Canadian Dollar: GBP/CAD Strengthens as Job Report Keeps Alive Prospect of 50bp BoC Cut

- Written by: Gary Howes

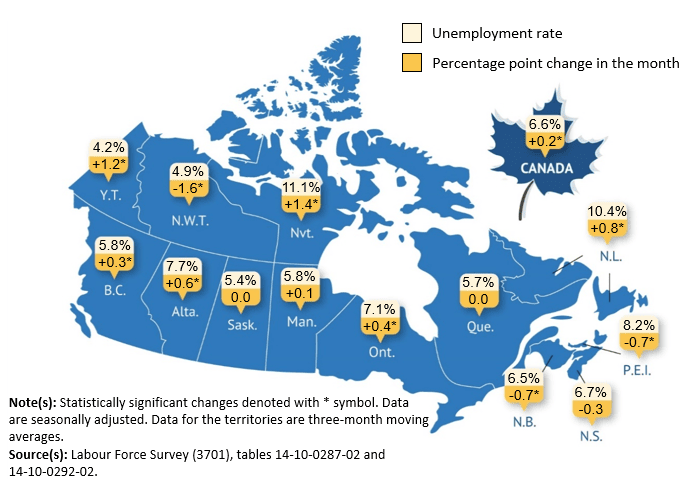

Unemployment rate by province and territory, August 2024

The Canadian Dollar fell following a below-consensus labour market report that keeps alive the prosepct of the Bank of Canada stepping up the pace of its rate cutting cycle with a 50 basis points chop.

The Pound to Canadian Dollar exchange rate (GBP/CAD) extended gains to 1.7832 (+0.25%) after the StatCan labour force survey said the country added 22K jobs in August, which marks a recovery from -2.8K in July, but was below expectations for 25K.

The unemployment rate rose to 6.6% from 6.4%, which was more than the 6.5% the market expected. Average hourly wages fell to 4.9% to 5.2%. To be sure, there was a healthy rise in private payrolls and an ongoing surge in immigration is pushing the unemployment rate higher.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

But the bigger picture is that these data confirm the labour market continues to cool, and with Canadian interest rates remaining in constrictive territory, the Bank of Canada has scope to cut by 50bp.

"The labour market continues to deteriorate and that, despite the rate cuts announced to date, monetary policy remains far too restrictive to stabilise it," says Matthieu Arseneau, an economist at National Bank of Canada.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"While the Bank this week set a high bar to larger interest rate cuts than its recent series of 25bp moves, the continued loosening of labour market conditions means the balance of risks still points to larger cuts rather than a pause," says Stephen Brown, Deputy Chief North America Economist at Capital Economics.

Currency markets are highly sensitive to interest rates and expectations of where they will go. Canada has already started its cutting cycle, and any acceleration in the pace could yield further CAD weakness against the GBP, EUR and other cross currencies.

But the Canadian currency is outperforming the U.S. Dollar, and USD/CAD (1.3497) could come under further pressure as interest rates are expected to fall in the U.S. this month. There is a 50/50 chance of a 50bp opening salvo from the Federal Reserve on September 18 thanks to another below-expectation U.S. labour market report, which was released at the same time as that of Canada.

The market often trades CAD as a proxy to the USD, which means the GBP/CAD might have risen regardless of what the Canadian numbers revealed simply because the USD was falling in reaction to U.S. data. The path of least resistance for the USD looks to be lower, and with Canada's labour market warranting further rate cuts, CAD crosses could follow suit.

CIBC Bank says the Bank of Canada will be concerned by evidence that the climb in joblessness is becoming more broad-based.

"The sharper than anticipated rise in unemployment during August, combined with evidence that the breadth of joblessness is increasing, suggests that the unemployment rate could peak higher than we were previously anticipating," says Andrew Grantham, an economist at CIBC.

The closer the rate gets to 7%, the more pressure the Bank of Canada will feel to accelerate the pace of interest rate cuts.

"We have one more jobs report to come before the October decision, and for now we are sticking to our previous forecast for consecutive 25bp cuts at the remaining meetings this year," says Grantham.