Pound / Euro Nudges New Highs, UK to Drop Remaining Covid Restrictions

- Written by: Gary Howes

Image Gov.UK

The British Pound extends a recent run of gains aided by rising UK bond yields amidst heightened expectations the Bank of England will raise rates again in February.

The Bank looks almost certain to raise the Bank Rate to 0.50% given news UK inflation reached a 30-year high in December, with contributions coming from right across the inflation measurement basket.

Indeed, the market implied odds of a February hike rose to above 90% in the wake of the midweek inflation report.

In tandem, the Pound to Euro exchange rate rose to a new two-year high at 1.2028.

"Investors surely are right to view another rate hike at February's MPC meeting as a near-certainty, following December's consumer prices figures," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Underscoring the likelihood of another rate rise was news the UK government would let Plan B Covid restrictions expire on January which could help boost UK economic activity in February.

The measures will afford the Bank's Monetary Policy Committee the assurance they require to proceed with a hike.

Prime Minister Boris Johnson told parliament midweek that Plan B restrictions would expire on January 26 in light of a consistent fall in UK cases and signs hospital admissions were starting to decline.

"We're more boosted than any country in Europe" said Health Secretary Sajid Javid in a press conference detailing the measures. "That's why we are the most open country in Europe and today we've announced plans to go even further."

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The development opens the door to a February economic rebound according to economists.

"The good news is that GDP should be rising again in February," says Tombs.

Expectations for an economic growth rebound combined with strong labour market data and hot inflation to push the yields paid on UK government bonds higher.

It is this rise in bond yields that is the ultimate drive of Sterling strength; particularly against other currencies that have seen yields rise at a slower pace such as the Euro.

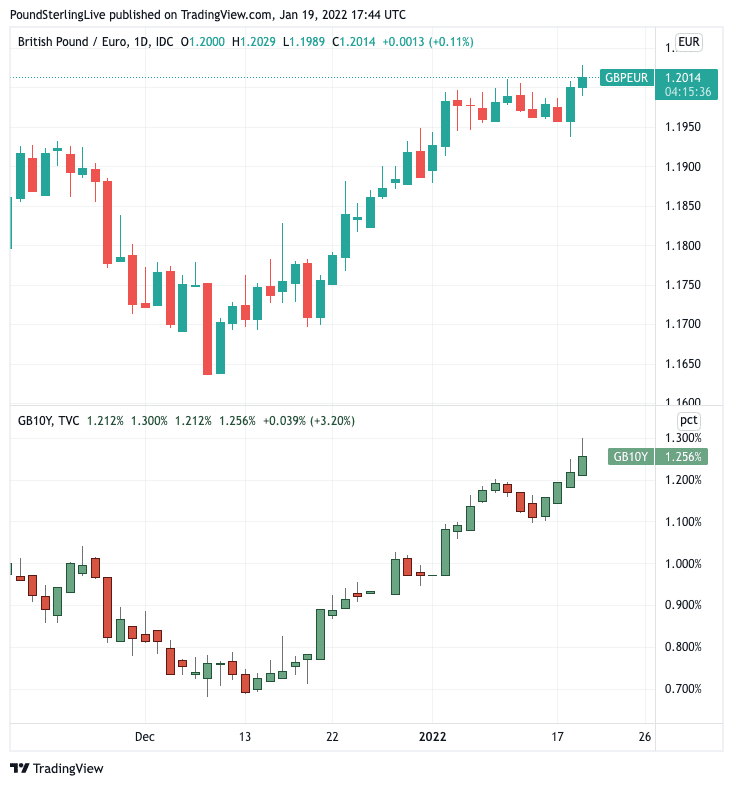

The below chart shows the yield paid on the UK ten-year government bond has a strong positive correlation with Sterling-Euro:

Above: The Pound to Euro exchange rate (top) tracking ten-year yields (bottom).

Yields and the Pound were supported by comments from Bank of England Governor Andrew Bailey who on Wednesday told UK lawmakers he and colleagues remain concerned by rising inflation and they stand ready to act.

The comments cement investor expectations for another interest rate rise in early February.

In an appearance before Parliament's Treasury Select Committee, Bailey said the Bank's regional agents report they are seeing some evidence of second-round inflation effects.

He says there is a concern of "second round effects" on wages from both rising inflation and a "tight" jobs market.

This is a signal that rising inflation in the UK is no longer being exclusively caused by external factors - such as oil and global supply chain bottlenecks - but also by home-grown issues, which the Bank can address via monetary policy.

In fact Bailey said his concerns that inflation would be stoked by the state of the labour market in part influenced his decision to raise interest rates in December.

It was reported Tuesday the UK added 184K employees to the payroll in December said the ONS, beating analyst expectations for a rise of 120K. This makes for a rise of 1,340,000 payrolled employees (+4.8%) compared with December 2020.

Bailey says the labour market is "very tight" in terms of supply, i.e. there are too few applicants chasing the 1.2 million+ vacancies.

This inevitably puts upward pressure on wages, which in creates a positive feedback loop for inflation.

He added the Bank "can and will do" everything it can to control inflation.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The market is currently pricing a ~90% chance of a February rate hike at the Bank, odds that rose in the wake of ONS data out Wednesday that showed UK inflation reached a 30-year high in December 2021.

Earlier this week strategists at Goldman Sachs said they raised their forecasts for Pound-Euro following a strong start to 2022 for the UK currency, in part on expectations for a series of rate hikes at the Bank of England.

"We argued that this GBP bearishness looked overdone," says Zach Pandl, Co-head of FX Strategy at Goldman Sachs in New York.

Goldman Sachs finds currency markets have of late primarily traded along the lines of a more optimistic global growth outlook, "which benefits Sterling more than most".

Also aiding the Pound in 2022 will be a "more aggressive policy" stance adopted by the U.S. Federal Reserve, according to Goldman Sachs.

They say the more proactive Fed will guide markets to anticipate a more proactive approach to fighting inflation by other major central banks, the Bank of England included.

"It is also worth noting that the Fed’s apparent preference for earlier balance sheet action makes the BoE’s own runoff plans less idiosyncratic, which we thought could have held back GBP’s response to policy action," says Pandl.