U.S. Dollar in Strong Rebound Following Hot PCE Inflation and Personal Spending Prints

- Written by: Gary Howes

Image © Adobe Images

The Federal Reserve has little incentive to step back from its fast paced interest rate hiking cycle after its favoured measure of inflation comes in above expectations.

The Dollar recovered after the Bureau of Economic Analysis said its measure of inflation, the Core PCE Price Index, rose 0.6% month-on-month in June, beating the consensus analyst expectation for 0.5% and doubling May's reading of 0.3%.

The index rose 4.8% in the year to June, hotter than the 4.7% the market was looking for and the previous print of 47%.

The PCE matters greatly to Federal Reserve policy, "the inflation objective of the FOMC is set in terms of the rate of change of the price index for total personal consumption expenditures (PCE)," the Fed says.

The Cleveland Federal Reserve explains PCE trumps the more commonly watched CPI measure of inflation in the Federal Reserve's decision making process:

"There are two common measures of inflation in the U.S. today: the Consumer Price Index (CPI) released by the Bureau of Labor Statistics and the Personal Consumption Expenditures price index (PCE) issued by the Bureau of Economic Analysis. The CPI probably gets more press... The Federal Reserve, however, states its goal for inflation in terms of the PCE."

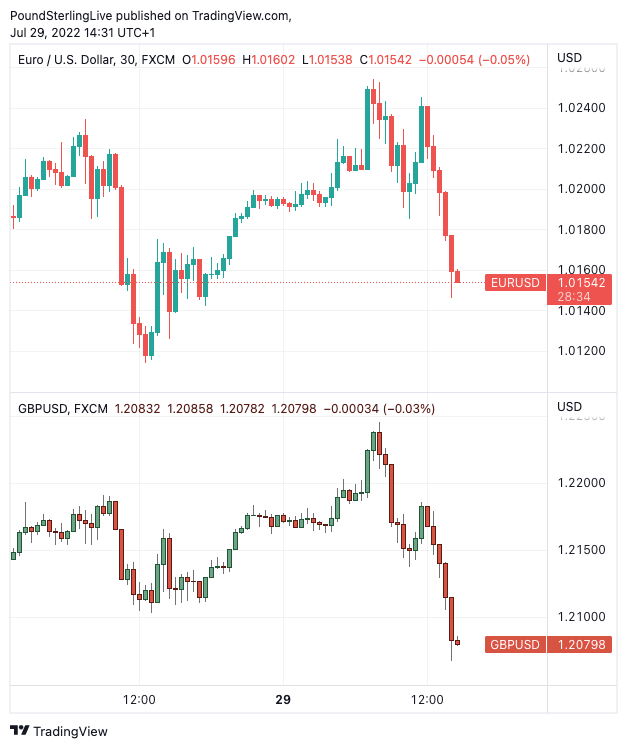

Above: EUR/USD (top) and GBP/USD (bottom) at 30 minute intervals.

The Fed raised interest rates 75 basis points on Wednesday and a further hike of similar magnitude is likely in September.

The Dollar fell in the wake of this week's hike as the market sensed the Fed was ready to ease off the peddle and slow the rate of interest rate increases ahead.

But that its favoured gauge of inflation is burning hotter than expected could confound these expectations.

This explains the Dollar's rally in the wake of the data.

The Pound to Dollar exchange rate fell a quarter of a percent in the 30 minutes following the release to go back to 1.21, having been at 1.22 earlier in the day. Bank accounts are quoting levels around 1.1858 for dollar payments and independent FX specialists 1.2060.

The Euro-Dollar exchange rate fell 0.20% in the 30 minutes following the print to go to 1.0160.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The data set showed a 0.1% increase in real personal spending in June, meaning personal spending was up 1.1% in the year to June, defying expectations for a more lacklustre 0.9% increase.

"Even after adjusting for the highest inflation in 40+ years, consumers are still increasing spending," says Tim Quinlan, Senior Economist at Wells Fargo Securities. "Like a dazed boxer still on his feet, the U.S. consumer is still in the fight."

Quinlan says consumers are reaching deep to find the means to go on spending in the face of the highest inflation in 40+ years.

"On trend, income is not keeping up with inflation, so in order to keep on spending, households are putting off saving," he says.

Wells Fargo says while they do not believe the economy is yet in recession, they do expect it will slip into one by the beginning of next year.

There was more data out Friday that further suggested investors might be premature in expecting the Fed to ease back.

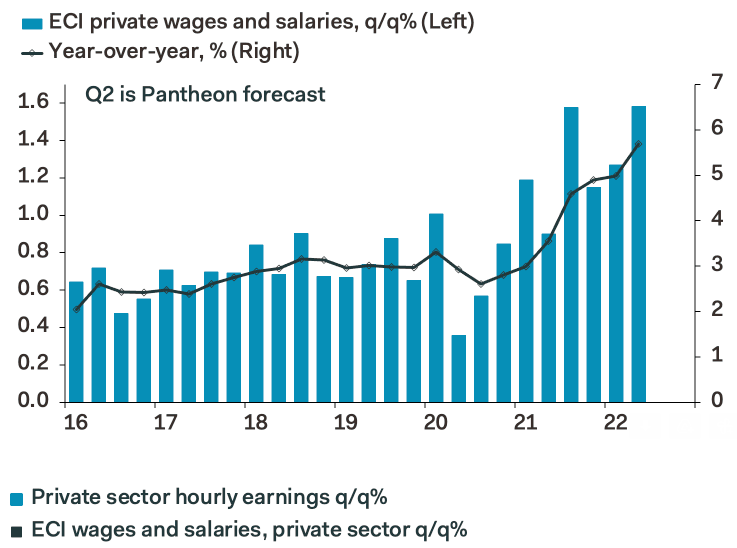

The Employment Cost Index rose 1.3% quarter on quarter in the second quarter, private sector wages and salaries meanwhile which rose 1.6%, or 6.5% annualised.

Image courtesy of Pantheon Macroeconomics.

"Wage gains far too fast for the Fed," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

"Wage gains at this pace are far too high for the Fed, because they would require implausible rapid productivity growth in order to be consistent with the inflation target in the medium-term. A lot more data will be released before the September Fed meeting, but this is not a great start for investors looking for the Fed to slow the pace of tightening. Our base remains 50bp, but the Fed will want to see plenty of other soft data; the ECI carries real weight," he adds.