Pound-Euro Exchange Rate Forecast: "Risk of Parity is High"

- The 3 reasons why Sterling is falling

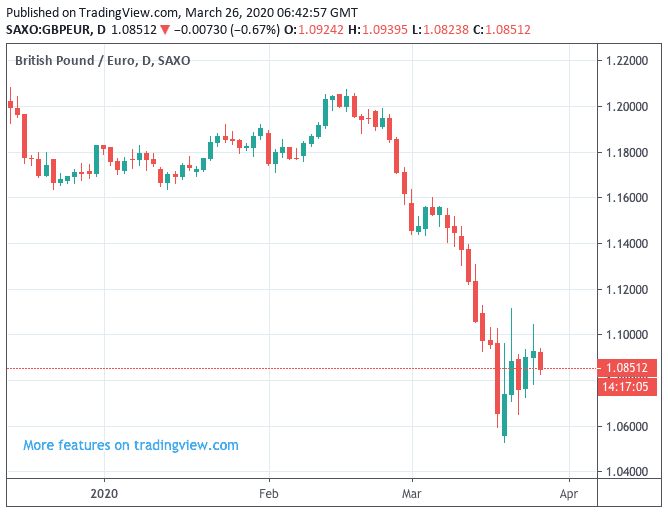

- GBP/EUR fell 12.8% peak to trough in one month

- New stock market capitulation risks GBP/EUR decline to parity

Image © Adobe Images

- GBP/EUR spot at time of writing: 1.0847

- Bank transfer rates (indicative): 1.0560-1.0640

- FX specialist rates (indicative): 1.0720-1.0750 >> More information

The risk of Pound Sterling falling to parity against the Euro is considered to be high by foreign exchange analysts at Nordea Markets, one of Europe's major lenders and investment banks.

"While it may seem like there is a long way up to 1.00, we would still not rule out that scenario," says Morten Lund, US & UK analyst at Nordea Markets.

The forecast for a potential decline in the GBP/EUR exchange rate to 1:1 comes amidst further declines in Sterling which remains vulnerable to the coronavirus-inspired global market sell-off, as well as a glut of freshly minted money from the Bank of England.

The Pound-to-Euro exchange rate was as high as 1.2074 on February 18, from where it proceeded to decline to a low of 1.0526 one month later, making for a month-to-month decline of 12.8%.

The exchange rate is currently quoted at 1.0872, amidst a pause in the sell-off. While the market is suggesting some consolidation is at hand we note that any meaningful attempts at a recovery have tended to fizzle out and Sterling simply lacks upside momentum.

There is a real risk that the recent stabilisation in market sentiment proves temporary and another rout ensues. Under such circumstances we would quite easily imagine that the Pound will fall to equality with the Euro.

Why Sterling is Falling

Lund says there are three reasons in particular as to why Sterling is susceptible to further losses.

The first reason is that the UK runs a current account deficit, this is a result of the country importing more than it exports. Typically a currency would fall until such a time as imports and exports reached equilibrium. However, Sterling has over the years traded above this equilibrium point, propped up by significant capital inflows from global investors attracted to UK assets.

"A constant capital inflow is therefore needed to underpin the GBP which is challenging in the present dash for cash situation," says Lund.

A second reason for Sterling vulnerability lies with the country's outsized banking sector: "the UK has a large and systemicaly important banking sector which is particularly exposed in times of credit crunches and disturbances in the global funding system - containing Libor-OIS and basis swaps spreads via more USD liquidity is key," says Lund.

Thirdly, the analyst believes Brexit has left Sterling exposed to investor fright. "After years of Brexit uncertainty and low returns, the Sterling has lost some of its appeal as a major reserve currency," says Lund.

How Far Can the Pound Fall?

A fair value model run by Nordea Markets shows EUR/GBP should trade around 0.96, which gives a GBP/EUR rate at 1.0416.

The lowest point reached by GBP/EUR occurred during the last period of serious global investor fright which followed the financial crisis in 2008, when the exchange rate fell to 1.0203.

"But the risk of parity is high," says Lund. "We do not think we have seen the highs in EUR/GBP yet."

Nordea Markets do say that while Sterling is at risk of equalising against the Euro "more is needed"; indeed these predictions of parity do tend to increase in frequency whenever the Pound is under pressure, yet the event has never occurred.

One potential catalyst to a major decline would be another market meltdown related to the coronavirus. Another would be the return of Brexit as a concern for markets.

Since the coronavirus crisis, Brexit has been kicked into the long grass as a market concern, but a June deadline for the EU and UK to agree the broad framework of a Canada-style Brexit deal is fast approaching.

It might simply be unreasonable to expect progress, particularly with the EU's chief negotiator Michel Barnier testing positive for coronavirus. Should Prime Minister Boris Johnson deny a delay, markets could grow incredibly nervous and the Pound will bear the brunt of this deterioration in sentiment.

Another issues that Lund reckons could trigger a Sterling sell-off of the intensity required for the Pound to par the Euro is a significant deterioration in the coronavirus outbreak in the UK.

The analyst says the UK appears to be lagging other European nations in attempting to contain the virus. A runaway rise in fatalities "poses the biggest risk for the UK financial system and could be the final trigger for EUR/GBP breaking parity," says Lund.