Pound-to-Euro Exchange Rate: Profit-Taking and a Pinch of Caution see Sterling Ease off Nine-Month Highs

- Written by: James Skinner

© European Union, 2018 / Source: EC - Audiovisual Service / Photo: Etienne Ansotte.

- GBP/EUR falters on "profit taking"

- Commerzbank takes profits on its 2019 bet on GBP/EUR rate

- GBP/EUR uptrend remains intact while market holds above 1.1280.

The Pound-to-Euro rate has staged a strong rally ahead of the weekend and hit the 1.16 marker for the first time in nine months, with pundits saying an apparent softening in the DUP's opposition to Prime Minister Theresa May's Brexit plan is the latest catalyst.

Northern Ireland's DUP are the king-makers in the British parliament and it is widely accepted that May needs to get their backing if her UK-EU Brexit deal is to be ratified by lawmakers.

"In our view, the most important driver behind this move has been markets pricing in a lower probability of a no-deal Brexit and a high likelihood of an extension of Article 50. Reports this morning that Theresa May has won the support of Northern Ireland’s DUP have sparked hope that a breakthrough may be within reach," says Kathrin Goretzki FX Strategist with UniCredit Bank.

The Pound has however, since retraced some of its advance to trade at 1.1561 at the time of writing, suggesting London traders are taking a more sober assessment of the news than their Asian counterparts.

Furthermore, the Pound-Euro rate has rallied to a notable area of resistance located just north of 1.16 that could see the advance stall. All this makes for the prospect of profit-taking ahead of the weekend in a replay of price action seen exactly one week prior, where Sterling suffered a sharp fall in Friday trade.

Currency strategists at a number of investment banks are meanwhile, telling clients to be wary of a potential retracement as traders sell the Pound in order to crystalise some of the handsome profits they've made this January.

Pound Sterling is the best performing G10 currency so far this year, having advance on all of its developed world rivals, and has risen more than 3.6% against the Euro during the past month.

"To push EUR/GBP lower, players need to be mindful that a weaker Eurozone outlook is an additional risk to the UK economy, especially if hopes for a Brexit delay turn out to be false optimism. Hence, expect some profit-taking to emerge near the 0.86 level," says Philip Wee, a strategist at Singapore's DBS Bank.

0.86 in EUR/GBP equates to the 1.1627 level in GBP/EUR. Forecasting is not an exact science, but the GBP/EUR rate did go as high as 1.1602 before hitting the brakes.

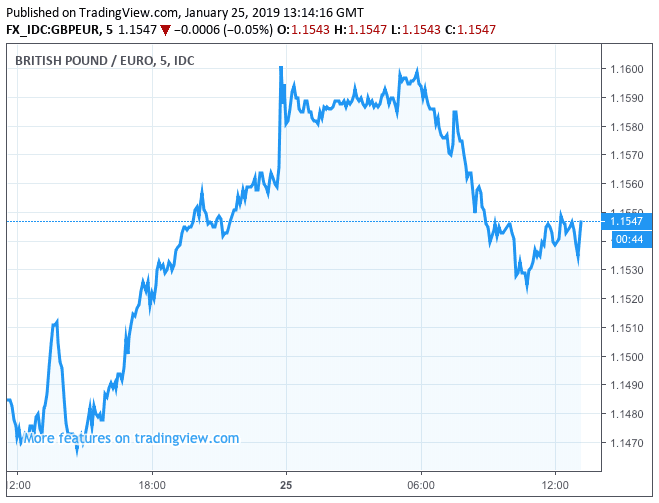

Above: Sterling hits fresh nine-month highs, it could however be time for a pullback after a solid run say some analysts.

The idea behind Wee's warning is traders might want to bank some of the profits they've already made by betting on the rate, in case the Brexit narrative turns against Sterling again, or in case escalating concerns about the health of the Eurozone economy begin to dent expectations for UK GDP growth.

"We think the FX market may be getting a little ahead of itself in pricing out the chances of a No Deal Brexit. We have seen some positive political developments in recent days but No Deal remains the law of the land unless Parliament moves beyond talk into actual action," says a note from the currency strategy desk of TD Securities. "With EURGBP bouncing off the 0.8620 level, we think risk/reward favors a squeeze higher. The daily RSI measure is now in 'oversold territory'. This suggests sterling now looks increasingly vulnerable to any disappointing headlines that may emerge."

Above: Sterling retraces its gains against the Euro after traders in London took over the reins from their counterparts in Asia.

Karen Jones, a technical analyst with Commerzbank in London says she is wary of a short-term bounce in the Euro, "there is scope for a bounce higher very near term," but Jones says she will look to sell any Euro strength on the observation that the technical setup now favours the Pound.

According to Jones, the Pound-to-Euro exchange rate outlook has turned increasingly positive after it broke through the 1.1554 November 2018 high, this suggests ongoing strength towards 1.17 and potentially even 1.20 says Jones.

Pound Sterling's fortune has improved in recent weeks because investors are increasingly betting that Prime Minister Theresa May will eventually ask the EU for an extension to the Article 50 withdrawal period.

That could ultimately lead to a second referendum, a Brexit-cancelling election or some other kind of exit-nullifying agreement between the political parties in Westminster, which would remove the Brexit-shaped Damocles Sword that's been hanging over Sterling since June 2016.

UniCredit's Goretzki thinks any retracements in Sterling should ultimately be short-lived. "While there is always a risk of disappointment and some correction after the sharp GBP appreciation of the past few weeks, we think this would likely be temporary, given that UK parliament is taking more and more control of the Brexit process and a majority of MPs is determined to avoid a no-deal scenario. We see room for further sterling appreciation in the medium term, with the biggest risk to this view being a snap general election, which would create a lot of new uncertainty."

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement