Euro Tipped to Rise Even Higher than Previously Expected as Eurozone Economy "Shoots Out the Lights"

© DragonImages, Adobe Stock

A strengthening Eurozone economy and reduced risk factors have JP Morgan forecasting a progressive strengthening in the Euro through the course of 2018.

The Euro is expected to strengthen at an accelerated pace in 2018 by analysts at investment bank JP Morgan who have at the start of February upgrade their forecasts for the shared-currency.

A combination of an enhanced economic outlook and diminished political risks has emboldened the currency strategy team to revise up the bank's official forecasts.

"Not only has the positive economic tail-risk for the euro thus become the central scenario, the tactical downside risks that we highlighted for 1Q have failed to materialize," says JP Morgan strategist Paul Meggyessi.

Indeed, the risks associated with politics, which reined in their aspriations for the single currency back in 2017, have now largely evaporated.

The risk of a the anti-EU five star party coming to power in Italy and fragmenting the EU is seen as non-material: "investors remain broadly sanguine about the prospect of a non-mainstream government in Italy, as indeed are we," says Meggyesi.

Secondly US corporate repatriation flows stimulated by Trump's tax reforms were expected to support the Dollar, yet apart from the much-advertised repatriation by Apple these have been, "noticeable so far by its absence," says JP Morgan.

Finally, in relation to the outlook for US interest rates, although last Friday's better-than-expected wage data may lead the Federal Reserve to raise rates at an accelerated pace in 2018, the Fed themsleves failed to signal an accelerated pace of hikes at the December FOMC.

This has weighed on the outlook for the Dollar since higher interest rates boost a currency by attracting greater capital inflows due to the draw of higher returns.

The outlook for the Eurozone, meanwhile has gained a boost, with J P Morgan's economists upgrading their view of Eurozone economic growth by a whole percentage point to 2.9% for 2018 and 3.25% for H1, since the previous forecast in November 2017.

This should prompt a speedier end to the European Central Bank's (ECB) supportive stimulus measures and thus lead to higher interest rates.

"From the middle of December we have been signaling that the prospects for EUR were improving in response to an economy that continues to shoot out the lights," says Meggyesi.

As far as individual forecasts go, the EUR/USD pair is forecast to rise to as high as 1.29 at the end of 2018, from 1.23 previously.

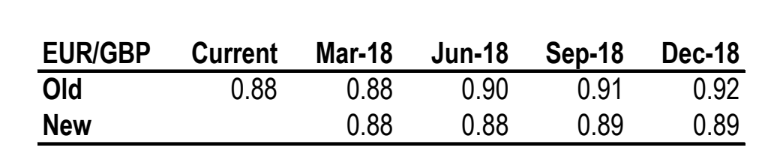

EUR/GBP is not forecast to rise as strongly now as before, since J P Morgan see Sterling strengthening too - instead they see it reaching 0.89 by the end of 2018 from 0.92 previously.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.