Pound Benefitting from Spending Binge Talk

- Written by: Gary Howes

Rachel Reeves. Picture by Kirsty O'Connor / Treasury.

The British Pound looks to be benefiting from reports that Chancellor Rachel Reeves is going to change the fiscal rules to allow her to borrow more.

In response to the reports we see UK government bond yields - which underpin interest rates - climbing on a day that yields are falling elsewhere.

This suggests markets are pricing in higher UK borrowing in the coming years.

"The currency seems to be gaining on a report, published in the Guardian newspaper, suggesting that new finance minister Rachel Reeves will increase borrowing activities in next week’s Autumn Budget, widening rate differentials against the euro, while helping boost the economic outlook," says Karl Schamotta, Chief Market Strategist at Corpay.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

UK government bonds rose by about six basis points to trade above 4.2% on Thursday, while comparable bonds in the Eurozone and U.S. fell.

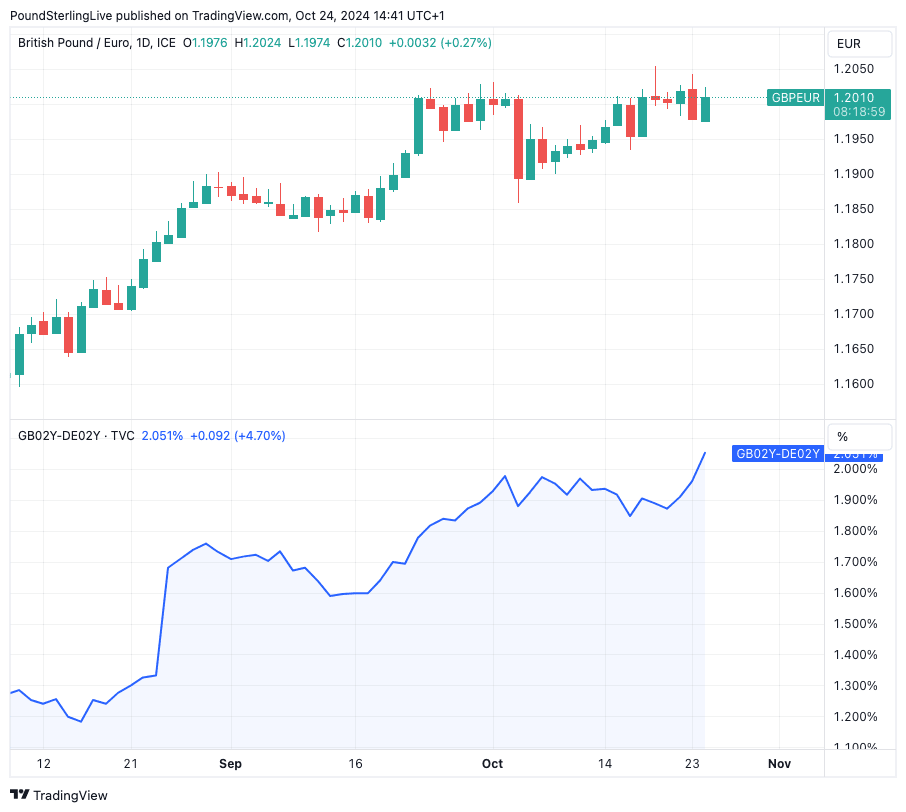

The spread between gilts and German debt rose to the highest in more than a year, which creates a potent upward pull on the Pound against the Euro.

At the time of writing, the GBP to EUR conversion is at 1.2015, up a quarter of a per cent on the day. The GBP to USD conversion is 0.45% higher at 1.2980.

Above: GBP/EUR (top) and the rise in the difference between the two-year yields on UK and German government debt.

The Guardian said Reeves was preparing to confirm at the International Monetary Fund’s annual meetings in Washington that she would change the way the debt rule is calculated.

A senior government source told the newspaper that she will target public sector net financial liabilities.

The measure – which is a broader definition of the government debt, including financial assets and liabilities – would have added £53bn to headroom within the fiscal rules if it had been applied at the last budget in March.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

This additional leeway is expected to be dedicated to investment spending, which economists say is long overdue.

The OECD's Chief Economist, Alvaro Santos Pereira, said recently, "the UK needs more investment, so we need to create fiscal space to do so." Extra borrowing headroom is needed for infrastructure, "including the green transition."

"Higher public investment is crucial for better public services and overall economic growth. The only purpose of the falling debt to GDP fiscal rule is to keep public investment low. That rule has to go," says Simon Wren-Lewis, Professor of Economics and Fellow of Merton College, University of Oxford.

Economists at Pantheon Macroeconomics think the Chancellor will announce additional borrowing next week, which will boost economic growth to the tune of 0.5% in 2024.

This would, in turn, restrict the Bank of England's ability to cut interest rates as fast as central banks in other comparable nations, which would ensure the Pound retains ongoing support.

Bank of England Governor Andrew Bailey appears to have acknowledged there is a limited chance of accelerating the rate-cutting cycle, saying in Washington that "disinflation is happening, I think, faster than we expected, but we still have genuine questions about whether there have been structural changes in the economy."

"Sterling continues to hold up as comments from BoE Governor Bailey encouraged a moderation in immediate rate cut expectations," says Jeremy Stretch, Chief International Strategist at CIBC.