Pound-Euro Exchange Rate Back Above 1.19, but Weakness Lies Ahead Warns Danske Bank

- January saw GBP outperform

- But February could see gains unwound

- "GBP weakness is on the cards this year" - Danske Bank

Image © Adobe Images

Month end rates:

- Spot interbank GBP/EUR: 1.1902

- Indicative range for bank money transfer rates: 1.1585-1.1669

- Indicaative range for specialist money transfer providers: 1.1750-1.1795 >> More details

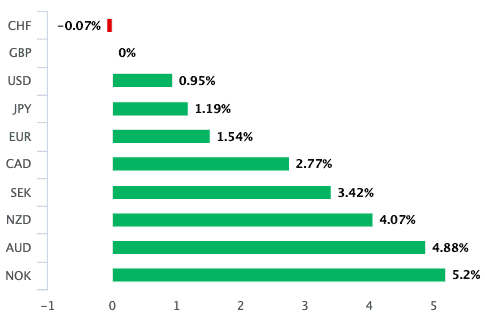

The British Pound powered higher into the turn of the month, ensuring it was January's best performing major currency alongside the Swiss franc, a currency which had a stellar month largely thanks to the coronavirus outbreak that sparked strong demand for so-called safe haven currencies, of which the Franc is king.

Underpinning the Pound's recovery - in place since August 2019 - is the improved political landscape in the UK which ultimately ensured the UK left the EU with a deal in place on January 31.

The Pound's most recent gains come amidst a decision on Thursday at the Bank of England to keep interest rates unchanged at 0.75%, a decision that surprised some in the market that had become increasingly convinced that the Bank would deliver a rate cut.

Above: Sterling's performance against its G10 counterparts in January

However, there remains a sizeable degree of scepticism amongst the foreign exchange analyst community as to whether the Pound can extend higher through February and in doing so keep alive a multi-month trend of appreciation.

Foreign exchange strategists at Scandanavian lender Danske Bank have this week warned that they see weakness ahead for the Pound-to-Euro exchange rate, as it is anticipated the UK economy will soon disappoint and EU-UK trade negotiations will prove difficult.

"We still think more GBP weakness is on the cards this year," says Danske Bank's Senior Analyst Mikael Olai Milhøj.

The call by Milhøj comes amidst a sharp move higher in Pound Sterling at the end of January, with markets bidding the currency following a decision by the Bank of England to leave interest rates unchanged at 0.75%.

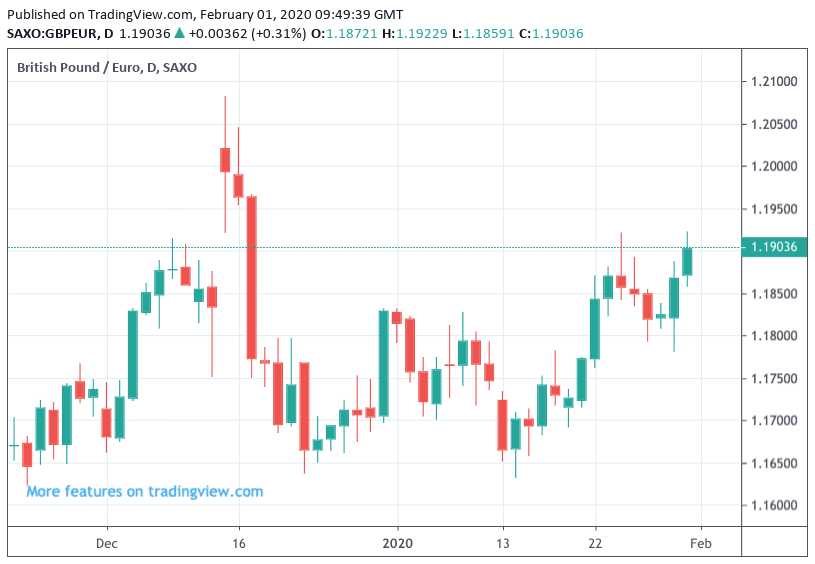

Above: GBP/EUR has recovered from mid-January lows

The GBP/EUR exchange rate closed the month at 1.1902, which is notably higher than the January low at 1.1630. This low was reached as foreign exchange markets saw the odds of a Bank of England interest rate cut rise rapidly.

In the end, the Bank did not cut rates and the Pound was quick to recover lost ground, ensuring GBP/EUR ended the month 1.53% higher.

Danske Bank had expected the Bank to cut interest rates, which would typically be expected to lead to a lower Pound. "While we were wrong in calling for a rate cut, we still think more GBP weakness is on the cards this year," says Milhøj.

"Near-term, we think GBP will remain sensitive to post-election data releases. If we are right that the economy will disappoint, we could see a repricing of the Bank of England," says Milhøj, who says such an outcome would likely send the GBP/EUR exchange rate lower.

Danske Bank is targeting a decline in the GBP/EUR to 1.15 in three months.

But even further weakness is expected in coming months, as investors are tipped to become increasingly sensitive to the status of EU-UK trade negotiations.

"Further out, we still think that the complicated Brexit negotiations and possible lack of progress will make investors impatient," says Milhøj.

Danske Bank forecast the GBP/EUR exchange rate to move to 1.1235 in the six to nine month timeframe.