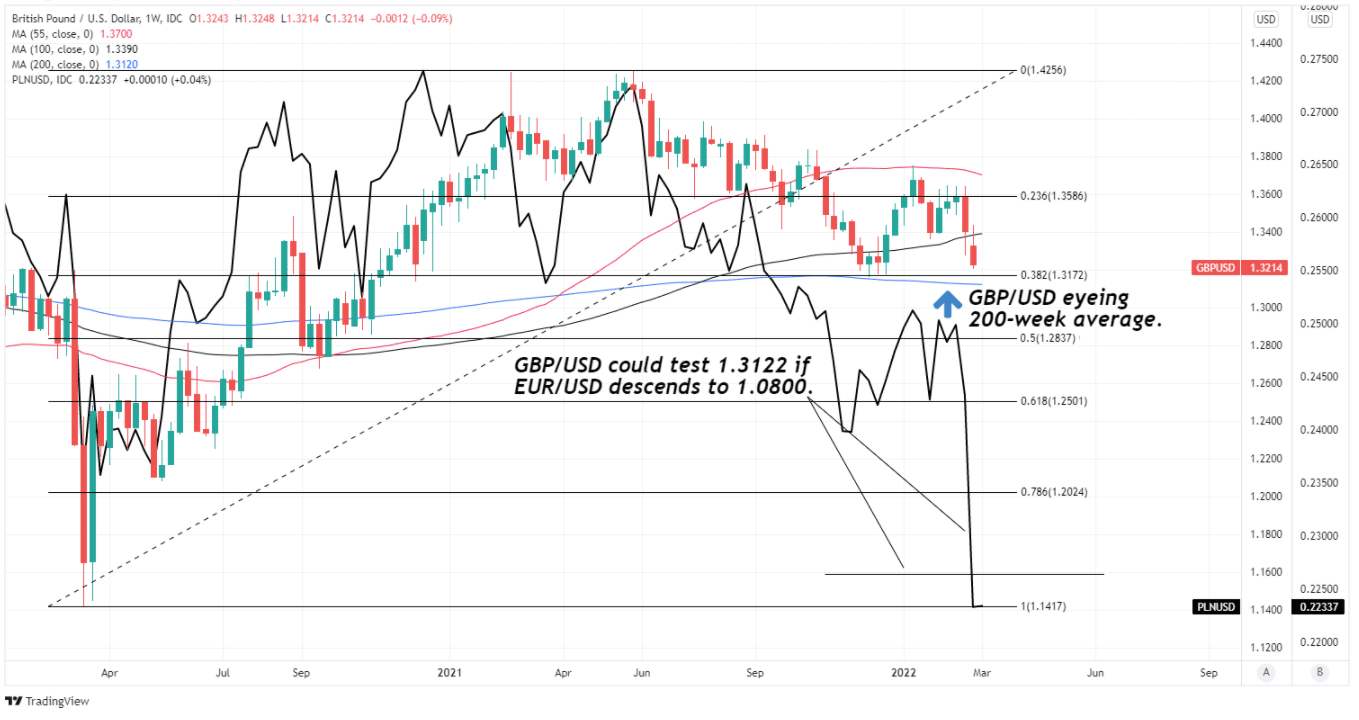

Pound / Dollar Week Ahead Forecast: Risking Slippage to 1.3120 as Vulnerability Remains

- Written by: James Skinner

- GBP/USD vulnerable to further losses ahead

- Risk of EUR/USD pulling GBP/USD to 1.3122

- With Ukraine invasion stressing EU & CEE FX

- Invasion still floundering but fallout growing

- Aiding USD as U.S. CPI & UK GDP data loom

Image © Adobe Images

The Pound to Dollar exchange rate fell heavily last week and could be susceptible to further losses that would potentially see it slicing through a major Fibonacci retracement and testing key weekly moving average around 1.3120 over the coming days.

Pound Sterling was little changed in overall trade-weighted terms last week after rising sharply against the Euro as it and other mainland European currencies bore the brunt of the market response to Russia’s ongoing and increasingly destructive attempt to impose itself on Ukraine.

But the Pound-Dollar exchange rate fell more than one percent in a second consecutive weekly decline after appearing to be pulled lower by the European single currency and both will likely remain susceptible to further losses over the coming days.

“USD is likely to increase further this week. It would not take much for the USD index to test 100pts for the first time since the early months of the pandemic,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“The main influence pushing the USD higher this week is likely to remain the war. Amongst the major currencies, EUR and GBP are bearing the brunt of the war as market participants price the risk of a disruption to Russian energy exports,” Capurso and colleagues said on Monday.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of March 2020 recovery and key moving-averages, shown alongside Euro to Dollar rate.

- GBP/USD reference rates at publication:

Spot: 1.3224 - High street bank rates (indicative band): 1.2860-1.2954

- Payment specialist rates (indicative band): 1.3086-1.3158

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Close proximity to the conflict has proven a heavy burden for European currencies, which are also heavily exposed to significant increases in oil and gas prices stemming from concerns about a possible loss of supply from Russia.

