Pound Sterling vs. Euro Week Ahead Forecast: Pennant Pattern Bodes for Further Upside

Image © Adobe Images

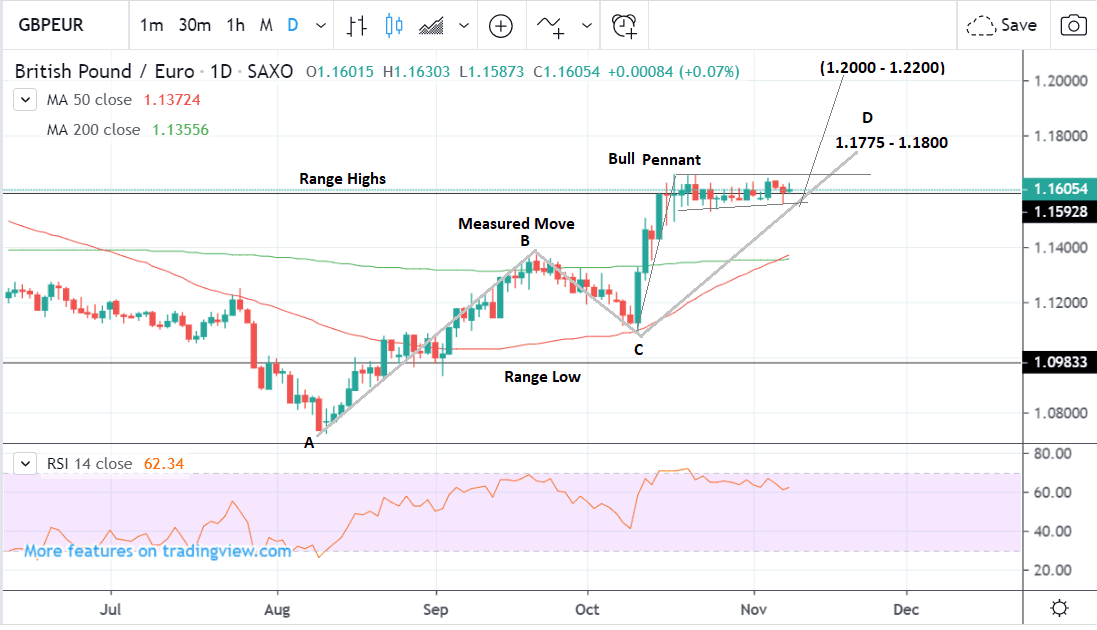

- GBP/EUR forms bullish continuation pattern

- Higher targets confirmed by a break above range

- Wage data is key economic release this week

The Pound-to-Euro rate opens the new week at 1.1592 after rising 0.15% in the week before. Studies of the charts show the pair pausing at the top of a long-term range, with bullish price patterns indicating a bias towards more upside in the future.

The 4 hour chart - used to determine the short-term outlook, which means the coming week - shows how the pair is trading at the top of a long-term range which might act as a ‘glass ceiling’ to further upside.

At the same time, however, it is forming a possible bullish continuation pattern called a ‘pennant’, which - subject to a breakout higher - might suggest substantial upside potential.

If the exchange rate can successfully rise above the top of the pennant, defined as the 1.1661 October 17 highs, it will probably confirm a continuation higher to a target at 1.1800 initially, and then perhaps 1.1915, in the short-term.

Although momentum is declining (circled) and suggests a risk of a bearish breakdown it is not a game-changer, and would only raise concern should the pair break below the 1.1525 lows. If that were to happen, a move down to 1.1350 could be possible.

The top of the range is a tough ceiling for the exchange rate to crack so our bullish forecast is dependent on a break to new highs.

Nevertheless, given the overall bullish trend, a continuation is marginally favoured.

The daily chart shows the pennant pattern more clearly, along with its full-potential upside target at 1.2000 - 1.2200.

Pennant patterns get their name from the triangular flags which used to fly from medieval castles.

The triangular pennant shape is preceded by a steep rally called the ‘pole’ - like a flag pole. It is used as a measurement guide since the rally which follows is normally either 61.8% of the length of the pole or the same length (100%).

In the example above this gives a target at either 1.1915 or 1.2200 respectively.

The daily chart shows another pattern may have formed called a ‘measured move’ or ABCD pattern, which is a three-wave zig-zag pattern higher.

Measured moves are useful for forecasting purposes as the first (A-B) and third (C-D) waves are often of equal length, so the length if A-B can help predict the length of C-D.

In the case of GBP/EUR such a calculation suggests an endpoint for 'D' and, therefore, a target at between 1.1775 - 1.1800.

A clear break above the range highs, confirmed by a move above 1.1661, would be a necessary prerequisite for achieving the target.

Either or both patterns may be valid and are not mutually exclusive.

