GBP/EUR Rate Finds its 'Line in the Sand' Ahead of UK and French Polls

- Written by: Gary Howes

Pound Sterling has recovered some recent losses against the Euro as the market establishes an equilibrium ahead of Sunday's final round of French voting that could yet result in a majority for National Rally (RN).

But immediate attention now turns to Thursday's General Election in the UK, which markets do not expect to offer much volatility, given expectations for a comfortable Labour win.

There is a tail risk for the Pound that the Conservatives do better than current polling suggests, owing to a significant portion of the electorate remaining undecided at this late stage, and a 'hung parliament' emerges. It's not that the Conservatives are necessarily a headwind for the Pound, rather currencies tend to dislike the uncertainty of a clouded political outlook.

Expect the Pound to Euro exchange rate to dip into the mid-1.1750s if Thursday night's exit poll (due at 10PM) throws up such a surprise. However, the fiscal orthodoxy of the main parties precludes any lasting damage to Pound Sterling's valuation.

The Pound to Euro exchange rate dipped below 1.18 on Monday as the odds of Marine Le Pen's RN forming a majority government faded in the wake of the results of the first round of the vote. Sunday's second round is still difficult to predict as French voters are tasked with moving away from the centre ground of French politics.

"Some form of hung parliament seems most likely which while not a positive outcome is better than some of the alternative scenarios. Near-term EUR risks remain to the downside," says Derek Halpenny, head of FX research at MUFG Bank Ltd.

Le Pen's RN can still win a majority, creating enough lingering doubt to halt the Euro's recovery. "We see the chances of a hung parliament at around 60%, with 25% probability of an absolute NR majority and 15% of an Ensemble + some left parties' coalition," says Evelyne Gomez-Liechti, Rates Strategist at Mizuhho.

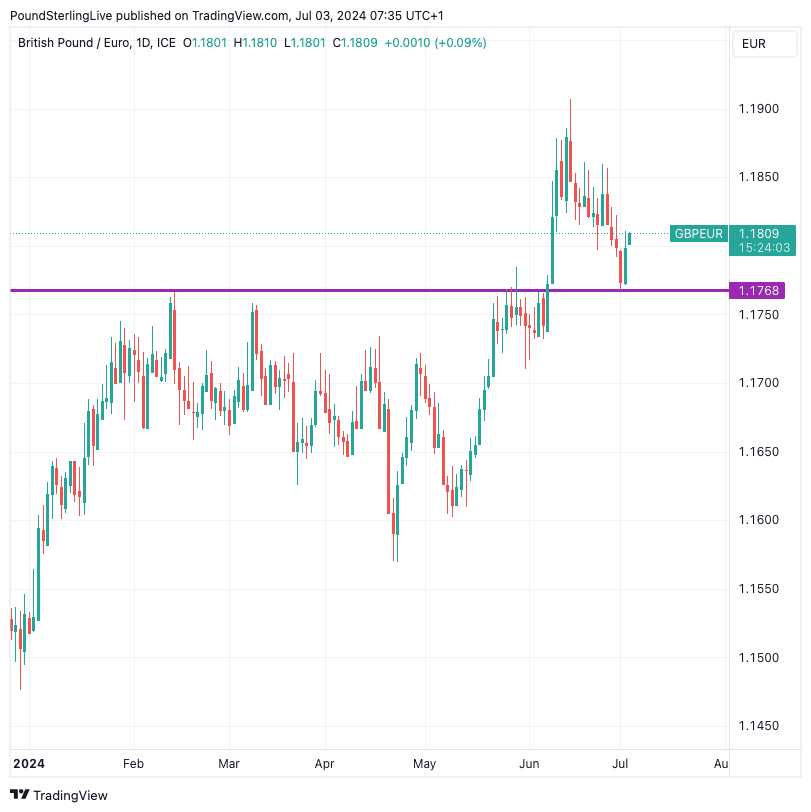

Lingering risks are reflected in the Pound-Euro exchange rate's recovery to 1.18 and the Monday lows at 1.1768 could be the technical 'line in the sand' that emerges.

"We suspect that political uncertainty will remain high and that doubts about fiscal sustainability will persist. In turn, this suggests to us that the discount on French assets is here to stay," says Hubert de Barochez, Senior Markets Economist at Capital Economics.

Residual risk premium could help Pound-Euro stay above the ranges of the year's first half, and we wonder if a new range above 1.17 will now form.

Above: GBP/EUR at daily intervals showing 2024 trading evolution. Track GBP/EUR with your own alerts, find out more here.

"The far-right party led by Marine le Pen secured 11.5 million votes, far surpassing its rivals, meaning that an outright majority remains a possibility, and the country's fiscal outlook looks set to continue its deterioration regardless of the victor," says Karl Schamotta, Chief Market Strategist at Corpay.

The highest turnout in decades – at close to 70% – means that 315 seats (over half of the assembly) will go to a three-way run-off, compared with just 22 such 'triangulaires' in 2022. On Tuesday some 200 candidates withdrew from these 'triangulaires' in an effort by centrist and far-left parties to consolidate the 'stop RN' vote.

"Widespread withdrawal of third candidates would significantly lower the chance of RN gaining an absolute majority," says Bill Diviney, an economist at ABN AMRO.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"But even in this scenario, uncertainty is very high, as it is not clear that centre-right voters would switch to a far left candidate in the head-to-head seats with RN," he adds.

Projections suggest RN will gain anywhere between 240-310 seats, with an outcome in the upper end of this range necessary to achieve an outright majority of over 289 seats.

This can limit the Euro's recovery potential. "Whatever happens, it looks clear that we will see less fiscal consolidation than under the current government. After the election, the French 10y spread narrowed around 5bp to 75bp, but our base case sees the spread widening again in the coming quarters," says Diviney.

Nevertheless, the odds of a significant decline in the Euro are reduced as the fat tail risk event of the far-left wining the vote is taken off the table. The far-left had a manifesto of significant fiscal expenditure that would have scared bond markets and sent the Euro into a nosedive.

RN's efforts to placate markets with assurances that it will pursue prudent fiscal policy also lower the odds of a significant selloff in the Euro.

"The outcome so far is consistent with our base case, which sees a minority RN government being formed. The lack of an absolute majority would significantly constrain the party from following through on its radical policy agenda. This should prevent a Liz Truss/UK-style fiscal crisis," says Diviney.

This is why Pound-Euro might be unable to get beyond recent highs at 1.19 anytime soon, and it will fall to central bank interest rate divergence between the UK and Eurozone to do any big lifting.

With this in mind, a potential Bank of England interest rate cut next month could could enthusiasm towards the Pound.