But with the Ukrainian government anticipating escalation of the artillery and air assault on the capital as soon as Monday, the risk is that energy prices continue along their upward trajectory and European currencies remain under pressure against the Dollar.

“The GBP may test the 1.32 level in coming days as the Russian invasion develops—to perhaps aim for 1.30 eventually,” warns Juan Manuel Herrera, a strategist at Scotiabank. “Resistance is ~1.3320 after the big figure followed by the mid 1.33s.”

A Kremlin readout of a Sunday telephone call between President Vladimir Putin and his Turkish counterpart confirmed that Moscow continues to insist on a complete capitulation from the Ukrainian government before it would be willing to cease its recently-increased shelling of major population centres.

This in turn implies risk of a protracted conflict and all it would entail in the absence of a decisive turning of the tide by the Ukrainian side, or a rethink in Moscow and retreat by its invading army; neither of which could be ruled out.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

“The Kremlin does not yet want to accept and acknowledge its fiasco. But this time is near. Dissatisfaction and demoralization among the occupying forces is growing…There are more and more cases of unwillingness to fight,” Ukrainian Defence Minister Alexey Reznikov said in a Sunday statement.

While the Kremlin continues to assert that it’s ‘special military operation’ is “proceeding according to plan and within the agreed timeframe,” repeated attempts and subsequent failures to capture and hold strategically important sites like Hostomel town and its airport near Kyiv - which were among the first to be seized in the initial invasion on February 24 - tell an entirely different story that remains indicative of an invading force that has floundered.

“Enemy military resources in Ukraine are running out, there will be a logistical collapse. Realizing this, the tendency to capture the enemy is growing. And not single soldiers, but whole platoons,” Defence Minister Reznikov had said on Friday.

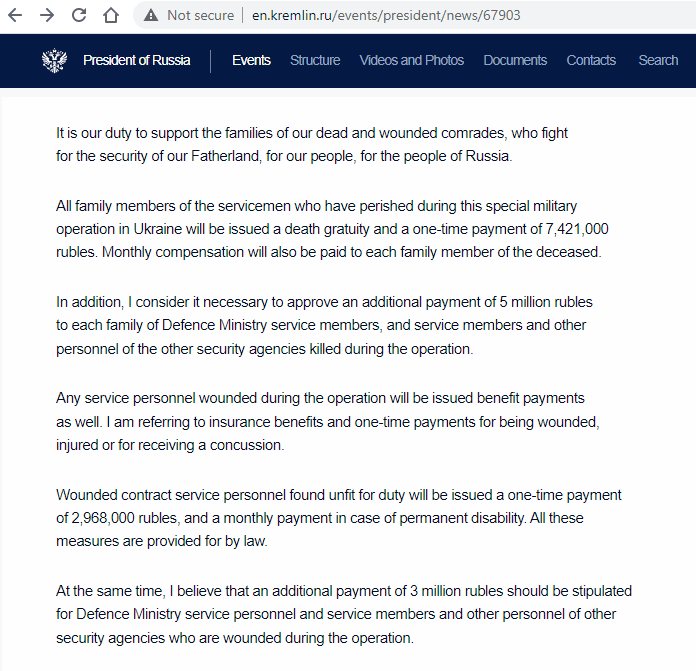

Meanwhile, the latest executive orders and laws emerging from the Kremlin potentially illustrate quiet concern in Moscow about the flagging campaign.

Last Thursday the President of Russia signed laws introducing civil and criminal liability "for public actions aimed at discrediting the use of the Russian Federation Armed Forces for the purposes of defending the interests of the Russian Federation and its citizens, maintaining international peace and security, including for public appeals to prevent the use of the Russian Federation Armed Forces for the above purposes."

In addition, a March 05 executive order provides for significant payments to families of deceased military personnel and to the injured including “gratuity” of up to 12 million Roubles (£86.9k) with ongoing benefits in relation to the deceased, and up 5.9 million (£42.7k) Roubles to the wounded.

Source: Kremlin readout of March 03 Security Council meeting.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The above emphasis by the executive on veterans’ welfare is unprecedented in modern Russia where, just like in many other countries, the maimed have typically returned home to lives of impoverishment and neglect that were well documented by the late Anna Politkovskaya in the chronicle Dispatches from Chechnya: A Small Corner of Hell.

“Russian artillery are making parts of Ukraine look like Grozny in 1999," says Michael Every, a global macro strategist at Rabobank. “Of course, escalating war and economic war mean deeper hits to economies and markets.”

The mounting human, infrastructural, financial and economic costs of the war on Ukraine are likely to be front and center for markets again this week.

However, Thursday’s release of U.S. inflation figures for February is also likely to garner some attention due to its potential significance to the Federal Reserve (Fed) policy outlook.

“We expect the US February core CPI to beat expectations for a 6.4%/yr increase. We estimate the trimmed CPI, a better measure of underlying inflation, increased at a rapid 8%saar. The US’ persistently high inflation rate will reinforce the view that the FOMC is behind the curve,” warns Commonwealth Bank of Australia’s Capurso and colleagues.