Pound-to-Euro Exchange Rate Supported at 1.13, Return of Parliament to Guide Next Moves

Image © Photocreo Bednarek, Adobe Stock

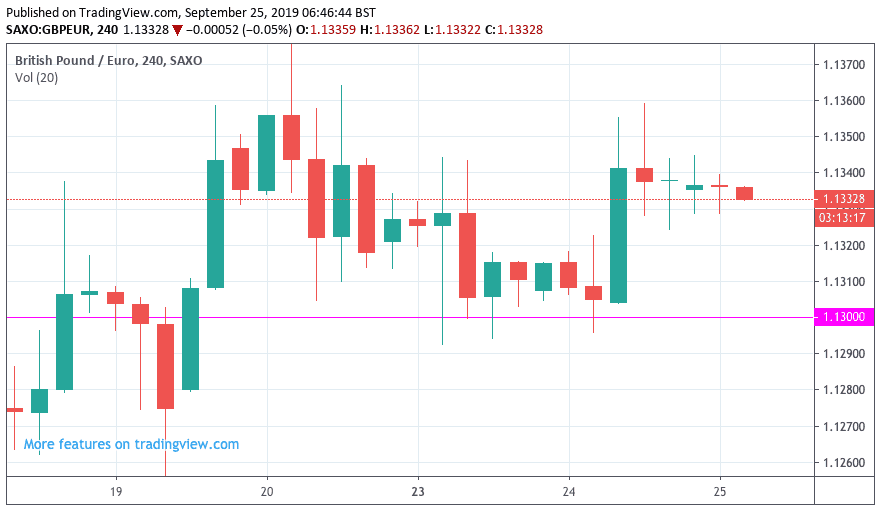

- GBP/EUR supported at 1.13

- Supreme Court ruling fails to shift fundamentals for Sterling

- Return of Parliament Wednesday could provide some short-term volatility

The British Pound trades an increasingly tight range against the Euro, Dollar and other majors as markets await fundamentally significant shifts in the Brexit saga. The return of Parliament on Wednesday could well spark some short-term volatility but we doubt we will see any 'game changing' developments from a currency market perspective.

Many readers will argue that Tuesday's Supreme Court decision that found the Government unlawfully prorogued Parliament should be considered to be fundamentally significant, yet currency markets profoundly disagree.

In short, very little has changed: Parliament has successfully passed a law that outlaws the UK leaving the EU without a deal on October 31, and the Government continues to strive for a renegotiated Brexit deal to be struck at the October 17 European Council meeting.

"In my view principally nothing has changed for Sterling, and instead I fear that every day during which Parliament and the government are locked in conflict leading to yet another day passing without a Brexit solution being found is more likely to increase the risk of a disorderly Brexit," says Thu Lan Nguyen, a currency analyst with Commerzbank.

The Pound-to-Euro exchange rate initially rallied on the news that the 11 Justices of the Supreme Court ruled that the suspension of Parliament in effect never happened, however those gains were swiftly reversed as markets came to the conclusion that the decision, on the face of it, does not alter the political landscape.

The exchange rate rallied to above 1.1350 on the news, in mid-week trade we find the pair back at 1.1334. If we look at the rates being offered to those looking to make international payments, we can see high-street banks are transferring at rates of between 1.1030 and 1.1120, independent providers are meanwhile offering rates of between 1.12 and 1.1250.

It appears that 1.13 is now acting as a layer of support where buying interest can be found; the pair has not closed below 1.13 since September 17 and in the current environment we would suggest weakness remains limited to this area.

Consolidation could well characterise Sterling markets for the foreseeable future until such a time as some 'game changing' news on the Brexit front emerges.

We do however expect Sterling to remain relatively volatile on an hour-to-hour basis, and expect the currency to show an ongoing sensitivity to political headlines.

With this in mind, the opening of Parliament on Wednesday should provide decent levels of political intrigue that could deliver some moves in the currency.

We expect Parliament to once again seize control of business from the Government and continue their attempts to frustrate the Government's Brexit strategy.

The details of what might be achieved are yet to emerge but it appears the prime aim of MPs will be to prevent a 'no deal' Brexit from happening.

Sterling has rallied since mid-August when it became clear that MPs would succeed in preventing a 'no deal' Brexit and it is therefore understandable that markets have perceived the sitting of Parliament at this time to be supportive of the currency.

We will however be particularly interested in whether the opposition Labour Party decide to call a vote of no-confidence in the Government, noting the SNP on Tuesday suggested the time was right to do so.

Leader Jeremy Corbyn in his party conference speech on Tuesday called on the Prime Minister to resign. However, it must be remembered he opted to vote against a General Election and all indications remain that he is not ready to call a vote of no-confidence in the Government.

The argument being pursued is that he wants to remove the threat of a 'no deal' Brexit before entering an election.

However, even if Parliament to succeed in preventing a Brexit on October 31 it does not erase the fact that an extension does not kill Brexit in its entirety.

The Conservatives will campaign in the next election on an uncompromising pro-Brexit stance, and depending on the response by the Brexit Party, could win a majority.

Therefore, a 'no deal' Brexit will merely be delayed and the outlying expectation for such an outcome will likely keep Sterling's gains capped.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement