Pound Sterling: The Economic Gloom Snaps and these Analysts see Further Gains against Euro and Dollar

- Written by: Gary Howes

- GBP appreciates sharply aided by strong PMI data

- Improved political climate also bodes well, say analysts

- Further GBP gains possible says Natwest, BNP Paribas

- But others remain positioned for further losses

Above: Foreign Secretary James Cleverly meets Vice-President of the European Commission, Maros Sefcovic door a bilateral meeting at the Berlaymont Commission. Picture by Simon Dawson / No 10 Downing Street.

The British Pound could be set to resume its uptrend against the Dollar and end a losing run against the Euro following a string of economic and political developments that have combined to snap the gloomy economic consensus hanging over the UK economy.

A run of stronger-than-expected data outturns suggests the UK economy is on course to avoid recession with a return to growth in February; in addition, gas market developments suggest the second half of 2023 will see improved growth as household energy bills fall again.

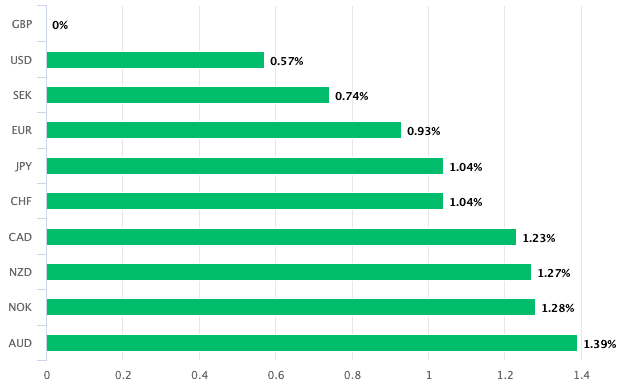

Pound Sterling rallied against all its major peers on Tuesday after S&P Global's Composite PMI hit 53.0 (above 50 indicates the economy is growing) beating the consensus expectation for 49 (contraction).

"GBP is firmer following better-than-expected PMI readings," says Clyde Wardle, Senior EM FX Strategist at HSBC.

The PMI data suggests a stronger UK rebound is underway in February as the corresponding data out of the Eurozone (52.3), France (51.6) and Germany (51.1), was softer than expected.

"We see room for further GBP gains ahead," says Wardle.

A list of supportive UK data events this February also includes the following:

- UK Retail Sales for January 2023 came in at up 0.5% month-on-month against expectations of down 0.3%

- Inflation came in at 10.1%, a smidgen lower than the market consensus forecast of 10.3%, but the all-important core rate fell a sizeable 0.9% month-on-month in January, which was far more than the -0.5% the market was expecting

- Headline wages rose 6.7% in January, beating consensus expectations for 6.5%

- The number of people in work rose by 74K against the market forecast of 40K

- New estimates suggest the average household annual energy bill will slide by more than £800 from July amidst the ongoing decline in wholesale prices from record levels reached last summer

"Together the data have a soft landing feel, a far cry from some stagflation, economic collapse views that seems so prevalent late last year," says Paul Robson, Head of G10 FX Strategy at NatWest Markets.

NatWest Markets expects the Pound to ultimately resume its stalled uptrend against the Dollar and sees increasing odds that it turns noticeably higher against the Euro.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The UK meanwhile recorded an unexpected budget surplus in January according to data, also out on Tuesday, that showed tax receipts outstripped spending for the month.

Markets had been expecting another deficit to be recorded on the national accounts.

Public sector net borrowing (excluding banks) in January 2023 was in surplus by £5.4BN said the ONS, the consensus was looking for a -6.95BN reading.

The data leads some analysts to anticipate more headroom for Chancellor Jeremy Hunt to offer further support to under-pressure households when he sets out his budget for the year ahead next month.

In the financial year to January 2023, the public sector borrowed £116.9BN, which was £7.0BN more than in the same period last year but £30.6BN less than forecast by the OBR.

"At some point there will be fatigue in the short Sterling trade and this will highlight the shift in the current account and financial account," says Robson.

"We note the UK's fiscal credibility has been somewhat restored, gas prices have normalised and there have been reports of some progress in resolving the Northern Ireland Protocol issues," says Parisha Saimbi, G10 FX Strategist at BNP Paribas in London.

>> Free download: 2023 investment bank forecasts for GBP/EUR from Global Reach.

Political 'Chaos-detox' Offers the Pound Support

Sterling nevertheless remains close to its post-Brexit lows, notes Saimbi, having only traded materially lower when negative news flow has been more extreme.

Such moments included political turmoil amid Brexit negotiations, Covid, the Great Financial Crisis and the UK's own fiscal crisis around the time of former Prime Minister Liz Truss' mini-budget.

Therefore, on this basis, it would require another significant shock to deliver a retest of September's lows for the Pound, something that is less likely given the trajectory of UK politics of late.

"After nearly six years of noise and chaos, the UK seems to be returning to something resembling a more normal political environment," says Kallum Pickering, Senior Economist at Berenberg Bank.

