Pound-Dollar Week Ahead Forecast: Dollar Drives in Data Heavy Week

- Written by: James Skinner

- GBP/USD in possible 1.38-to-1.40 range short-term

- USD in driving seat after BoE’s cold water stymies GBP

- U.S. PMIs, IMF’s COFER report in focus ahead of payrolls

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3928

- Bank transfers (indicative guide): 1.3540-1.3637

- Money transfer specialist rates (indicative): 1.3802-1.3830

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar exchange rate enters the new week looking to stabilise near the lower end of a multi-month range but could be susceptible to any renewed recovery attempt by the Dollar after the Bank of England (BoE) neglected to give Sterling a pretext for extending its own 2021 gains last week.

Sterling entered the new week below 1.39 and closer to this month’s floor around 1.38 than the 1.40 level it made a failed attempt at reclaiming ahead of last week’s BoE decision, which turned the Pound-Dollar rate back in the direction of its June low.

The BoE gave short shrift to the market's idea that "transient" increases in inflation might see UK interest rates rise as soon as the middle of 2022, and suggested in minutes of its meeting that such expectations could ultimately hamper the recovery it’s hoping to cultivate, through an “unwarranted tightening of financial conditions.”

The bank's 'wait and see' mood is cold water poured over any suggestions that it might have been close to becoming ‘hawkish' in its policy stance, as well as over one of the popular arguments for a higher Pound-Dollar rate, which could now leave the outlook for Sterling hinged on the market's appetite for the greenback.

“GBP/USD continues to be side-lined above the 2020-2021 support line at 1.3790 but below the 55 day moving average at 1.4014,” says Axel Rudolph, a senior technical analyst at Commerzbank.

Above: Pound-Dollar rate shown at daily intervals with Fibonacci retracements of January rally.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Sterling failed to capitalise on the Dollar’s weakness last Friday and could be susceptible to any further attempt by the greenback to win back earlier lost ground in what will be a data heavy week for the U.S. currency.

The Dollar will take its cues this week from a range of Federal Reserve (Fed) policymakers' speeches throughout the week, leading up to Thursday's Institute of Supply Management Manufacturing PMI survey and Friday's non-farm payrolls report for Jun, each of which will provide relevant context for ongoing developments in Fed policy.

“It seems likely markets will revert to trading tight ranges now that the step adjustment in US rate prospects has happened. The hurdle is high for data moving rate expectations further, given the ongoing pandemic/reopening,” says Adam Cole, chief FX strategist at RBC Capital Markets.

Federal Reserve Bank of New York President John Williams will participate in a panel discussion at the Bank for International Settlements on Monday while FOMC voter and Federal Reserve Bank of Richmond President Thomas Barkin will address a Market News International conference Tuesday.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Most relevant will be any remarks that provide colour on whether investors are right to bet that U.S. interest rates are more likely to rise in 2022 than in 2024, which is a question that could be pivotal to the outlook for GBP/USD and others over the coming days, weeks and months.

This is after Chairman Jerome Powell and other senior members of the FOMC suggested on their post-policy-meeting lap of the speaking circuit last week that the market may be being overly optimistic when wagering that U.S. interest rates could begin rising in the latter part of next year.

“The Fed leadership still wants to see the US economy close to full employment before rising rates. The latest NFP report will provide insight into how long it will take for the labour market to fully recover. Absent a significant upside surprise, recent USD gains should reverse further,” says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

With the Fed and financial markets at opposite ends of the same field what may now await major exchange rates is a potentially months-long period in which economic numbers like this week's PMI surveys and Friday’s non-farm payrolls are of enhanced importance.

Above: Pound-to-Dollar exchange rate shown at weekly intervals with U.S. Dollar Index.

The payroll data is out at 13:30 on Friday and consensus is looking for a 700k increase to push the unemployment rate down from 5.8% to 5.7%; some way off the pre-pandemic low of 3.5%.

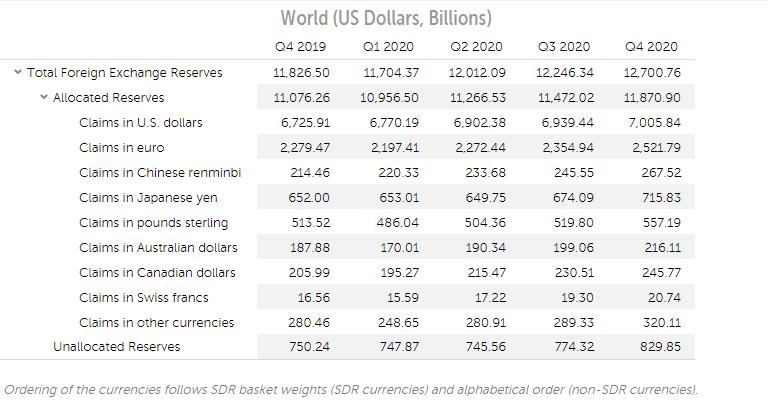

And in the meantime, the most recent Composition of Official Foreign Exchange Reserves (COFER) report from the International Monetary Fund (IMF) will be out mid-week with an update on whether the late 2020 decline in the U.S. Dollar's overall share of the reserve basket continued during the opening months of the year.

“A fair bit of the decline over the last few quarters was due to valuation effects as the Dollar depreciated, but the decline in Q4 can be partially attributed to active selling as well,” says Michael Cahill, a strategist at Goldman Sachs in an April note covering the last IMF report.

“The Euro, Yen and Renminbi were the main beneficiaries, while the uptick in Sterling’s share appears to be mostly due to the currency’s appreciation,” Cahill wrote at the time.

The last count saw the Dollar's share fall to its lowest since 1995 so this report could draw more attention than usual: It may also provide a sentimental filip for Sterling if the author was right about something back in February.

Above: IMF Composition of Official Foreign Exchange Reserves (COFER) data to year-end 2020.