GBP/EUR Week Ahead Forecast: Weakness Could Extend to 1.1540, Bank of England Eyed

- Written by: Gary Howes

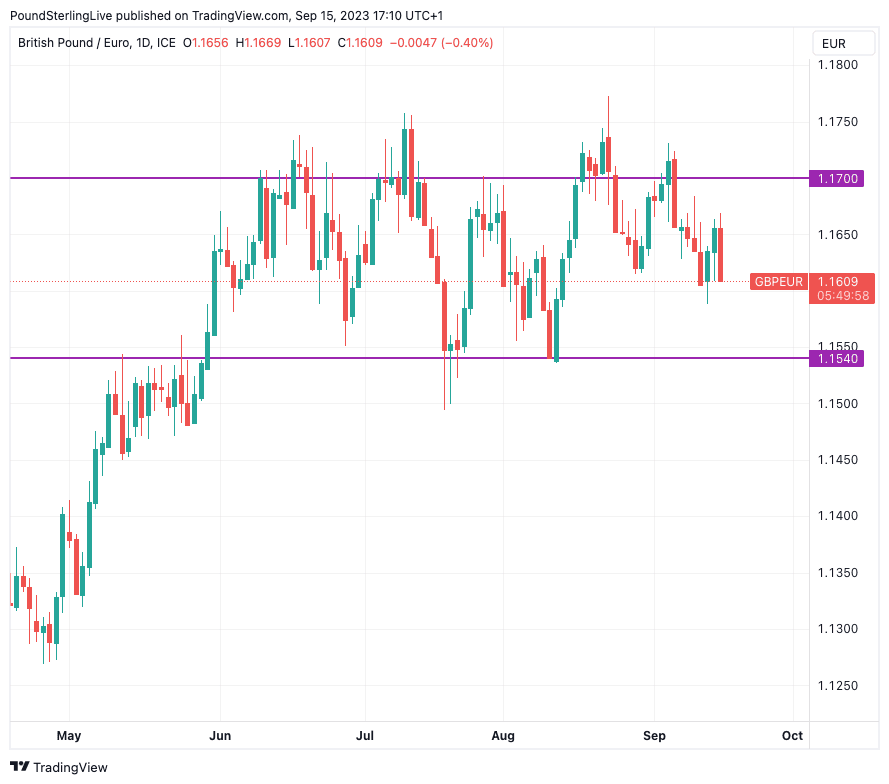

- GBPEUR continues to respect a well-understood range

- But the downside boundary is coming back into focus

- UK inflation data due Wednesday

- Thursday's Bank of England decision will be main event

Image © Pound Sterling Live

Pound Sterling experienced a significant selloff against the Euro at the end of last week and now faces another pivotal week with inflation figures preceding what could be a disruptive Bank of England interest rate decision.

The Pound to Euro exchange rate lost nearly 0.40% on Friday - an unusually large daily move for this pair - and could be set to lose further value ahead of the Thursday decision as investors adopt a defensive stance on the UK currency.

A retest of lows at 1.1589 therefore cannot be ruled out over the first part of the week.

But should Wednesday's inflation data and Thursday's Bank of England go against the Pound then the July and August lows towards 1.1540 could be tested by Pound-Euro.

Selling pressure would likely fade in this area as it forms the lower bound of a well-established summer range that the pair looks resolutely intent on holding.

Above: GBP/EUR at daily intervals with a rough outline of the summer range.

Indeed, it will require a game-changing shift in the narrative for either the UK or Eurozone to break this current multi-week range and with both the European Central Bank and Bank of England looking to pause their hiking cycles it is hard to see such a development.

The Bank of England could, of course, send signals that prove supportive of Pound Sterling, and under such a scenario we would expect the upside elements of the summer range to be tested, which could bring in levels just above 1.17.

"We expect the BoE to raise the policy rate to 5.5%, which is largely priced in by markets. This move should give the pound underlying support," says Thomas Flury, Strategist at UBS.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

That said, price action has shown time and time again that GBP/EUR holding ground above 1.17 is difficult for Sterling bulls and, as with the downside scenario, there doesn't appear to be any imminent catalyst that would introduce fresh 2023 highs for Pound-Euro.

The Bank of England is anticipated to raise interest rates by 25 basis points and retain a commitment to further rate hikes should they be warranted.

However, the Bank is almost certainly likely to introduce guidance aimed at preparing markets for an end to the interest rate hiking cycle that will draw questions on whether a further interest rate hike is likely in November.

This is a development expected by markets and is reflected in the weakening of the British Pound over the course of the past month and should therefore not come as a shock to currency markets.

For sure, the experience of the Euro following the European Central Bank's policy meeting last Thursday serves as a cautionary note on how 'dovish' guidance can undermine a currency and the Pound is at risk of downside if the Bank communicates a hard stop to the cycle.

"Will BOE indicate a pause after hiking 25bp next week? If so, GBP should have room to drop," says Anders Eklöf, an analyst at Swedbank.

Markets are pricing an approximately 80% change likelihood of a 25bp rate hike on Thursday and a roughly 50% chance of a further move in November, meaning the scope for disappointing against market expectations has reduced markedly when compared to recent times:

Above: "Market pricing suggesting the BoE are finally within striking distance of the terminal rate" - Deutsche Bank.

If it is market disappointment with the scale of the Bank of England's ambitions that driver GBP weakness, then the closing of the gap between ambition and delivery will surely limit the currency's downside potential.

"Pricing implies that a hike in November is essentially a coin toss, and suggests the market would not be particularly surprised by another dovish revision to the forward guidance next week," says Shreyas Gopal, Strategist at Deutsche Bank.

Ahead of the decision is the release of UK inflation data where markets are looking for a headling CPI rate of 7.0% y/y and a core CPI rate of 6.6% y/y.

The rule of thumb is that a beat is supportive of the Pound and a miss is unsupportive. But in the current environment, it is hard to see the Pound getting much lasting traction from a massive upside surprise, indeed it could prove to be detrimental as it sends a clear signal the UK has a stagflationary problem brewing which is hardly supportive of a currency.

"The MPC's hope will be that Wednesday's CPI print doesn't now raise pricing - and thus raise the stakes for sterling - right before their decision," says Gopal.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes