Pound-Euro Rate Forecast Higher by Goldman Sachs

- "EU and UK converging towards a Brexit Deal" - Goldman Sachs

- "increased demand for GBP call options" - Reuters

- "sentiment is continuing to build for a positive outcome" - JP Morgan

- "best strategy is to avoid holding much GBP risk" - Nomura

Picture by Andrew Parsons / No 10 Downing Street

- GBP/EUR spot rate at time of publication: 1.1016

- Bank transfer rate (indicative guide): 1.0730-1.0808

- FX specialist providers (indicative guide): 1.0874-1.0917

- More information on FX specialist rates here

Foreign exchange analysts at Goldman Sachs see value in buying Pound Sterling against the Euro in anticipation of the EU and UK striking a Brexit trade deal in coming weeks, while foreign exchange market options pricing suggests a market becoming increasingly of the view the two sides will strike a Brexit deal.

"Go long vs Euro as Brexit Deal nears," says a weekly foreign exchange note to clients from the Wall Street bank. "On our read, recent events are consistent with the EU and UK converging towards a Brexit Deal, in line with our economists’ longstanding expectation for a relatively 'thin' trade deal, likely agreed by early November and subsequently ratified by the end of December."

The Pound recovered poise in the first week of October after numerous media reports suggested progress towards a Brexit deal was being made in the final round of official negotiations, which concluded on Friday.

Indeed, enough progress was made for the President of the EU Commission Ursula von der Leyen and UK Prime Minister Boris Johnson to agree on the weekend to further talks over coming days to try and make a breakthrough on matters concerning fisheries and state aid rules.

"The EU’s restrained response to the UK Internal Market Bill, reports of (limited) progress at the latest Brexit talks, and news that UK and EU leaders pushed to speed up negotiations in a weekend call all point in this direction. Though it is unlikely to be a straight line from here, we think the market is still pricing a significant degree of uncertainty into Sterling that is no longer warranted," says Goldman Sachs analyst Zach Pandl.

Goldman Sachs tell clients that an orderly exit on January 01 2021 should persuade longer-term investors to reduce their UK underweights that have persisted since the Referendum, as well as significantly reduce the risk that the Bank of England will introduce negative rates.

"While we have frequently cautioned that the more uncertain global backdrop has made it harder to express views on the Brexit process in the currency this year, we are encouraged by the Pound’s increasingly idiosyncratic price action as the negotiation deadlines draw near," says Pandl.

Goldman Sachs are looking to target a recovery in the Pound-to-Euro exchange rate back towards 1.15.

Data from Reuters meanwhile suggests the broader market is coming around to a pro-Sterling outcome to Brexit trade negotiations, with forward-looking FX option pricing and flows are suggesting a more positive outlook for the British Pound.

"Dealers report that end users of FX options, who typically hedge exposure to GBP in a certain direction, have increased demand for GBP call options, allowing them to benefit from any GBP gains over coming months," says Richard Pace, a Reuters market analyst.

"The only certainty amid the fog surrounding European Union-UK trade talks is that sterling will weaken or strengthen once the fog clears and the outcome of the talks is known."

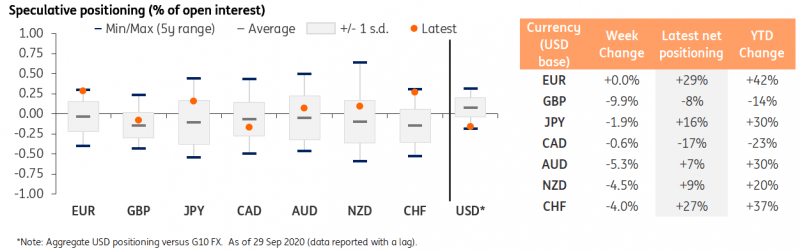

Friday's CFTC data on how speculators are positioning for future moves in Sterling showed speculators have flipped to a net Sterling short position for the first time in eight weeks in the week to September 29. A 'net short position' means there are more outstanding bets that would profit on Sterling downside than would profit on upside.

(Find out here how to book today's exchange rate for use in the future, thereby protecting your payments budget. Alternatively, you can automatically book your ideal when it does eventually get reached.)

"Sterling’s positioning experienced the biggest swing in G10 in the week 23-29 September, dropping by almost 10% of open interest to -8% of opening interest," says Francesco Pesole, foreign exchange strategist at ING Bank. "The reason for GBP’s exacerbated move in positioning compared to the rest of G10 is indeed related to the uncertainty around EU-UK trade negotiations and the Brexit Withdrawal Agreement."

However, it must be noted that the latest CFTC report covers a period of negativity towards Sterling, and there is a chance of a reversal in positioning given the tone towards negotiations over the course of the past week.

"Indeed, the newsflow over the past few days has given reason for more optimism that a trade deal will be eventually agreed in the next weeks, so we may see some of this positioning drop being pared back," says Pesole.

"There is no denying that sentiment is continuing to build for a positive outcome and while Johnson’s October 15th deadline is fast approaching it does feel that the will is there from both sides to do a deal although this is likely to be a very skinny one. We are feeling a bit more positive on the whole situation but mindful there will continue to be plenty of headline risk in the coming days," says a note from the institutional FX sales desk at J.P. Morgan.

However, not all institutional strategists are convinced the Pound is an attractive proposition in the current environment.

Strategists at investment bank Nomura have been maintaining a strategy of selling the Pound while buying the Euro (short EUR/GBP) over recent months, but they have recently exited the trade citing the growing prospects of a last minute Brexit deal which would likely push the Pound higher.

Despite no longer expressing a desire to sell Sterling, Nomura are not yet willing to be buyers.

"We believe the best strategy is to avoid holding much GBP risk until it becomes clearer which direction talks will go. Hence, why we took profit on our long EUR/GBP cash position, but did not flip into a long GBP trade," says Jordan Rochester, foreign exchange strategist with Nomura. "We wait for better levels to reinitiate medium-term long EUR/GBP positions once a Brexit deal is out of the way by the 15/16 October EU summit or in the immediate weeks after (end-October is said to be the new timeline for a deal)."