Dollar Weakness Against Euro and Pound a High Conviction Call for H2 at Wells Fargo

- Written by: Gary Howes

Image © Adobe Stock

Dollar weakness in the second half of 2024 is a high-conviction call for economists at Wells Fargo, one of the biggest main street lenders in the United States.

In a monthly financial forecast note, Wells Fargo says it will stick with its call for U.S. dollar depreciation later in 2024.

"U.S. economic outperformance and an 'on-hold' Federal Reserve has supported the greenback in early 2024. However, looking forward to later this year, while we do expect the U.S. to avoid recession, we still anticipate slower growth as the year progresses," says Nick Bennenbroek, International Economist at Wells Fargo.

At the start of the year, dollar weakness throughout 2024 was a consensus call among institutional economists, but a resilient U.S. economy, stalling disinflation, and a strong Federal Reserve upended this call.

The result at the start of the second quarter is the Dollar is 2024's best-performing currency.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The USD outperformance vindicates those currency forecasters who went against consensus by calling for Dollar strength this year. Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, is one such analyst, and he reckons Dollar strength will remain a feature of this year.

But Wells Fargo says inflation trends are still improving, albeit gradually.

"We also forecast the Fed to begin lowering interest rates from around mid-2024. The U.S. economic slowdown could occur just as some key foreign economies begin to recover, a growth swing that should weigh on the greenback," says Bennenbroek.

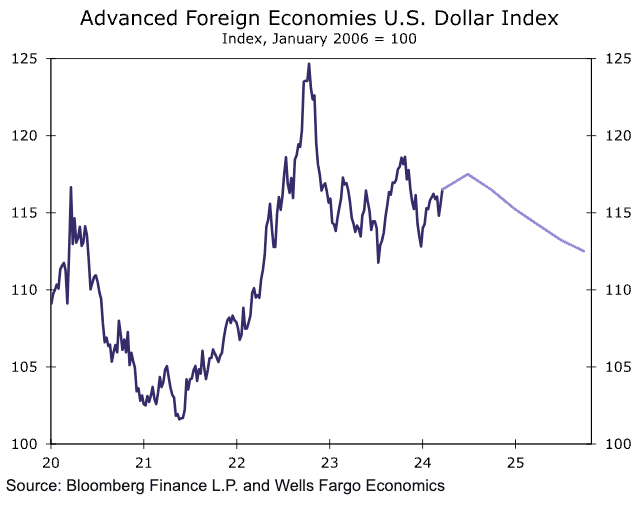

Above: USD weakness in H2 is a high conviction call at Wells Fargo.

He adds that additional headwinds to the Dollar will be a soft U.S. landing - whereby inflation falls and the economy avoids falling into recession - and lower U.S. yields, which could also support broader financial market sentiment. This can weigh on the safe-haven support for the U.S. dollar.

"Overall, we expect moderate U.S. dollar depreciation against G10 and emerging currencies later in 2024 and into 2025," says Bennenbroek.

Wells Fargo's forecast profile for the Pound to Dollar exchange rate envisages further weakness into year-end, with 1.25 pencilled in for end-June. The exchange rate can recover into year-end where 1.26 is expected. Further steady gains through 2025 are anticipated towards a peak at 1.29.

For the Euro-Dollar exchange rate, 1.07 is expected for mid-year ahead of 1.09 at year-end and a 2025 peak at 1.12.

"Among the G10 currencies that could perform solidly over the longer term, we would highlight the euro, yen, Australian dollar and Norwegian krone. For the euro, improving real income trends and sentiment surveys suggest the ingredients for economic recovery are coming increasingly into place, and should support a more solidly performing euro from later this year," says Bennenbroek.

Wells Fargo believes the yen could be particularly sensitive to Fed easing and falling U.S. yields, while Bank of Japan tightening could also offer some support to the Japanese currency at times.

"Against this backdrop, we remain reasonably constructive on prospects for the yen over the longer term. For Norway and Australia, we do not expect rate cuts to begin until Q3 or later this year, and to proceed at only a gradual pace, which should be supportive of both the Norwegian krone and Australian dollar," says the analyst.