EUR/USD Upside Back in Play on Rising Odds of 50bp Fed Rate Cut

- Written by: Gary Howes

Image © Adobe Images

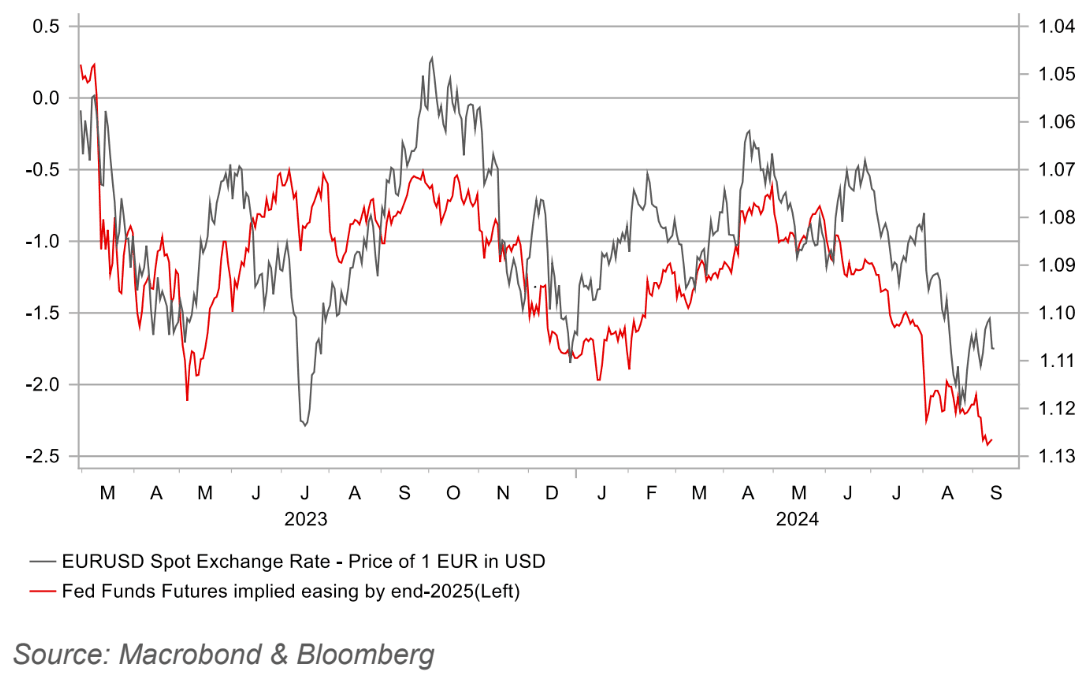

The Euro to Dollar exchange rate (EUR/USD) looks intent on breaking back above 1.11 on a combination of subdued ECB interest rate cut expectations and rejuvenated expectations of a big 50 basis point rate cut at the Federal Reserve next week.

The European Central Bank's decision to cut interest rates was no surprise, more importantly, the central bank gave markets little rope to build expectations for an acceleration in the pace of future cuts.

This communication was enough to bolster Euro exchange rates and allow market focus to quickly return to next week's pivotal Federal Reserve interest rate decision, where events have taken an unexpectedly 'dovish' turn.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The consensus heading into the Wednesday decision was that the Fed would go with a 25bp rate cut, but events in the past 24 hours have conspired to give an impression that a bigger 50bp cut is in play.

This has resulted in lower U.S. bond yields, which are weighing on USD exchange rates, prompting a 0.57% rise in Euro-Dollar over the past 24 hours. Gains extend ahead of the weekend to 1.1088, and there is a good chance follow-through price action could take the conversion above 1.11 in the coming days.

Markets currently see a 43% chance of a 50 bps cut on Sept 18, up from only 13% after the U.S. CPI data release on Wednesday.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"EUR/USD has been given a further lift by the increased speculation that the FOMC may indeed cut by 50bps next week," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank Ltd.

Market analysts we follow say there is now a higher risk of a half-point Fed cut due to reports in the Wall Street Journal and the Financial Times. Also being cited was a speech by a former member of the Federal Reserve's interest rate-setting committee, the FOMC.

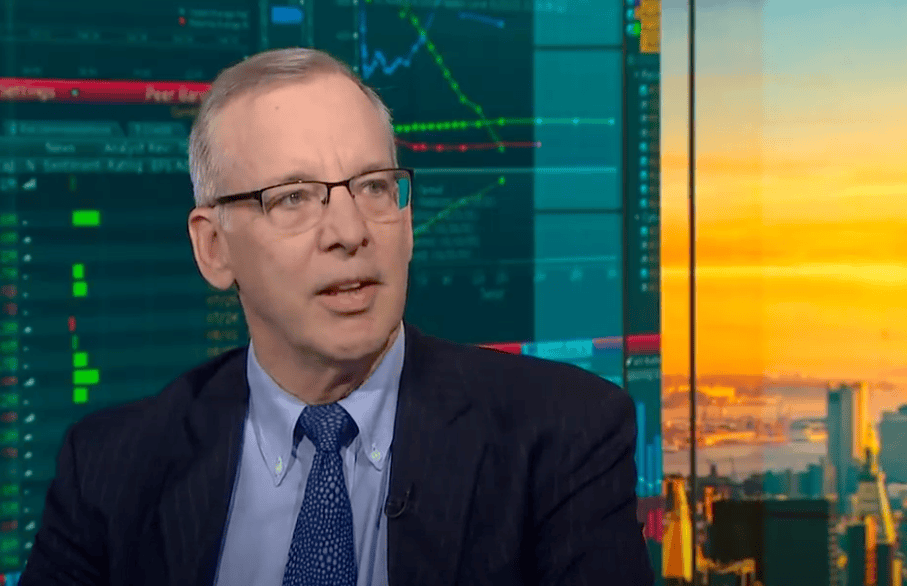

Former Federal Reserve policymaker Bill Dudley made it clear he would push for a 50 basis point interest rate cut were he still in the FOMC.

"I think there's a strong case for 50, whether they're going to do it or not," he said at the Bretton Woods Committee's annual Future of Finance Forum in Singapore.

But how does a former member of the FOMC still hold such sway over the market?

Above: File image of Bill Dudley. Image: Pound Sterling Live / Bloomberg TV.

Francesco Pesole, FX Strategist at ING Bank, says the following part of Dudley's speech was particularly important: "It's very unusual to go into the meeting with this level of uncertainty – usually the Fed doesn’t like to surprise markets".

Pesole explains that one possible interpretation is that markets themselves can tilt the balance towards a half-point move should their dovish bets be pent up into Wednesday’s meeting.

"There were also some media reports suggesting it would be a close call between 25bp and 50bp, which contributed to the dovish repricing," says Pesole.

The FT leads on Friday with a report that states, "the Federal Reserve faces a close call on whether to cut US interest rates by a larger than expected half-point next week or go with a quarter-point move as officials wrestle with how quickly to ease monetary policy."

The Wall Street Journal's much-respected Fed specialist, Nick Timiraos says the Fed still faces a dilemma to "start big or small".

Above: EUR/USD (inverted) vs. basis points of easing expected of the Fed by mid-2025. Image: MUFG Bank.

MUFG's Halpenny says this article is "being interpreted by the markets as being an orchestrated move by the Fed given this journalist is known to have Fed links... we don’t know if this WSJ article has been orchestrated or not, but this leaves the decision next week finely balanced."

MUFG economists say they expected a 50bp cut even before these reports. The surprise 0.3% core CPI rise reported earlier this week was seen by many to argue against a 50bp move, but MUFG reasons that the upside surprise was not broad-based (only rents and airfares fuelled the upside surprise).

Halpenny says four 75bp rate hikes and two 50bp rate hikes when policy was being tightened in 2022-23 certainly provide recent precedent for moving in larger sizes.

The Euro can remain bid as markets position for higher risks of a strong start to the Fed's upcoming rate cutting cycle.