Say Brexit-Bears HSBC

- No Parity for Pound to Euro Exchange Rate say Capital Economics

- British Pound to go Below 1.0 v Euro say Morgan Stanley: The Full Details

There are a number of reasons Nordea don’t see it fit to downgrade GBP/EUR to equality, as i) the inflation outlook, ii) the valuation, iii) the macro momentum and iiii) the Q4 effects don’t point at much lower GBP/EUR.

In fact, Nordea believe that the current valuation of the GBP/EUR exchange rate is more appropriate for a complete meltdown of UK economic data - think of the last time GBP/EUR almost hit 1.0 - it was in the wake of the 2008 crisis and the UK was grappling with a significant recession.

Is the economy at that point in 2017, will it reach that point in 2018?

Even the most ardent remain supporter would have to conceded that such a dire structural shock is unlikely.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Inflation to Remain Robust

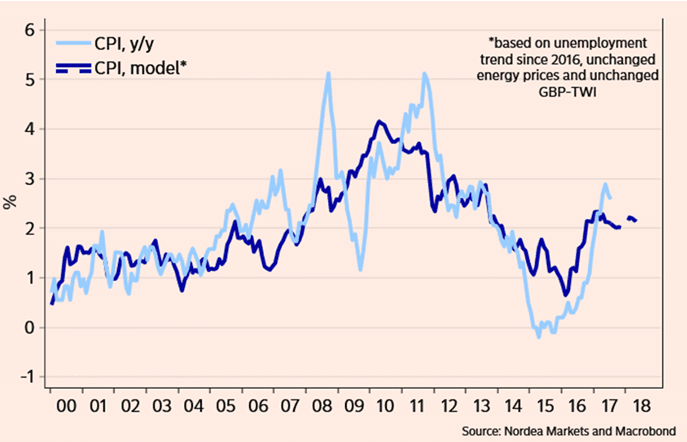

On the point of inflation; Larsen and his team don’t believe it will fall far enough to warrant a lower GBP/EUR on any kind of sustainable basis. Larsen reckons it should stabilise above 2%; pretty much in line with the long-term view of the Bank of England.

Above: UK inflation to stabilise above 2%.

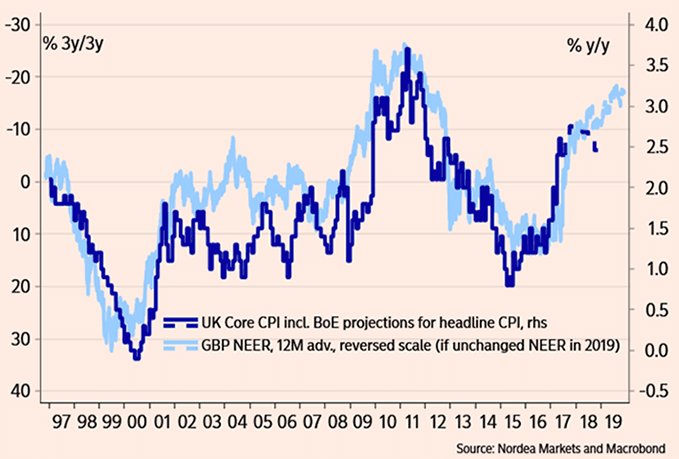

Indeed, the risks for heightened inflation remain elevated, “longer out the risk is tilted towards inflation pressures re-emerging as 3-year effects of a weak currency filter through to higher core inflation,” says Larsen.

Above: Based on previous patterns, a consistently low exchange rate will lead to persistently high inflation in the future.

The Bank of England won’t tolerate a long-run rate of inflation closer to 3%, they will raise interest rates should such an outcome appear likely.

And higher interest rates make for a higher currency.

Valuations are Extreme

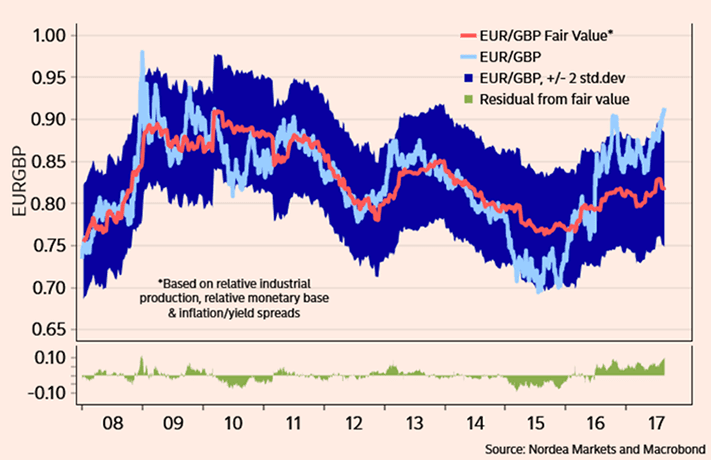

We have mentioned that Nordea say the GBP/EUR is priced as if the economy were in the throws of a major structural realignment, i.e. a substantial recession.

Yes, realignment on Brexit is coming and potentially underway. But the thinking at Nordea is that the impacts of this event are over-exaggerated.

“In terms of valuation, it could seem like almost a complete meltdown of UK key figures is already priced into EUR/GBP. Judging from fundamental parameters EUR/GBP fair value is closer to 0.82-0.84, while 0.916 (spot 22nd of August) is a 2 standard deviation event, that is, a move towards parity will be a 3 to 4 standard deviation event,” says Larsen.

EUR/GBP at 0.82-0.84 flips to 1.22-1.19 in GBP/EUR terms.

“Is a potential rough and sudden Brexit such an event? Could be. But a very bumpy ride out of the union is already priced in,” adds the analyst.

Above: A complete meltdown of UK key figures is already in the price of EUR/GBP

Analyst nerves regarding potential Sterling undervaluation are certainly growing.

Valentin Marinov at Credit Agricole echoes this view in a recent briefing to clients:

"EUR/GBP hit yet another multi-month high with the recent price action suggesting that investors are still very comfortable being long the cross despite its lofty levels.

"We believe that some cautiousness may be warranted, however, given that the latest bout of GBP-weakness has brought it into undervalued territory against both EUR and USD."

Of course picking the top is the difficult part but a good number of technical analysts are eyeing a move to Sterling's flash-crash lows achieve in October 2016.

America to the Rescue

Both Morgan Stanley and HSBC Holdings forecast the GBP/EUR to reach parity in late 2017, early 2018.

Neither see any substantial move below this point.

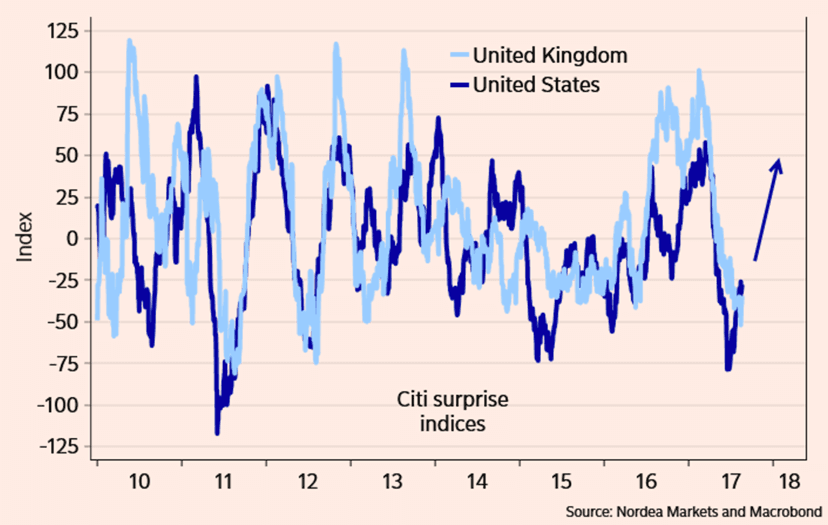

Nordea warn that the UK economy might actually well kick up a gear heading into this time period - better UK economic activity would surely promote a recovery in the currency.

“While fair values/valuation models may not be a clue that support a lower EUR/GBP short-to medium-term, other factors do. Judging from seasonal patterns, US key figure momentum almost always peaks in Q4 and troughs mid-year. Usually better US momentum spills over to better UK momentum with a few months’ lag. This time might be no different,” says Larsen.

Scarce Dollar Liquidity

Another factor that could boost the Pound against the Euro is a drying up of Dollars on the global economy.

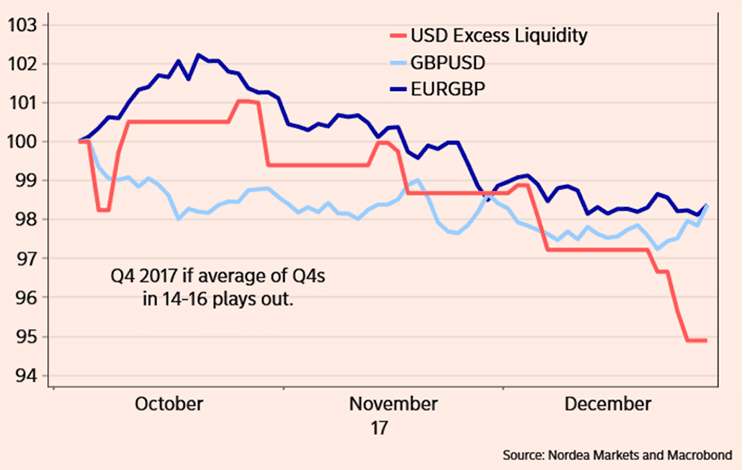

There is typically an observable seasonal effect of USD scarcity towards the latter part of the year and Nordea believe it should play a big role in global FX in 2017.

What does this bode for Pound Sterling?

"If anything the price of USD liquidity versus GBP liquidity seems to rise somewhat less than versus EUR liquidity in Q4. In other words, scarce USD liquidity leads to a somewhat wider EUR/GBP basis (GBP liquidity gets more expensive)," says Larsen.

In other words the average effect stemming from the scarcer USD liquidity in Q4 (estimated since 2014) sends GBP/USD a tad lower, but also EUR/GBP lower on the margin.

Nordea forecast the GBP/EUR to be in the vicinity of 1.15 by year-end.

“While we acknowledge the short-term upside risks to EUR/GBP, we see no reason to expect parity judging from the information we have now. Rather Q4 could prove EUR/GBP negative,” says Larsen.

The report comes amidst a particularly rocky time for the UK currency which has been in a concerted downtrend against the Euro.

GBP/EUR has now suffered four consecutive weeks of decline and markets are eyeing a test of the flash-crash lows located in the vicinity of 1.06 as a potential area where some support might be found.

It would appear markets are increasingly convinced that the UK will leave the EU without a deal on March 2019 in which case the trading relationship between the two jurisdictions will be subject to WTO rules.

The EU are unlikely to give any ground to the UK which means Prime Minister Theresa May is going to have to make numerous concessions.

Such a concession was seen on Wednesday, August 23 when it appears the UK accepts the European Court of Justice will have a degree of oversight on the relationship between the UK and EU. Previously it had been a red line for the UK but a new position paper issued by the Department for Exiting the European Union concedes some ground on the point.

Clearly, the market wants more red lines to be watered down.