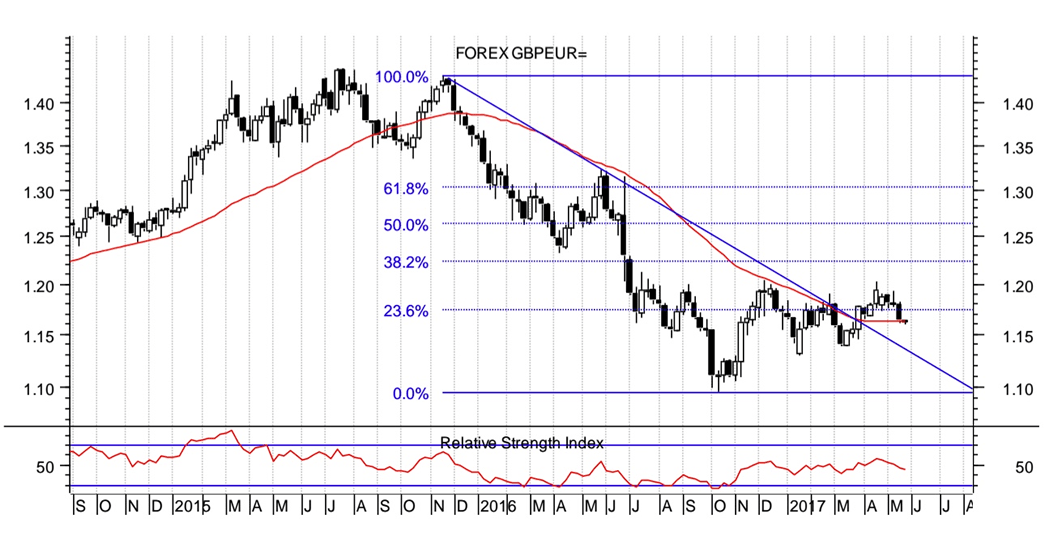

Lower-Bound for Pound / Euro Rate seen @ 1.10 by Technical Analyst

- Written by: Gary Howes

Pound Sterling is seen stabilising in the May 23-24 period after the currency had fallen to a 7-week low against the Euro earlier in this session.

The trend is certainly favouring the Euro at present with recent analytical studies suggesting further gains for the Euro are likely.

One analyst tells us that any re-emergent Pound Sterling strength is likely to prove corrective and therefore should not be regarded as sustainable at this juncture.

“An extension back beyond 1.1670/80 looks necessary in any case to reduce immediate bearish pressure but even if this develops the presence of major resistance at 1.1750 then 1.1825 limits upside potential in broad terms,” says analyst Lucy Lillicrap at Associated Foreign Exchange, a UK-based currency broker.

Lillicrap is a note technical analyst who studies the historical price charts of foreign exchange rates to understand the underlying structure of the market and potential motives of traders moving forward.

And what the analyst is seeing is broadly negative for the UK currency.

“If Sterling values manage to establish themselves under 1.1490/00 support potential exists for a broader sell-off toward 1.1250 next with longer term potential implied towards 1.1000 as well,” adds Lillicrap.

Those who need to make international payments are looking at their bank offering rates between 1.1141 and 1.1222. However, astute individuals will be seeing their indpendent foreign exchange provider offering rates towards 1.1450, a big advantage.

Pound is Now Oversold

The UK currency has now fallen against the Euro for a third week in a row as bearish momentum builds.

“This price action reinforces the impression that there is now a good deal of resistance in the region of €1.20 and, although Sterling already looks somewhat oversold on a short-term view,” says Bill McNamara, an analyst wit brokers Charles Stanley.

However, for McNamara, the broader technical picture is implying that it could lose further ground before the buyers return.

“1.14 looks like it could turn out to be a key level,” says McNamara.

No Stopping the Euro Express

The real driver of foreign exchange markets at present is the Euro which has come into favour with global investors in a big way of late.

The Euro is charging higher again thanks to two sets of impressive Eurozone economic statistics released today.

Data from IHS Markit showed that firms are seeing business expand at its strongest pace in six years, giving rise to expectations for a strong quarter for the Eurozone economy.

The composite PMI for May - a broad-based assessment of the business activity of Eurozone firms - read at 56.8, analysts had forecast a reading of 56.6.

“Capacity is being strained by the strength of demand, with backlogs of work showing one of the largest increases in the past six years. Job creation has surged to the second-highest rate in nearly a decade as firms seek to expand capacity and meet rising demand,” says Chris Williamson, Chief Business Economist at IHS Markit.

Meanwhile, data out from Germany was equally impressive.

The Ifo index rose further from 113.0 to 114.6 (Consensus: 113.1).

This is a record high since the index was started in 1991 after reunification.

Business expectations were up strongly from 105.2 to 106.5.

The current assessment component surged from 121.4 to 123.2 and hence also to its highest level since 1991.

When looking at sectors, especially manufacturing and construction companies became again more optimistic.

Both the forward-looking expectations and the current assessment components among manufacturers increased.

The current assessment figure in the construction industry hit another record-high level.

Undoubtedly the news is good for the Eurozone outlook and we would expect the Euro to remain supported. But the chance of such surprises being repeated in future months are unlikely.

“The latest renewed and strong rise in German business sentiment is great news. However, the air for further improvement is increasingly getting thin. While it is impossible to forecast exactly when the peak will be reached, it is clear that we are getting close to it. Repeatedly strong increases in the next few months towards levels seen before reunification (i.e. sentiment among companies in Western Germany) are unlikely in our view,” says Dr. Andreas Rees at UniCredit Research

UK Politics Back to Haunt Sterling

In spite of the sharp price action, particularly around PM May’s election announcement and Macron’s presidential election victory, GBP/EUR continues to trade within its 1.13 to 1.20 range.

Right now we appear to be heading towards the bottom of the range, as per the views of the analysts highlighted above.

Sterling was seen suffering renewed pressure on Monday, May 22 as political considerations came to the fore once more and we have become increasingly expectant that the Pound will maintain a softer tone as we approach voting day.

“Confidence has been damaged recently over Prime Minister Theresa May’s propositions to amend the social care system and revelations that its introduction was kept in the strictest confidence, putting into question the unity of the Conservative party,” says Arnaud Masset, an analyst with Swissquote Bank in Gland, Switzerland.

Knowing that the GBP has been rallying strongly on anticipation of a stronger Conservative Party majority following the elections, “investors are naturally trimming their bullish bets on the Pound,” notes Masset.

“We remain cautious on the GBP outlook, especially since the tone between the EU and UK has turned up as discussions surrounding the divorce bill,” says Masset.

A narrative that GBP will react positively to a landslide Conservative win appears to be dominant.

However, we are warned by some analysts that this could be a lazy assumption, "especially after the recent short positioning adjustment," says Viraj Patel at ING Bank N.V.

ING continue to cite greater two-way risks to GBP crosses; while GBP/USD remains range bound (due to a soft USD), GBP has been a laggard within the European FX space through the course of May – "highlighting its bearish fundamentals".

Mixed News on Government Borrowing

The UK Chancellor suffered a setback at the start of the new fiscal year as public borrowing rose unexpectedly in April.

Public sector net borrowing, excluding public sector banks, stood at £10.4bn in April, according to the Office for National Statistics (ONS).

This was £1.2bn higher than the same month a year ago and economists' expectations for borrowing to fall to £8.7bn.

However, borrowing for the previous fiscal year was revised down by £3.5bn to £48.7bn in 2016-17 - or 2.5pc of gross domestic product (GDP) - amid higher VAT and income tax receipts.