Pound Sterling Has Better Prospects against the Euro than the Dollar say Analysts

- GBP is 2021's best performer

- But GBP/USD could have peaked

- Broader USD strength said to be hard to resist

Image © Adobe Images

- GBP/EUR: 1.1416 +1.20% *

- GBP/USD: 1.3684 -0.14%

- GBP/AUD: 1.7958 +0.71%

- GBP/NZD: 1.9027 +0.34%

- GBP/CAD: 1.7530 +0.40%

- GBP/CHF: 1.2351 +1.24%

* Change this week. Global Reach can get you a rate closer to the above spot market rates than your bank can. Learn More here.

The British Pound retained its position as this year's outperformer on global currency markets ahead of the weekend, with gains over the past 24 hours stoked by fading expectations for an interest rate cut at the Bank of England in coming months.

However, analysts say the strengthening Dollar could mean the GBP/USD exchange rate loses out on a broader rally in Sterling and that any further gains are more likely to be realised against the Euro and other currencies.

The Bank of England on Thursday declined to boost its quantitative easing programme and/or cut interest rates in an unanimous vote of the Monetary Policy Committee, sending a strong signal to markets that their earlier expectations for negative interest rates in the second half of 2021 was misplaced.

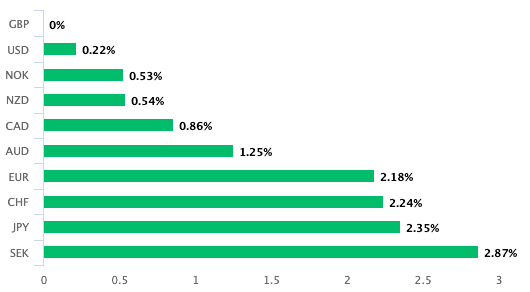

With Brexit negotiations and negative interest rates removed as threats, the outlook for Sterling has improved markedly and the currency has recorded advances against all G10 majors thus far in 2021:

Above: GBP performance in 2021

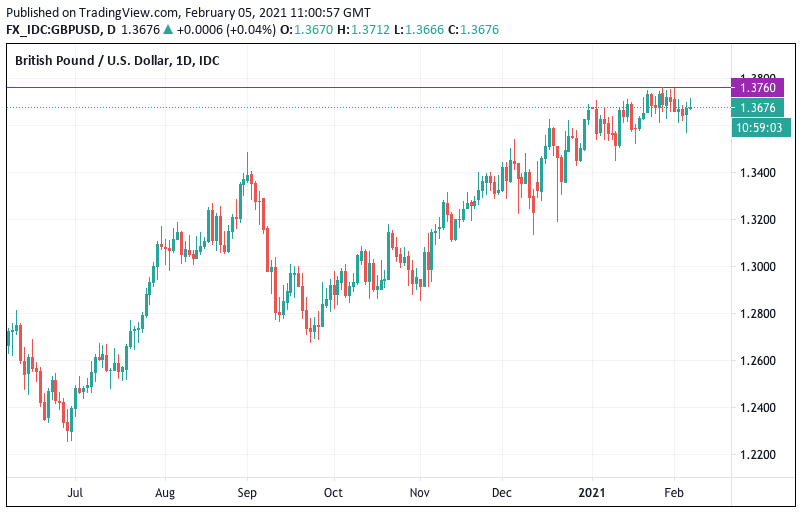

Despite Sterling being the top performing G10 currency of 2021, against the Dollar gains are now proving harder to come by owing to the Greenback's broad-based appreciation and there are some suggestions that further weakness in GBP/USD can be expected as a result.

"The BoE's decision provides GBP with some degree of near-term support, but we do not think cable (GBP/USD) will escape the steady pull of a stronger USD overall. With downside risks building in GBP/USD, we think Sterling could still advance against select G10 counterparts with weaker near-term fundamentals," says Ned Rumpeltin, European Head of FX Strategy at TD Securities.

Above: Has GBP/USD reached the limits of its abilities?

