Pound Sterling to Weaken Against Euro if Inflation Undershoots, Predict Strategists

- Written by: Gary Howes

Image © Adobe Images

The British Pound has struggled over the course of May and the trend could extend if midweek's much-anticipated inflation reading surprises to the downside.

The rule of thumb is that the Pound would rally if inflation comes in above expectation, and fall if it undershoots.

This is simply because markets would expect a downside miss to imply the Bank of England would abandon its interest rate hiking cycle sooner rather than later, while another hot reading bakes in at least two more hikes in 2023, in turn supporting Sterling.

But as we noted in our week ahead report, a downside miss could yet prove supportive: after all, the UK's economic woes are a result of hot inflation hammering the consumer and business. If inflation falls, the economic outlook brightens allowing for economic growth that ultimately underscores a currency's value.

Adam Cole, Chief Currency Strategist at RBC Capital Markets, is nevertheless expecting an undershoot to result in broad currency weakness.

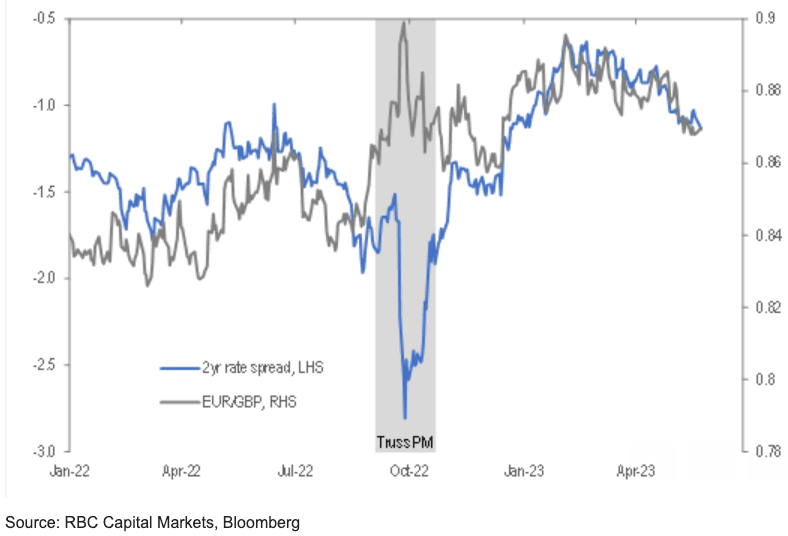

"GBP is a mild outperformer in 2023 so far (+2.6% vs USD and 1.8% vs EUR). We see this being pinned on everything from Brexit (the ditching of the NI Protocol Bill and likely ditching of Retained EU Law Bill in its current form) to broader political stability. In reality, as the chart shows (below), since the volatility last autumn, GBP has become a fairly vanilla nominal rate expectations story, with outperformance vs EUR reflecting a small widening of spreads in GBP's favour," says Cole in a recent research briefing.

Above: "GBP has become a vanilla rates story" - RBC Capital Markets.

The above chart shows UK interest rate differentials, which are ultimately underpinned by the Bank of England's base rate. It also shows the value of the Pound tracks these rates higher suggesting any pullback in rates would result in Sterling weakness.

The evidence, therefore, is that the Pound would come under pressure if markets were to lower expectations for future Bank of England rate cuts, something that would almost certainly be likely in the event UK inflation undershoots.

Money market pricing suggests investors are positioned for a further two 25 basis point hikes heading into the data release.

"Where does that leave us? Pushing back against what feels like an increasingly-positive consensus. The 50bp of further hikes priced into SONIA forwards contrasts with our view that the debate should be between one further hike and no further hikes," says Cole.

"April CPI release is critical in this respect. Even an in-line release (8.2% y/y from 10.1%) could see that debate shift as BoE rhetoric again starts to recognise rates may have risen enough already (where we were in February before the Q1 CPI data intervened)," he adds.

Expecting weakness in the Pound, RBC Capital is selling the currency against the New Zealand Dollar this week.

Jordan Rochester, FX Strategist at Nomura, is another seller of pounds ahead of the inflation report.

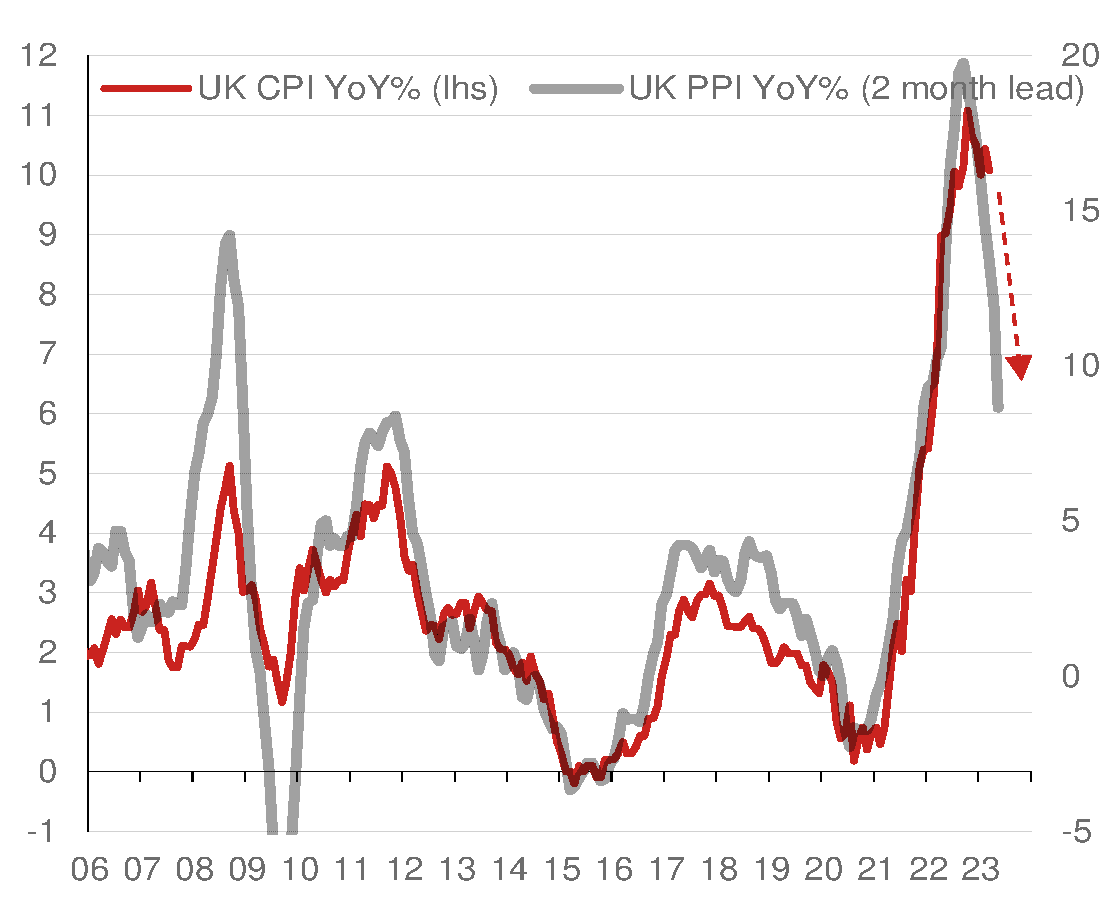

"We anticipate a significant cooling of inflation," says Rochester.

UK inflation has been at, or above, 10% for eight of the past nine months, but the sharp rise in energy bills a year prior is now anticipated to fall out of the data.

Nomura anticipates a sharp fall in April as a result, with projections suggesting headline CPI could drop from the current 10.1% to approximately 7.9%.

This would be below the Bank of England's expectation of 8.4% and the consensus estimate of 8.0%.

Above: UK inflation is expected to fall sharply from here. Image courtesy of Nomura.

Rochester, expressing a conviction level of 3 out of 5 for a 'short' Pound Sterling position, says "given the prevailing circumstances, we believe shorting GBP/USD is a prudent move at this time."

But a soft inflation report could prove to be the catalyst for Pound Sterling underperformance against the Euro, too.

"We have been biased toward long EUR/GBP positions, expecting 0.90 in Q2. However, we have been waiting for the right moment as EUR/GBP has been on a downward path in May. If the CPI comes in weak next week, it may trigger an upward movement in EUR/GBP," says Rochester.

Ahead of the report, the Pound to Euro exchange rate trades around the 1.15 area (EUR/GBP at 0.8670) with the Pound to Dollar succumbing to an ongoing USD rebound by testing 1.24.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market is looking for headline CPI inflation to read at 8.0% with core CPI inflation expected to read at 6.2%.

"Headline inflation is set to fall further this year, with Ofgem (Thu) due to announce its price cap for July which, for a typical household, is expected to fall to around £2,000, the lowest since April 2022. Nevertheless, policymakers will continue to ponder whether 'stickier' services inflation warrants more policy tightening," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

Valentin Marinov, head of FX research at Crédit Agricole, says recent UK data has shown signs of cooling and there has been a tendency in May for numbers to undershoot.

"The GBP could thus look vulnerable to potential downside surprises in the near future, especially given that the currency remains one of the biggest longs in the G10 FX market," says Marinov.

"The BoE has signalled that it expects UK inflation to slow down sharply from here, and a confirmation of that view could encourage rates investors to pare back their aggressive BoE rate hike expectations to the

detriment of the GBP. The currency could be even more vulnerable if we further get evidence of slowing domestic demand and softening business sentiment outlook," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes