Budget Angst to Limit Pound Sterling's Ambitions Against the Euro

- Written by: Gary Howes

- GBP/EUR recovery still fails to convince

- Budget fears capping recovery

- But one analyst says budget fears overblown

- UK to see improving finances and boost to investment

Image © Adobe Images

Pound Sterling continues to claw back recent losses against the Euro, but a retest of 2024 highs remains a distant prospect as long as markets remain nervous about the upcoming budget.

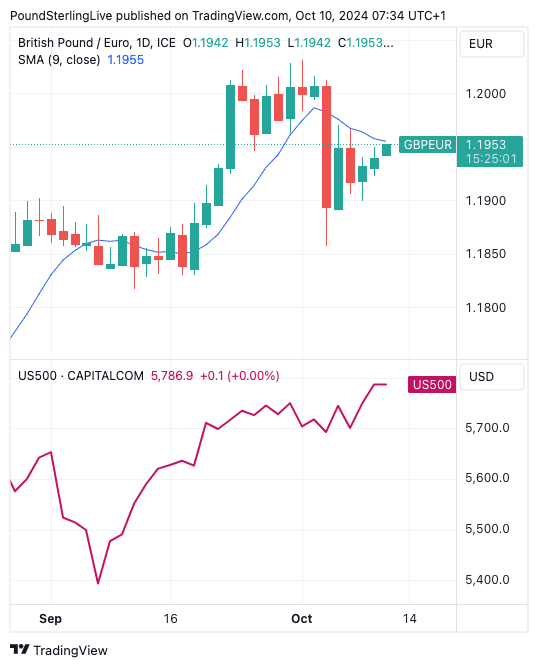

The Pound to Euro exchange rate (GBP/EUR) has risen for three days in a row and is quoting near 1.1950, meaning the major payment providers are offering rates just north of 1.19.

However, the recovery is tepid, with the exchange rate only reclaiming half of last Thursday's 1.0% decline.

Bank of England Governor pulled the rug from beneath those looking to score the best rate of exchange in more than two years with his comment that the Bank could be more "activist" in cutting interest rates.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Yet, markets have now largely discounted those comments, and expectations for future interest rate cuts are back to levels seen ahead of Bailey's curious intervention.

In addition, global equity markets are on the rise, with the benchmark U.S. S&P 500 index reaching record highs on Wednesday.

So why is GBP/EUR not back to 2024 highs if the two fundamentals of interest rate expectations and global investor sentiment are aligned in its favour?

Above: GBP/EUR (top) and the S&P 500.

The culprit could be the uncertainty surrounding the UK economy and fears of growth-killing tax rises from the new Labour government's budget announcement, due at the end of the month.

Incoming surveys show businesses have grown nervous, and consumers are still saving money amidst the government's gloomy messaging about the state of public finances and warnings of difficult decisions.

Tax rises aimed at entrepreneurs and business owners, as well as various pension raids, are all being tested in the media by the Treasury.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

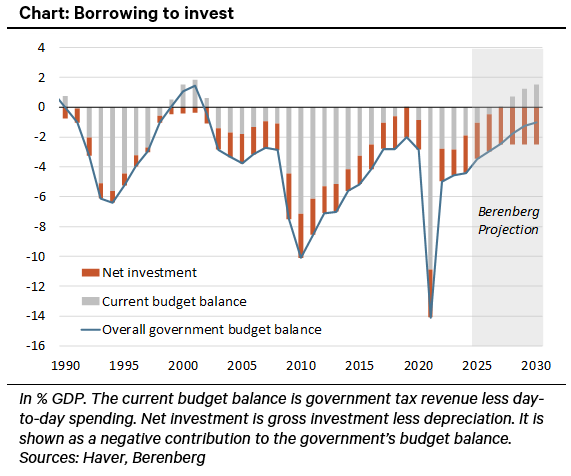

There is another concern: the government also wants to introduce a more relaxed approach to the 'fiscal rules' in order to borrow more. The UK is desperate for more borrowing, so this should be welcome. However, there is a risk that the chancellor will squander the fresh funds to fund day-to-day expenditures, such as boosting public sector pay.

"A material loosening of policy would approach the limit of what the bond market would accept," says Andrew Wishart, Senior UK Economist at Berenberg.

The risk for the Pound is that bond markets reject Reeves' plans and dump UK bonds, as was the case in 2022 when ex-Prime Minister Liz Truss tried to boost spending and slash taxes.

"Thus far, the bond vigilantes have given this Government the benefit of the doubt, but they are saddled up and circling," says The Telegraph's Tom Stevenson. "Changing the definition of public sector net debt to facilitate more borrowing risks yields pushing higher still if it is not handled well."

Near-term uncertainty over the Budget will likely limit any potential upside for Pound exchange rates in the coming days.

Image courtesy of Berenberg.

However, a new analysis by Berenberg Bank suggests fears might be overblown and that the economy is set to outperform expectations.

"The debate about a looser set of fiscal rules indicates that the Labour government will raise planned public investment significantly in the 30 October budget," says Wishart.

Wishart also thinks fears of wide-ranging increases in taxation to pay for it are overdone.

"Stronger pay growth than the Office for Budget Responsibility (OBR) expected in the spring should raise enough revenue to fill the entire spending "black hole" identified by Chancellor Rachel Reeves," he explains.

In addition, any tax rises are anticipated to be modest.

"The budget is likely to support our view that GDP growth will come in above consensus in 2025 and 2026. With the economy operating close to capacity, we expect this to cause inflation to remain sticky," says Wishart.

Growth outperformance and sticky inflation would keep the Bank of England on the cautious side when considering rate cuts, which can underpin the Pound over the medium-term.