Pound / Dollar Holds 1.3600 after Better than Expected UK Retail Sales

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling held above a key level against the U.S. Dollar after UK retail sales for January beat analyst expectations.

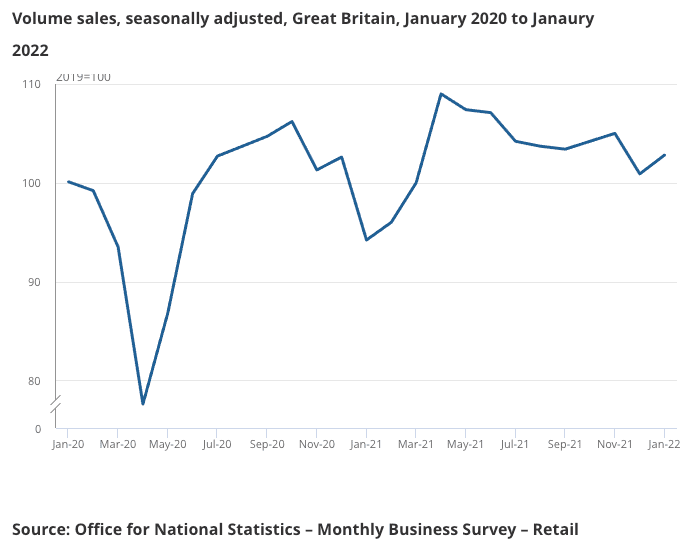

UK retail sales rose 1.9% month-on-month in January said the ONS, beating the consensus estimate for 1.0% and beating December's -4.0% reading.

Retail Sales rose 9.1% year-on-year in January, beating expectations for 8.7% and December's reading of -1.7%.

"Cable remains above 1.3600 after better than expected UK Jan retail sales," says Robert Howard, an analyst at Reuters.

1.3643 is the three-week high for the Pound to Dollar exchange rate.

"As expected, UK retail sales (data released this morning) rebounded fiercely in January, as the Omicron-induced slump dissipated. This is yet another indication of how the British economy has started the year with some good momentum, which is ultimately keeping the market comfortable with its aggressive pricing for Bank of England tightening," says Francesco Pesole, FX Strategist at ING

"GBP/USD broke above 1.3600 yesterday likely on the back of the recent positive data flow and solid BoE rate hike expectations, while the pound also appears relatively less exposed than other European currencies to the adverse swings in geopolitical sentiment. Cable could hold above 1.3600 today," adds Pesole.

The strongest monthly increase in retail sales since April 2021, when restrictions were lifted, followed a fall in December which the ONS said was due to earlier Christmas trading than normal.

Retailers also struggled amidst reduced retail footfall in December, linked to concerns around the Omicron variant of coronavirus.

The pick up in January activity comes as the UK economy faces significant inflationary pressures, with the ONS reporting the highest inflation reading in 30 years in January.

"After a truly dire December, it's encouraging that things appeared to start picking up in January. Long may it continue. However, inflation and the cost of living crisis are hitting small high street businesses from all angles. Customers have less to spend, raw materials are costing more, supply chains are being squeezed, interest rates are on the up and the cost to heat their premises is skyrocketing," says founder of ShopAppy and High Streets Task Force expert Dr Jackie Mulligan.

The Bank of England hiked interest rates in February in an effort to calm inflation expectations and financial market pricing shows another rate hike is almost certain to fall in March.

In fact over 125 basis points of rate hikes are now priced for the UK over the remainder of 2022.

"The sales uplift in January shows the Omicron recovery is underway but retailers haven’t yet recouped all of December’s losses. At some point lockdown savings will be spent, and the rapid rise in prices on supermarket shelves, energy bills and petrol forecourts, combined with looming tax increases, is highly likely to put a dampener on consumer spending," says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

The prospect of further interest rate hikes from the Bank of England has underpinned the Pound over the course of 2022, however questions remain concerning the outlook.

Surging inflation is anticipated by economists to weigh on consumer spending and sentiment over coming months, creating headwinds to the economic recovery.

Whether the Pound can outperform in a slowing economy with rising interest rates remains to be seen.