"Following the failures of two populists (Boris Johnson and Liz Truss), the typically sensible Conservatives have put a safe pair of hands (Rishi Sunak) back in the prime minister’s seat. Sunak is combining fiscal restraint with a genuine effort to end UK-EU tensions over the Irish border," he adds.

Above: GBP outperformance on Feb. 21. Consider setting a free FX rate alert here to better time your payment requirements.

EU and UK negotiators continue to work towards a new deal on the Northern Ireland protocol, with both sides saying progress is at advanced stages.

Pickering says a deal would lift the threat of a tit-for-tat trade war with the UK's biggest market, the EU, which "is exactly what UK businesses and financial markets need."

There is no deadline for the talks, but the Prime Minister's office says a deal is still possible over the coming days.

"Absent a shock... we deem it necessary to moderate the degree of weakness we expect in the GBP in the coming years," says Saimbi.

BNP Paribas now projects EUR/GBP to stabilise at around 0.89, a figure revised down from 0.93 previously.

In Pound to Euro exchange rate terms, this equates to a new target of ~1.1230, versus ~1.0750 previously.

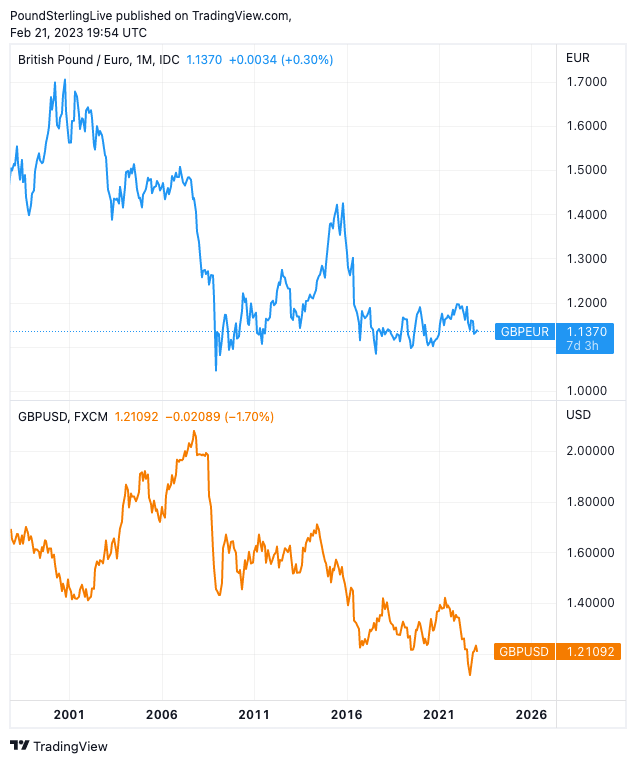

Above: A long-term view of GBP/EUR (top) and GBP/USD shows it remains close to multi-year lows, but 'fair value' could lie higher.

BNP Paribas' FEER model - a long-term fair-value estimate - suggests equilibrium levels of 1.62 for GBP/USD and 0.84 for EUR/GBP.

The bank's medium-term fair-value model - BNP Paribas CLEERTM - suggests the GBP/USD would be fairly valued at 1.27 and EUR/GBP at 0.73 (GBP/EUR at 1.37).

Taking a host of other factors into account leads BNP Paribas to forecast GBP/USD at 1.28 by the end of 2023 and 1.33 by the end of 2024. (Free download: 2023 investment bank forecasts for GBP/EUR and GBP/USD from Global Reach.

EUR/GBP is forecast at 0.89 through this entire period, suggesting GBP/EUR will continue to grind around ~1.1230 for an extended period.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Too Soon to Bet on the Pound say Some

The positive run of UK data comes against a gloomy consensus regarding the UK economic outlook, and that of the Pound.

The UK is forecast by the Bank of England and IMF to suffer a multi-quarter recession in 2023 that lasts into 2024, predictions that inform a broadly soft narrative on the Pound.

Bank of America has studied its books and finds its clients have pared back shorts on the Pound, but nevertheless remain bearish and unwilling to go long.

Shorts are trading positions that would deliver returns if the Pound falls in value, while longs would deliver profits on advances. The positioning gives an indication of where sentiment towards the currency lies.

Analysts at the bank say this as evidence that the market's stance on the Pound is "less bad" but not "much better".

"This provides a ceiling on the extent to which GBP can recover, and consequently, our bias is to fade any rallies," says Kamal Sharma, FX Strategist at Bank of America in London.

Jordan Rochester, a foreign exchange strategist at Nomura, says the UK's economic growth and inflation momentum are expected to cool off quickly from here as UK consumers are more exposed to rate hikes than peers in Europe.

He looks for EUR/GBP to trade into a range of 0.90-0.92 by the second quarter of the year. (This gives a Pound to Euro range of 1.11-1.0870.)

Citi, UBS and RBC Capital Markets are other names expecting weakness for the Pound against the Euro over the coming weeks.