The daily chart is used to analyse the medium-term trend, which is the next week to month of price action.

The weekly chart meanwhile shows the pair is currently trading at tough resistance from the 200-week moving average (MA) and the long-term range highs.

The combination of both levels is quite strong and only a clear break above the 1.1661 highs would provide confirmation of a continuation to the upside.

Such a move could see an extension of the uptrend to a long-term target of, perhaps, 1.2200, as suggested by the bull pennant on the daily chart.

The 1.20s represents a long-term equilibrium point for the exchange rate and gains above could be more difficult to come by.

At that level, there is an increased risk of a pull-back, and a consolidation evolving over the long-term, defined as the next few months, which is the time-frame that the weekly chart is used to analyse.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

GBP this Week: Polls and Important Data

The Pound has entered a decidedly sideways orientated range against the Euro of late, a clear reflection of a market that is paralysed by political uncertainty.

We believe Sterling is reflecting the Conservative's 10 point lead over Labour in the polls, the assumption is that the advantage is enough to deliver a majority government that will swiftly deliver Brexit in the new year under the terms of the EU-UK Brexit deal struck in October.

We would expect Sterling to break out of its recent ranges should polls suggest either the Conservative's lead has grown, or shrunk. The general rule of thumb is that should it shrink the Pound will come under pressure, should it grow then the Pound can find some upside momentum.

Away from politics, focus turns to key economic numbers, with third quarter GDP out on Monday, labour market numbers on Tuesday, inflation figures on Wednesday and retail sales on Friday

"We have a busy week ahead of us in terms of economic data releases, which will be interesting in the light of the dovish message sent by the Bank of England last week," says Aila Mihr, Senior Analyst at Danske Bank, adding:

"Given the weak PMIs, growth seems to remain sluggish but there might have been a positive contribution from stockpiling ahead of the previous 31 October Brexit deadline. On Tuesday, the jobs report for September is due out, which will be interesting, as the last couple of reports have shown decreasing employment. On Wednesday CPI inflation for October is due out and retail sales for October are out on Thursday."

Third quarter GDP is forecast to read at 0.4% when released at 09:30 GMT, an improvement on the previous quarter's -0.2% reading.

Tuesday's average earnings data (with bonus) is forecast to read at 3.8% when released at 09:30 GMT, unchanged on the previous month. A beat would be positive for Sterling, a miss would be negative.

The three-month-on-three-month employment change is forecast to read at -90K.

Wednesday's headline inflation rate is forecast to read at 1.6% year-on-year for October, down slightly on September's 1.7%.

We would expect any currency reaction to the above data to ultimately be short-lived as the market remains focussed on the General Election.

EUR Faces an Important Week

"In the euro area we have an important week ahead of us," says Mihr, citing Spanish election results, President Trump's decision on EU tariffs and Eurozone industrial production numbers.

Spain on Sunday voted in its fourth election in four years as Prime Minister Sanchez failed to strike a deal with far left Podemos after the latest elections in April.

"Sanchez now hopes to gather enough support to govern, but recent polls show falling support for PSOE and again no party or block is likely to get an absolute majority in the highly fragmented parliament," says Mihr. "For markets, a left-wing government supported by nationalist parties would be slightly market unfriendly in the near term, whereas a PSOE minority government with right wing abstention should be market friendly in the near term due to the possibility of market-oriented reforms."

Tuesday sees the release of German ZEW Current Conditions data for November released, as well as the Economic sentiment reading.

The German economy is struggling, and markets will be eyeing these forward-looking indicators for signs of whether Europe's targets economy is about to turn a corner.

The Current conditions number is expected to read at -21, while the Currency Conditions number is forecast to read at -13.

Wednesday will likely see U.S. President Trump announce whether or not he will impose additional tariffs on cars imported from the EU.

"Additional tariffs would be the last nail in the coffin for the already weak euro area manufacturing (and car) sector, just as signs of a stabilisation are becoming more abundant. However, it will also be a hard hit to US consumers, which President Trump will be keen to avoid going into the 2020 Presidential elections," says Mihr.

A decision to slap tariffs on the EU would prove to be a negative surprise as the market consensus does appear to suggest Trump won't move forward with punitive tariffs.

Indeed, Commerce Secretary Wilbur Ross recently said tariffs could be off the table for now after ‘good conversations’ with car manufacturers about potential production relocations. Nevertheless, investors should keep a very close eye on the announcement.

Wednesday September industrial production figures for the Eurozone are released at 10:00 GMT. Market consensus is looking for a reading of -0.3% month-on-month to be released for September.

"The question is whether the stabilisation in the latest manufacturing PMIs shows up in the production figures. We expect the figures to confirm that the manufacturing sector has stayed in recession in Q3," says Mihr.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement