Pound Sterling Back on the Offensive Against the Euro

- Written by: Gary Howes

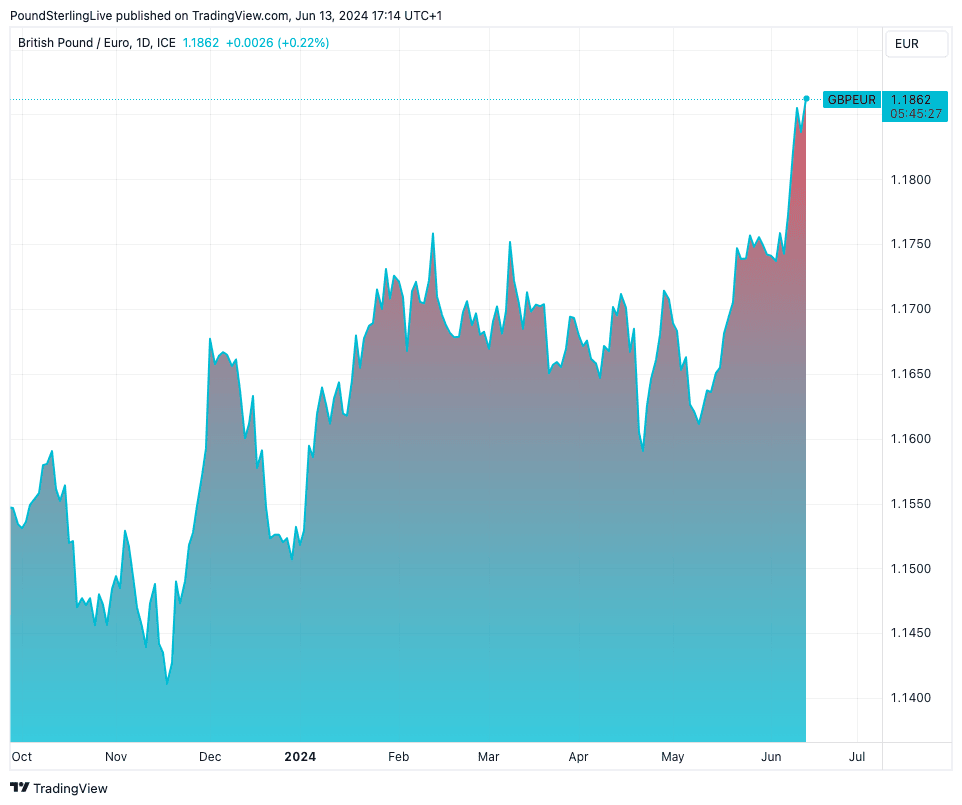

Above: Sterling to Euro at 1-day intervals.

The Pound to Euro exchange rate is on the front foot again and looking to register its highest daily close since August 2022.

Euro exchange rates stabilised through the midweek session, boosted by a weak U.S. inflation print, which offered a temporary shift of focus away from European politics. However, we have seen a pickup in selling pressure through the late Thursday session as French government bonds drop in value amidst fears over the outlook for the country's finances amidst political uncertainty.

French bonds tumbled, driving the yield they offer investors higher, with analysts saying the move owes itself to concerns Marine Le Pen’s far-right National Rally (NR) party will usher in looser fiscal policies if it wins upcoming elections.

French bond yields are at their highest level in seven years against comparable German bonds. This spread between French and German 10-year yields is a useful gauge of French risk premium:

"It has been a week to forget for Europe. Snap French elections have sent investors scurrying," says Chris Beauchamp, an analyst at IG. "Compared to the prospect of hard-right members sitting in the National Assembly, the UK seems an island of stability".

GBP/EUR is trading at 1.1864, Monday's high is at 1.1878, and competitive international payment providers are offering rates comfortably above 1.18.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

A strong showing by NR in the looming vote could mean President Jordan Bardella is installed as Prime Minister, potentially paralysing the French government at a time when it faces burgeoning debts. Jeroen Blokland, Founder of the Blokland Smart Multi-Asset Fund, says, "a weaker euro, French equities underperforming, and France’s bond spread spiking have little to do with the European elections. And everything with the complete lack of budget discipline!"

Pound-Euro returned to levels not seen since 2022 on Monday after Sunday's shock announcement by French President Emmanuel Macron that legislative elections would occur at the end of July after a surge in support by NR in the European elections. The move is seen as an attempt to press the French people into confronting the realities of being governed by a far-right party.

For markets, this political high jinks is unsavoury.

"The lack of attention on budgetary issues has allowed the EUR to remain remarkably resilient this year and gain ground against most other G10 currencies with the exception of the USD and the GBP. It seems likely that this veneer is now failing and that the EUR could face a rockier road in H2," says Jane Foley, Senior FX Strategist, Head of FX Strategy at Rabobank.

There are potentially wider ramifications of the developments in France. It is reported that European leaders at the G7 summit in Italy believe Macron's decision poses risks not only for France but for the security of the continent as a whole, particularly given the European hard-right's affinity for Vladimir Putin.

Georgette Boele, Senior FX Specialist at ABN AMRO, thinks further GBP/EUR upside is possible and raises her forecasts for the exchange rate in the near term while seeing a steady decline thereafter.

"So far this year pound sterling has performed well. Indeed, it is the only major currency that has outperformed (albeit by a small percentage) the US dollar this year," she says.

Boele warns of the potential for some UK election-inspired weakness, as is often the case when there is the potential for political uncertainty. However, a near-assured Labour win is expected by ABN AMRO to have no impact on the growth, inflation and the Bank of England outlook.

ABN AMRO expects more interest rate cuts from the European Central Bank than the market expects, and this can weigh on the Euro relative to Sterling.

"There may be some room for sterling to strengthen versus the euro in the coming months," says Boele.

ABN AMRO raises its Pound to Euro forecast for Q2 to 1.2050 from 1.19 previously. The Q3 forecast is maintained at 1.2050, but then the pair falls to 1.19 in Q4 and 1.1765 in Q1 2025.