Pound Sterling Falls as Bank of England Signals August Interest Rate Cut

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling fell after the Bank of England kept interest rates unchanged at 5.25% but issued guidance that suggested it was close to a 25 basis point rate cut.

The odds of an August cut rose after it was revealed the decision to hold interest rates unchanged was "finely balanced" for three of the members of the Monetary Policy Committee (MPC) who voted to hold.

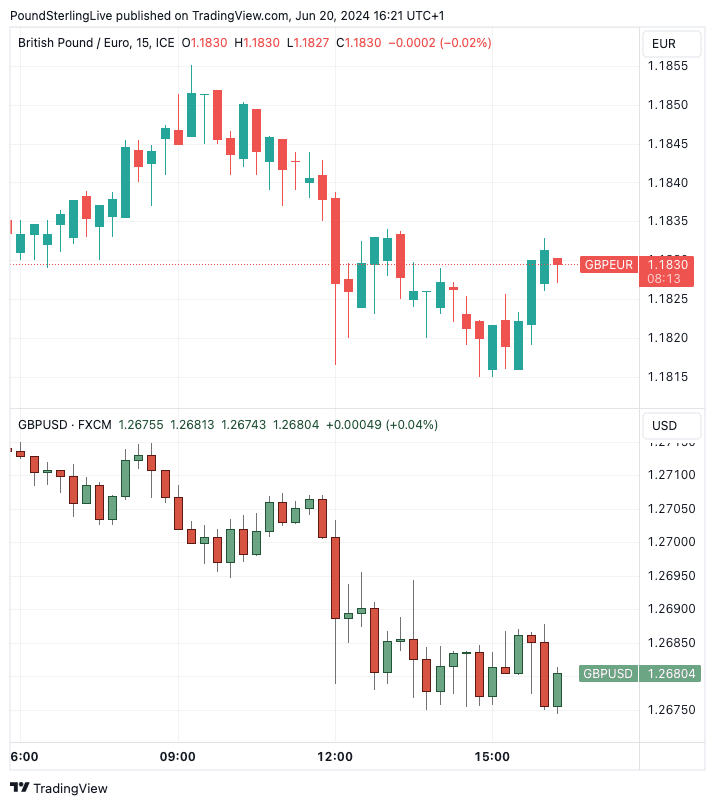

This information suggests the decision to hold was close. Reflecting the higher odds of an August cut, the Pound to Euro exchange rate fell to 1.1826 and the Pound to Dollar rate fell to 1.2690.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound rose on Wednesday after UK services inflation - which the Bank wants to see fall before cutting interest rates - came in at a stronger-than-expected level of 5.7%. But, the minutes of the meeting suggest members of the MPC are increasingly confident it will continue to fall from here.

Some of those who voted to keep rates on hold thought "the upside news in services price inflation relative to the May Report did not alter significantly the disinflationary trajectory that the economy was on."

"For these members, the policy decision at this meeting was finely balanced," revealed the meeting's minutes.

With the odds of an August interest rate increasing, the Pound might find it difficult to print fresh highs against the Euro. Trade against the Dollar will, meanwhile, continue to be heavily influenced by developments regarding the U.S. economy and interest rates.

"We stick with our view that a lot of positives seem to be in the price of the GBP and see downside risks for the currency vs the USD and the EUR from current levels," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

However, other analysts don't think the Bank of England poses a material headwind to GBP performance.

"We still feel the UK’s likely persistent rate advantage is helpful for GBP at a time when UK data are improving as real incomes slowly start to rise," says Shahab Jalinoos, a currency analyst at UBS.

Above: GBP/EUR (top) and GBP/USD price action through the day. Track GBP with your own alerts, find out more here.

Michael Brown, Senior Research Strategist at Pepperston, says an August interest rate cut is unlikely to be a unanimous decision, with the MPC's hawks likely still concerned about intense earnings pressures, and sticky services prices.

"These concerns should, more broadly, see the pace of policy normalisation after the first cut remain relatively gradual, with just one further 25bp cut, probably in November, the base case for the remainder of 2024," says Brown.

This underscores a general consensus amongst currency analysts that it is the quantum of rate cuts that are due, rather than the start date of a cutting cycle, that truly matters for FX direction.

"From a markets perspective, such a pace of easing, if delivered, would see the BoE normalising policy at a rate roughly equivalent to that of G10 peers, likely insulating the GBP from any significant medium-term headwinds, at least those stemming from a policy perspective," says Brown.

Ahead of the meeting, the probability of a cut at August’s meeting was around 40% according to money market pricing; it rose to around 60% in the wake of the meeting.

Markets see a 90% chance of two cuts by year-end.

"The relatively dovish BoE hold led to a somewhat weaker GBP following the meeting today, consistent with the rates market reaction. With two BoE rate cuts for this year fully priced, which supports our call, we now see BoE risks for GBP well balanced. Ahead of the UK and the French elections, we remain constructive GBP," says Kamal Sharma, FX strategist at Bank of America.