Stay Bearish Euro (Until EZ Wages Hit 3%) says Credit Suisse

- Written by: Gary Howes

"The main risk to our ongoing EUR bearishness has to be the possibility that the ECB changes tack in a hawkish direction" - Credit Suisse.

Above: File image of ECB Chief Economist Philip Lane, © ECB.

The Euro is tipped to struggle by strategists at Swiss bank Credit Suisse, however they also warn the currency could make a material recovery should Eurozone wages reach 3.0%.

This after a key member of the European Central Bank (ECB) said a determined rate hiking cycle was only likely in the event Eurozone wages increased notably, thereby threatening to push inflation over 2.0% on a sustained basis.

Shahab Jalinoos - Global Head of FX Strategy at Credit Suisse - says he and his team are holding a "core bearish EURUSD view", based on the ECB remaining "very dovish".

In fact, the ECB appear "almost untouched by high realised inflation which has so clearly been a pivotal factor elsewhere," says Jalinoos.

But, "the main risk to our ongoing EUR bearishness has to be the possibility that the ECB changes tack in a hawkish direction with the kind of urgency that the Fed, the BoE and now even the MAS is showing," says the analyst.

What would prompt such a change in tact?

The ECB's chief economist Philip Lane this week gave a strong hint when he said the key metric to watch going forward would be wage growth, specifically whether it will be able to sustain Eurozone inflation above the ECB's 2.0% target over the longer-term.

"So far, we do not see a big response of wages. We do expect a response of wages but what is critical is how big," said Lane in an interview.

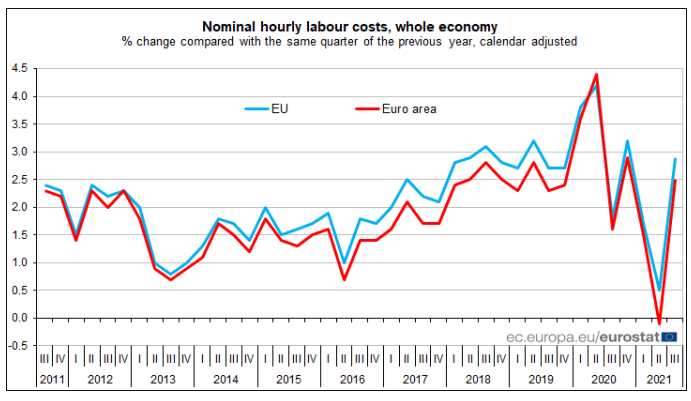

In the third quarter of 2021, Eurozone wages rose by 2.5% and by 2.9 % in the EU according to official figures, compared with the same quarter of the previous year.

- EUR/USD reference rates at publication:

Spot: 1.1289 - High street bank rates (indicative band): 1.0894-1.0973

- Payment specialist rates (indicative band): 1.1187-1.1233

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

Lane said that in the euro area, for inflation to be around 2% and allowing for a typical increase in labour productivity of about 1%, then wages should be growing around 3% a year in the euro area on average to be consistent with the 2% target.

"We are not, right now, seeing wage increases in that zone. But of course, we will continue to look at this throughout the year," said Lane.

Lane said that unless wage growth can reach these levels it is unlikely inflation can sustain a 2% rate and will instead fall below that level again in 2023 and 2024, thereby requiring ongoing ultra-easy monetary conditions.

"But markets are trying hard to push against this narrative, or at least making a bet that wage growth will indeed reach levels where a shift in gears is needed," says Jalinoos.

Current money market rates pricing shows one 25 basis point hike is expected in 2022 and another 1.5 hikes priced for 2023.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"This is already priced in, the hurdle for EUR to make gains is reasonably high, not least because by strengthening it would immediately tighten monetary conditions further anyway," says Jalinoos.

Although Credit Suisse reiterate their bearish stance on the Euro they would reconsider were wage pressures to point higher.

"What’s needed now to get the EUR to rally meaningfully is a wage jump that’s both a) imminent and b) powerful so that the market feels confident enough to price in a June ECB hike, and perhaps a second in December, with no particular concern about currency strength derailing the process," says Jalinoos.

Credit Suisse remains open to the possibility wages do move higher, "given global developments and media reports of brewing euro area wage pressures."

But, "we prefer to wait for more concrete evidence the ECB could be compelled to shift stance - as opposed to trying to anticipate it at this early stage in proceedings," says Jalinoos.

More: Euro Forecasts Upgraded at Deutsche Bank, says ECB to Hike Rates in December