Pound-Dollar Rate Turns Higher on Big U.S. Jobs Data Miss

Image © Adobe Images

- GBP/USD spot at publication: 1.3724

- Bank transfer rates (indicative guide): 1.3344-1.3440

- FX transfer specialist rates (indicative): 1.3573-1.3628

- More information on acquiring specialist rates, here

The U.S. Dollar pared its recent gains against the Euro, Pound and other major currencies following the release of U.S. jobs data that showed the economy added 49K jobs in January.

The result proved to be a vast improvement of the -227K figure that was reported in December, but a big miss on the +105K the consensus was expecting.

The market appears to have also latched onto the notable downgrade to the December data, which was reported at -140K when initially released in January.

"This is a significantly softer report than expected, at least in terms of payrolls," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics. "The bottom line here is that the labor market was frozen at the start of the year, and is completely dependent on the pace of reopening, which in turn is contingent on the speed and sustainability of the fall in hospitalisations."

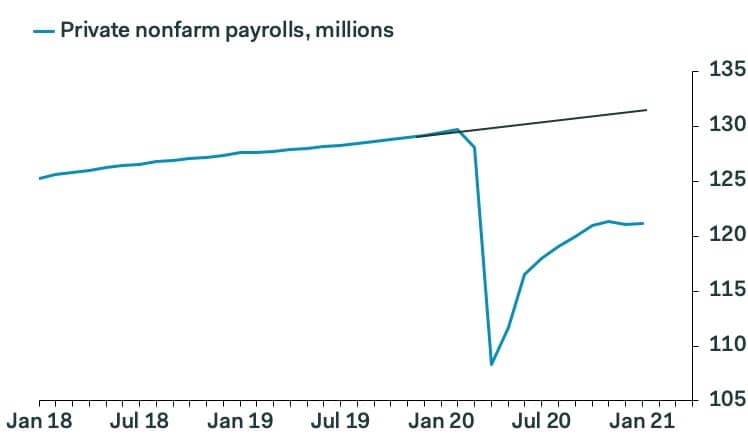

January's gain in employment was almost exclusively driven by new government jobs as the private payrolls report showed only 6K jobs were created by the private sector, with industries including retail trade, and leisure and hospitality showing job losses.

Stock markets are nevertheless higher and the Dollar is lower following the data, suggesting the market expects the Federal Reserve to maintain an accommodative monetary policy as a result of the underwhelming figures.

The market function therefore is one where markets perversely reward poor data, given an assumption the Fed will maintain its generous stimulus programme for as long as the economy is weak.

The Dollar dropped in the wake of the data's release, allowing the Euro-to-Dollar exchange rate to recover back above 1.20

The Dollar and the Pound have been the two strongest performing currencies this week, but the downshift in fortunes for the Greenback ahead of the weekend could allow Sterling to secure the top performer crown.

"Sterling rallied on Friday after U.S. nonfarm payrolls figures and downward revisions disappointed rising expectations following a string of strong data, which could provide impetus for GBP/USD to push above its 2021 high at 1.3759," says Paul Spirgel, a Reuters market analyst.

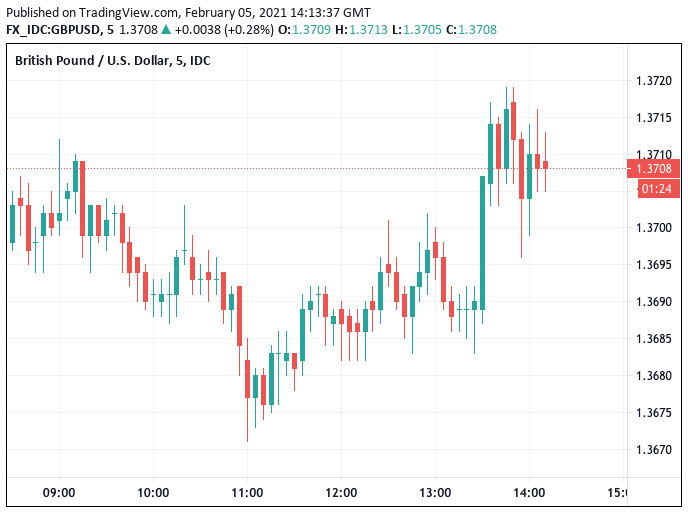

The Pound-to-Dollar exchange rate has recovered back to 1.3710, ensuring Sterling is set to eke out a weekly gain:

The data also presses home the need for the Biden administration to proceed swiftly with their stimulus programme, which is also a key foundation of the current market rally.

In a sign of haste, Democrats are pushing ahead with plans to pass a $1.9TRN economic relief plan without significant support from Republican lawmakers, threatening to ditch the bipartisanship pledged by the new administration.

"The decision to move on stimulus without Republican support really changes the game," says Neil Wilson, Chief Market Analyst at Markets.com. "Biden wants to act fast and does not want to spend his first 100 days in office horse trading with the GOP over relief plans... dumping an extra 10% of GDP in stimulus is being lapped up by the market."

"The big increases needed to restore the lost 10M-plus jobs can’t come until the economy can reopen more fully and people are confident in mingling again. That likely will take until mid-year, but we hope that January’s mere 6K increase in private sector payrolls turns out to be the low point of the year," says Shepherdson.

While the Dollar has fallen in the wake of the data, readers must be aware that the Dollar's reaction function is shifting.

We have noted this week how the Dollar has been advancing alongside stock markets, suggesting that positive investor sentiment can be good for the Dollar (whereas today's reaction to the jobs data suggests the opposite).

The Dollar could well outperform other currencies and rise alongside markets if investors believe the U.S. economy is due to outperform the rest of the world in 2021, as had been the case over recent years.

The assumption had been that the rest of the world would see strong economic growth in 2021 and diminish U.S. exceptionalism, but between the generous fiscal support package and the country's strong vaccination programme, this assumption has been thrown on its head.

Therefore, Dollar strength could resume again before long.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |