GBP/USD Rate at Year Highs, But Looking Stretched Heading into CPI and Bank of England

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate (GBPUSD) hit a new one-year high at 1.2668 at the start of the week but new technical analysis reveals it is looking stretched ahead of a key U.S. inflation release and Thursday's all-important Bank of England decision.

"Sterling/Dollar merits a closer look following its latest price action. The UK currency closed higher last week versus the greenback, which means that it has advanced in seven out of the last eight weeks," says Bill McNamara, head of The Technical Trader.

GBP/USD rallied to 1.2668 on Monday as a well-entrenched uptrend extended to levels that were last seen almost a year ago.

Gains follow the previous week's Federal Reserve rate hike and guidance that gave investors confidence that further hikes were unlikely again in 2023 and they are pricing in around 70bp worth of rate cuts by the end of the year.

Meanwhile, the inflationary picture in the UK suggests that the Bank of England still has further work to do with a further 25 basis point hike due on Thursday, with market pricing showing investors are expecting at least a further two hikes before year-end.

The rally does however take GBPUSD to an area of notable resistance that could mean the pair faces a near-term setback in the coming week.

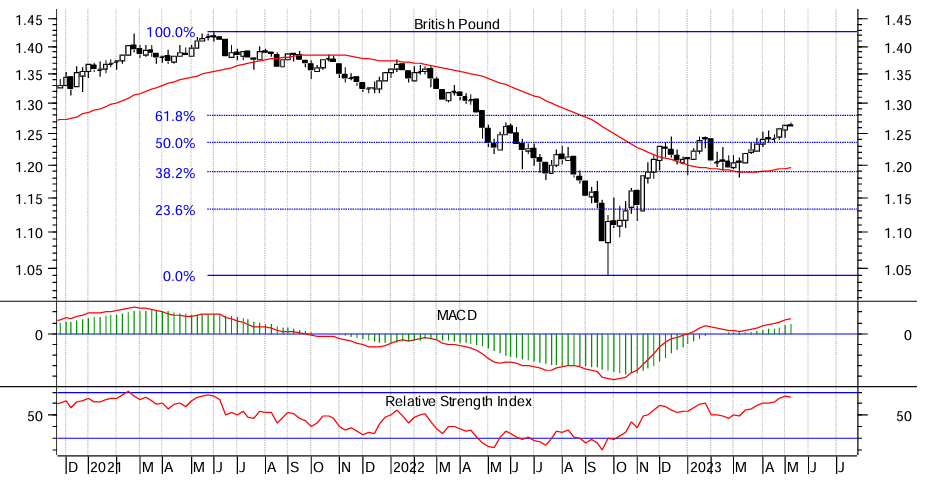

Image courtesy of The Technical Trader.

"The chart shows that sterling is close to retracing fully 61.8% of the decline that began in June 2021, i.e. at $1.28 or so, and the fact that it is now looking pretty stretched implies that there might well be a degree of resistance at that level," says McNamara.

The first test for the exchange rate comes midweek with the release of U.S. inflation figures.

Charalampos Pissouros, Senior Investment Analyst at XM.com, says investors are reluctant to assume large positions ahead of Wednesday's U.S. CPI inflation numbers.

The inflation headline rate is forecast to have held steady at 5.0% year-on-year and the core to have ticked down to 5.5% y/y from 5.6%.

"Given that the ISM and S&P global PMI surveys showed that output prices accelerated during the month, the risks surrounding Wednesday’s numbers may be tilted to the upside," says Pissouros.

"The U.S. dollar could gain if indeed there is an upside surprise, but calling for a bullish reversal may still be premature," he adds.

However, the XM.com analyst says Fed cut bets are unlikely to vanish, ensuring Dollar strength ultimately remains limited.

"As long as the ECB and the BoE are expected to deliver more hikes this year and no cuts at all, the greenback may stay in a downtrend against both the euro and the pound," says Pissouros.

"Gains for the U.S. currency could be limited with monetary policies’ directions not playing in its favor over the long term. Both the European Central Bank and the Bank of England are expected to continue raising rates during the next few months while the Federal Reserve could pause and potentially reduce rates," says Daniel Takieddine, CEO for MENA at BDSwiss.

The market expects a further 60 basis points of hikes from the Bank of England before year-end with only the European Central Bank expected to deliver more.

This has supported Sterling until now but also leaves it at risk of declining if the Bank of England pushes back against these expectations on Thursday.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

After all, the Bank has form in this area, warning throughout 2022 that it expects a deep recession to take hold in 2023 and therefore rates will not need to rise as high as the market expects.

This has meant that over recent months the Pound has tended to fall in the wake of 'dovish' Bank of England assessments.

Can the leopard change its spots? i.e. can the Bank truly shake its 'dovish' instincts? If not, the Pound could come under pressure on Thursday.

A dovish outcome would see the Bank hike by 25 basis points but warn via its forecasts and verbal guidance that it won't need to hike by as much as the market expects.

If this were the case, the Pound-Dollar exchange rate would fall below 1.26.

However, the Bank's economic forecasts have proven woefully inadequate given the long-predicted economy simply has not materialised and inflation rates remain elevated amidst a strong labour market.

The Bank will raise its forecasts again on Thursday as it accounts for recent data outturns. It could also warn that it will continue to raise interest rates as long as data warrants it.

This would, in effect, mean a repeat of March's policy decision. The Pound actually rallied in March as the Bank was seen to have given a more credible message in which it puts more emphasis on the importance of incoming data.

If the Bank does a copy-and-paste, Pound Sterling could hold its recent gains.