U.S. Inflation Surprise Wounds the Dollar

- Written by: Gary Howes

- U.S inflation peak firmly in the rear-view mirror

- USD extends recent run of losses

- GBP/USD at 6-month highs

- GBP/EUR higher as GBP benefits from global sentiment uplift

Image © Adobe Images

The Federal Reserve will feel justified in slowing down the pace it raises interest rates after U.S. inflation roundly underwhelmed expectations in November.

The Dollar fell and stocks rose on a second consecutive inflation reading that signalled price rises were cooling and that the Fed can afford to ease back on interest rate hikes, allowing investors to spy a halt on the horizon.

Headline CPI inflation grew 7.1% in the year to November said the BLS, which represents a sizeable decline from October's 7.7% and is well below the consensus expectation for 7.7%.

Inflation rose 0.1% in the month to November, slower than the 0.3% expected and October's reading of 0.4%.

Core inflation, which is arguably more important to the Federal Reserve's reckonings, also undershot at 6.0% year-on-year, a deceleration on October's 6.3% and below expectations for 6.1%. The month-on-month increase in core was set at 0.2%, below both consensus and October at 0.3%.

The Pound to Dollar exchange rate (GBP/USD) displayed the expected knee-jerk response by going to a new six-month high of 1.2413 in the wake of the data release before paring back to 1.2385 at the time of writing.

"The dollar index plunged to June lows after cooler than expected U.S. inflation moved the Fed’s most aggressive tightening cycle in decades a step closer to the finish line," says Joe Manimbo, Senior Market Analyst at Convera.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The data is on balance consistent with the Dollar's recent trend of weakness and it's one-day loss against the Euro extended beyond a percent to $1.0640, losses were recorded against all G10 peers.

"We’re seeing USD sell off against all major currencies as the market now prices in a peak Fed funds rate of 4.88% in March 2023, well below where implied rates have been trading for the last few months," says Mike Owens, Senior Sales Trader at Saxo UK. "EURUSD has hit 1.0650 and GBPUSD reached 1.2438, their highest prices versus the US dollar since June."

The move higher in Sterling-Dollar lifts typical bank transfer rates to approximately 1.2128. Competitive cash and holiday money providers were seen quoting near 1.2212 and competitive international transfer providers at 1.2339.

The Pound to Euro exchange rate was also higher on the day as global markets rallied amidst renewed investor optimism and confirms the UK currency will remain supported as long as global conditions permit.

The pair reached 1.1660 on the spot market, taking bank transfer rates to approximately 1.1428, cash and holiday money rates at competitive providers to around 1.1547 and transfer rates at competitive international payment firms to around 1.1626.

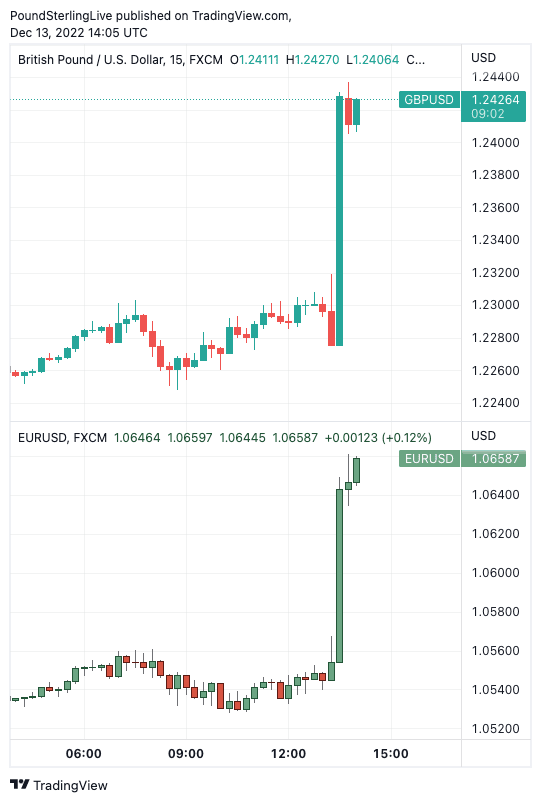

Above: GBP/USD (top) and EUR/USD at 15-minute intervals showing a clear reaction to the U.S. inflation data. Consider setting a free FX rate alert here to better time your payment requirements.

"There was some good news on the inflation front in the US in November, as prices decelerated by more than expected," says Katherine Judge, economist at CIBC Capital Markets. "Although the downside surprise is a welcome development, the Fed remains on track to hike by 50bps tomorrow given that the downside was concentrated in a few components, and the labor market remains tight."

A breakdown of the data reveals that although energy and food prices were falling, there remain pockets of resistance in the price dynamics.

Notably, services inflation remains sticky as it adjusts to the previous bout of supply-side inflationary pressures.

"Service inflation continues to buck the trend and is now the key metric to watch as we have seen that energy and goods price pressures are easing a bit," says Richard Carter, head of fixed interest research at Quilter Cheviot.

Owners' Equivalent Rent rose 68bps, rent was up 77bps, apparel was up 20bps and food away from home was up 50bps.

"While the war against inflation is turning, we are a long way off declaring victory and the Fed will keep its hawkish stance for a while longer," says Carter.

The Federal Reserve is expected to hike rates 50 basis points on Wednesday and raise its projections for the peak in interest rates.

Updating this article in the hours following the inflation release reveals the Dollar's losses in the wake of December's inflation surprise appear smaller to those of the November CPI release.

"The decline in the dollar in response to today’s inflation response has proven much more moderate compared with October’s release. This is due to differences in both positioning and the level of US financial conditions," says Simon Harvey, Head of FX Analysis at Monex Europe.

Heading into November's report the market was still heavily positioned towards further USD upside, therefore there was a significant volume of 'long' dollar trades to be unwound.

Heading into the December release this positioning has been cleared and therefore the easy part of the Dollar selloff is in the past.

U.S. financial conditions are meanwhile much looser now that markets have unwound further their expectations for the peak in U.S. interest rates. This means a whole tranche of financial assets are now subject to lower interest rates and the prospect of this unwind extending is far smaller than was the case one month ago when conditions were more restrictive.

The Dollar's near-term trend of weakness, therefore, looks intact, but the impressive declines of November and early December look unlikely to be repeated. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks