Pound / Euro Week Ahead Forecast: Looking to Stabilise Above 1.18

- Written by: James Skinner

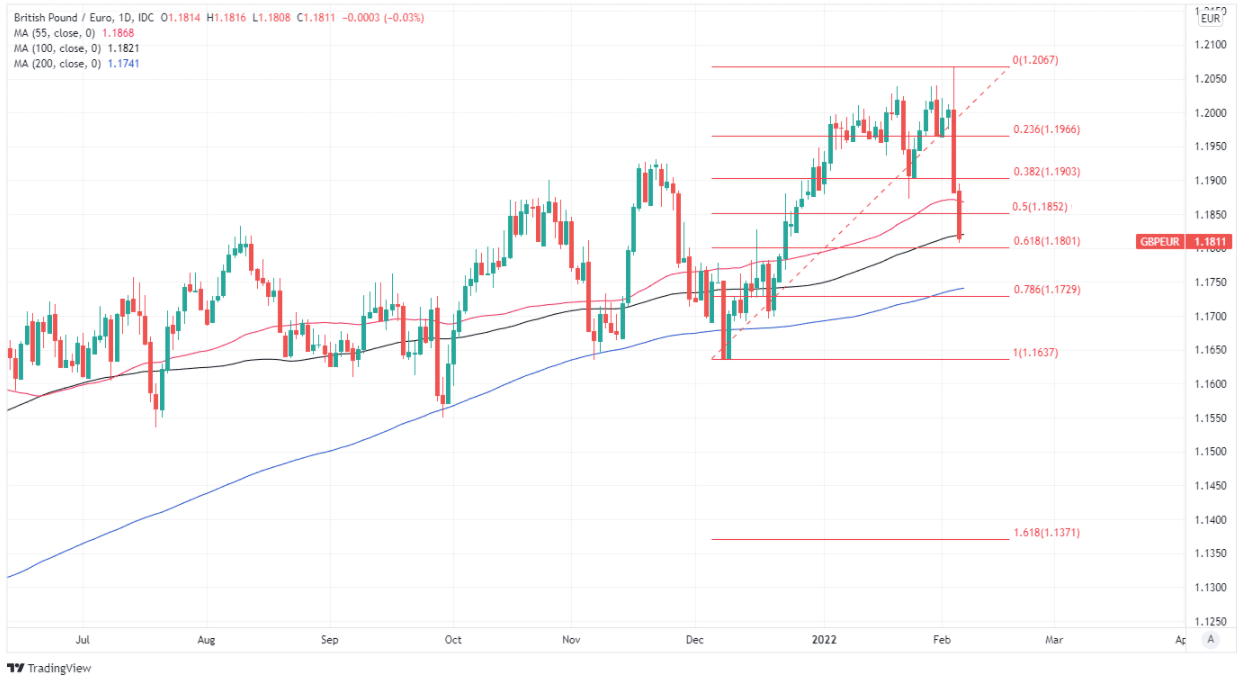

- GBP/EUR looking for support above 1.18

- After BoE & ECB updates prompt sell-off

- But downside risks linger amid EUR rally

- EUR limits scope for recovery short-term

- ECB, BoE speeches, Q4 UK GDP in focus

Image © Adobe Images

The Pound to Euro rate sustained heavy losses last week but could look to stabilise above an important and nearby level of technical support around 1.18 over the coming days, although Pound Sterling would be vulnerable in the event of any further extended rally by the European single currency.

Pound Sterling had rallied sharply after last Thursday’s Bank of England (BoE) decision to lift Bank Rate from 0.25% to 0.50% but was quickly overcome by losses when the subsequent press conference brought the market’s attention to bear on the negative implications of some of the BoE’s forecasts.

The Pound to Euro rate was reined in after Governor Andrew Bailey and colleagues warned of a subdued economic growth outlook and observed that meeting market expectations for Bank Rate over the coming year could ultimately lead inflation to fall below the targeted two percent level.

February’s forecast for inflation would remain above the desired two percent level for more than two years before dropping below two percent in the early months of 2025 was a tacit indication that the BoE could be unlikely to lift Bank Rate next year as far as has been envisaged by the market.

“While market pricing on tightening appears a bit too hawkish, this may not be challenged until later in the year, which should leave the pound able to withstand any appreciating pressures in the dollar and the euro,” says Francesco Pesole, a strategist at ING.

Above: GBP/EUR shown at daily intervals with Fibonacci retracements of December rally indicating likely areas of technical support for Sterling.

- Reference rates at publication:

GBP to EUR: 1.1830 - High street bank rates (indicative): 1.1517 - 1.1600

- Payment specialist rates (indicative: 1.1725 - 1.1727

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

“A continuation of the soft dollar environment today could see Cable test the 1.3750 January highs, while EUR/GBP could stabilise around 0.8400 [1.1904] now after a short-lived move yesterday to the 0.8300 mark,” Pesole and colleagues said in a Friday research note.

While Sterling was deflated by the BoE’s caution about the level of “monetary tightening” baked into UK interest rate markets and the Bank’s concerns about what recent surges in energy and internationally traded goods prices could do to UK economic growth, it was last Thursday’s European Central Bank (ECB) policy decision and resulting rally in the European single currency that really undid GBP/EUR.

“It was the glaring absence of Lagarde’s previous guidance that a rate hike in 2022 was “very unlikely” that confirmed her hawkish shift to investors. The money market reaction was rapid. The markets moved to price in a 40 bps increase in interest rates on a 1 year view. This triggered an immediate response in the EUR which lurched higher,” says Jane Foley, head of FX strategy at Rabobank.

“This week’s hawkish pivot suggests that the EUR’s recovery may have already begun. We will be re-examining our EUR forecasts across a range of currency pairs over the next couple of weeks. This reappraisal will take account of what higher interest rates now means for growth potential further down the road. This is a factor which is also very pertinent to the USD outlook and also for GBP,” Foley said in a Friday research note.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