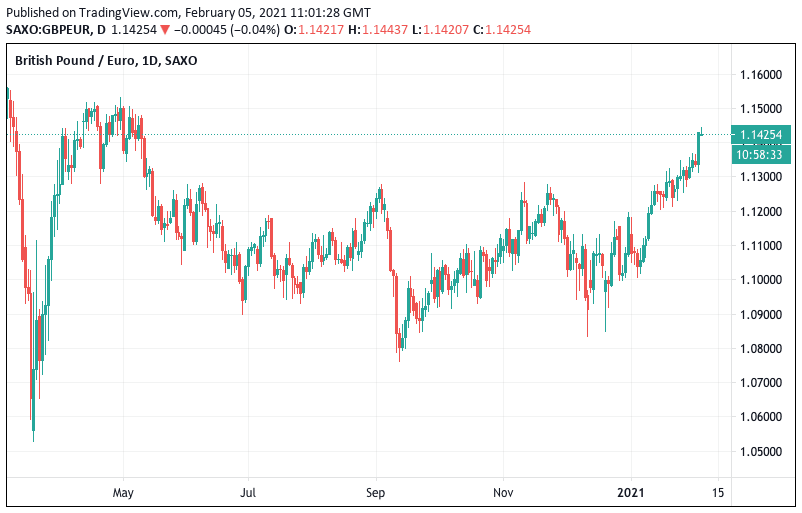

Sterling strength is likely to be selective in nature going forward says Rumpletin, adding the Pound-to-Euro exchange rate (GBP/EUR) may have some further room to run higher.

"The MPC's hesitation to deploy negative rates helps draw a line under near-term risks for Sterling," says Rumpeltin in a note out following the BoE decision. "We continue to see tactical upside for Sterling in certain crosses. For those looking for greater bullish potential, we prefer to look for further near-term downside in EURGBP."

Above: Despite GBP/USD potentially peaking, GBP/EUR looks more susceptible to advances says TD Securities.

Justifying the decision to keep policy settings unchanged, a statement from the Bank revealed UK economic growth is projected by the Bank to recover rapidly towards pre-Covid levels over 2021, as the vaccination programme is assumed to lead to an easing of Covid-related restrictions and people’s health concerns.

Furthermore, projected activity is also supported by the substantial fiscal and monetary policy actions already announced by the government, thereby negative the need for negative interest rates.

"We would have to see significant economic weakening in the UK for them to become a reality, and with inflation expected to tick up as the year goes on, the BoE can’t afford to sink Sterling as we get back into recovery mode," says Hinesh Patel, portfolio manager at Quilter Investors. "There are reasons to be optimistic as a UK investor. With the hugely successful vaccination drive and supply issues being overcome, it’s not unrealistic to believe the second half of the year will produce the return of consumer confidence."

Martin Beck, Economist at Oxford Economics says the biggest area of uncertainty prior to the meeting concerned the outcome of the BoE’s consultation with the financial sector on the practicality of cutting interest rates below zero.

"The UK central bank’s conclusion – that technical issues confronting financial firms meant negative rates could not be implemented in a “safe and sound way” for at least six months – ruled out the possibility of using this policy tool anytime soon," says Beck.

The Bank nevertheless said it would move ahead and prepare UK lenders for the possibility of negative interest rates, but they were also keen to emphasise that this was not a signal that negative rates were "imminent, or indeed in prospect at any time".

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Why the Dollar is Outperforming

The Dollar's rebound has wrong-footed many market participants and foreign exchange analysts who saw 2021 as the year in which the Dollar declined as a global economic rebound drew investor attention away from the U.S.

However, the currency's strength in January has seen this consensus view challenged, particularly in light of Thursday's capitulation below they key 1.20 marker in the EUR/USD exchange rate.

The Euro has come under pressure of late owing to some fundamentally-justified concerns, notably the the slow vaccine rollout in the area that could mean it exits lockdown well behind the UK and U.S.

Vaccines aside, the EU economy was already struggling in comparison to the U.S. economy at the turn of the year, and this outperformance can continue given:

1) cases in the U.S. are already coming down, regardless of vaccines

2) lockdown measures in the U.S. as a whole are markedly less stringent than is the case in the Eurozone

3) a big wad of cash is going to soon make its way into the bank accounts of U.S. citizens.

"Markets are taking another look at the USD and questioning whether increased fiscal stimulus after the Democrat’s blue wave success will mean yield support for the USD or the prospect of an improved economic pick-up," says Ray Attrill, Head of FX Strategy at NAB.

U.S. economic outperformance is therefore back, and it is helping the Dollar advance.

Athanasios Vamvakidis, a strategist at Bank of America, says U.S. fiscal policy is now more supportive: In addition to the $900bn that the last administration agreed during the holidays, the Biden administration is now proposing $1.9tn, with even more latter in the year for infrastructure.

"Even if the plan weakens during the negotiations, the starting point is massive. It would bring total fiscal stimulus in the US to about 15% of GDP, equal to fiscal stimulus last year and three times more than the EU Recovery Fund, and spent now instead of the next 7 years in the latter case," says Vamvakidis.

The implications for the Dollar of such massive U.S .fiscal stimulus are also not as straightforward anymore adds the analyst.

"Last year, US fiscal stimulus was positive for risk and negative for the USD. This year, it also increases the risks of an earlier Fed policy normalisation, which has an offsetting impact supporting the USD," says Vamvakidis.