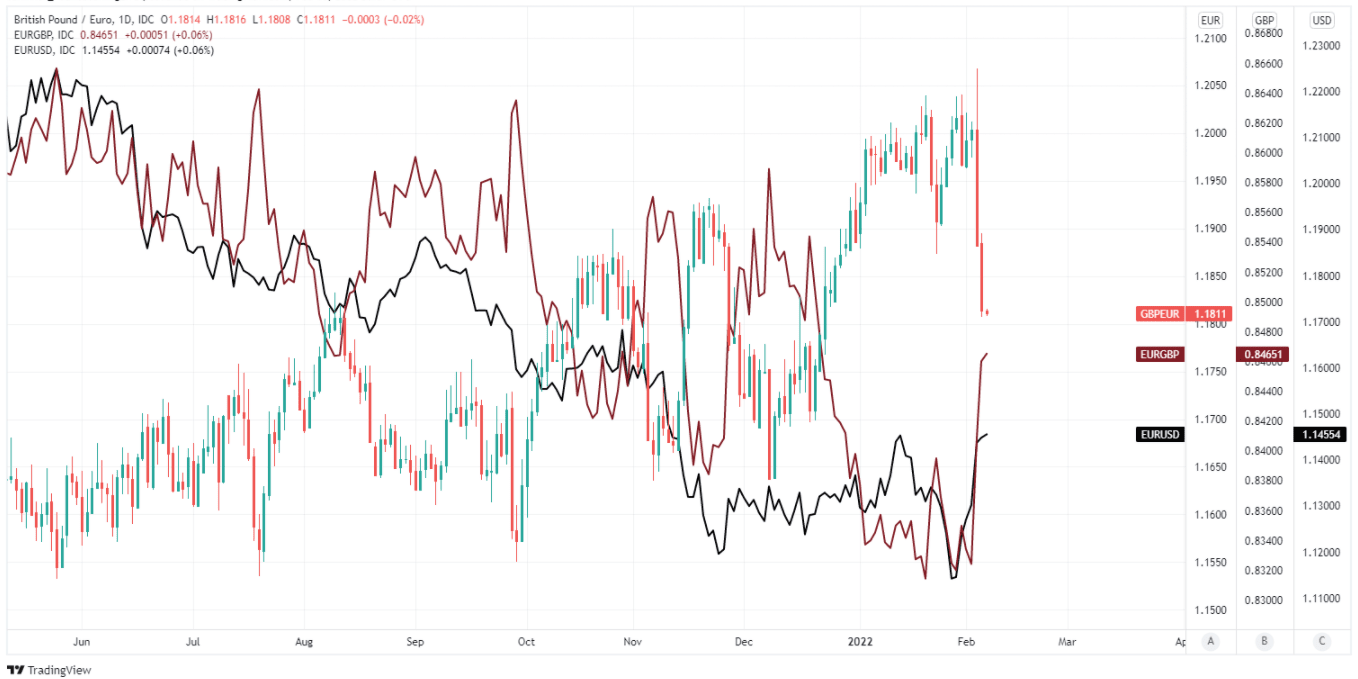

The Euro rallied strongly against all major counterparts last week after President Christine Lagarde said that uncertainty about the Eurozone inflation outlook has increased and that risks are tilted to the upside along the immediate path ahead, leading to widespread speculation in financial markets that a possible end to the era of negative interest rates could be near in Europe.

While that may yet turn out to be a premature judgment, the market hasn’t wasted any time chasing the Euro higher and the prospect of further extended gains by the single currency is an ongoing risk for the Pound to Euro rate this week when the market will likely pay close attention to testimony from President Lagarde before the European parliament on Monday as well as public appearances from BoE Governor Bailey and colleagues.

“The latest ECB policy meeting could prove to be an important pivot point for the EUR. We are more confident now that the lows are in place against the USD and GBP at 1.1121 and 0.8285 [GBP/EUR: 1.2070] respectively. Furthermore, we see room for EUR strength to extend further in the near-term,” warns Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

“Our initial targets on the topside for EUR/USD and EUR/GBP are provided by their 200-day moving averages which come in at around 1.1680 and 0.8520 respectively, [GBP/EUR: 1.1737],” Halpenny said in a Friday research note.

Above: GBP/EUR shown at daily intervals with EUR/GBP and EUR/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

President Lagarde’s 15:45 appearance on Monday before the European Parliament Economic and Monetary Affairs Committee is the highlight of the week for the Euro, which would likely be sensitive to any suggestions that financial markets may be right to expect a change in the ECB’s monetary policy settings later in the year.

Such remarks could extend the single currency’s rally and weigh heavier on the Pound to Euro rate, which will also be highly sensitive to remarks made by BoE Chief Economist Huw Pill in Wednesday’s online event with the Society of Professional Economists and Governor Andrew Bailey in Thursday’s at an online event hosted by TheCityUK, which are are the highlights of the week for Sterling ahead of Friday’s UK GDP data.

“Mr. Bailey said in the press conference following the publication of the Monetary Policy Report that “it would not be surprising if we saw a further increase [in Bank Rate], but please do not get carried away”. The MPC's latest forecasts also signal that the Committee thinks it will not need to raise Bank Rate as far as markets expect,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“The forecast for year-over-year growth in GDP in 2022 was cut to 3.7%, from 5.0%, and for 2023 to 1.3%, from 1.6%. This primarily reflects the "terms of trade" shock emanating from the surge in prices for imported goods and energy. The shock is so large that the MPC expects excess capacity, equal to 0.75% of GDP, to emerge by 2024, and the unemployment rate to rise to 5.0%, if it raises rates as much as markets expect,” Tombs also said.

The week rounds off with the release of GDP figures for December and the final quarter overall, which will reveal the extent to which the emergence of the Omicron variant of coronavirus weighed on economic activity into year-end.

Consensus looks for GDP to have fallen by -0.5% in December and to have grown by a mere 1.1% for the final quarter, while the BoE suggested in last week’s policy decision that it could be February or March before the economy fully recovers its footing.