Pound vs. Euro: Goldman Sachs Shifts Target

- Written by: Gary Howes

Image © Adobe Images

Investment bank Goldmans Sachs have raised their target on a trade betting the Euro will rise further in value against the British Pound.

In a weekly strategy briefing Zach Pandl, Co-Head of Global FX Strategy at Goldman Sachs in New York, says the increased conviction Sterling would fall further against the Euro than initially expected is largely down to the Bank of England.

Goldman Sachs had been 'long' on the Euro-Pound exchange rate heading into the Bank's May policy decision and Monetary Policy Report, but were surprised at just how downbeat Governor Andrew Bailey and his team were on the UK's economic outlook.

The Bank raised near-term inflation forecasts and lowered growth forecasts alongside an announcement they would be raising interest rates 25 basis points to 1.0%.

But long term inflation forecasts were likely to fall below the mandated 2.0% target even without further interest rate rises.

For Goldman Sachs the message and projections from the Bank represents in a shift in strategy in a more 'dovish' direction, just as other central banks are becoming more 'hawkish'.

In a world where such divergence matters for currencies this leaves the Pound exposed to weakness.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Indeed, the Federal Reserve hiked by 50 basis points just hours before the Bank raised rates while guiding on the need for a succession of further 50 bp rate hikes.

The European Central Bank meanwhile looks keen to get interest rates rising by the summer and before a window for such 'normalisation' closes.

Informing Goldman Sachs' more 'dovish' stance on Sterling is the observation the Bank of England is more confident in the view that the UK's current inflation surge is 'transitory', a now widely derided reading of the global inflationary landscape.

"Other central banks have moved on from that thesis," says Pandl, who says the Bank appears to believe inflation will fall away simply as global supply chains normalise.

The Bank of England's stance contrasts to that of the Federal Reserve where Chair Jerome Powell recently argued the Fed would be setting policy based on "actual progress" on the supply side "and not assuming near-term supply-side relief."

As a result the Bank of England is said to be relying on hope as a strategy by Goldman Sachs.

"Other central banks are now responding more forcefully to the shifting inflation outlook than the BoE, which is weighing on Sterling," says Pandl.

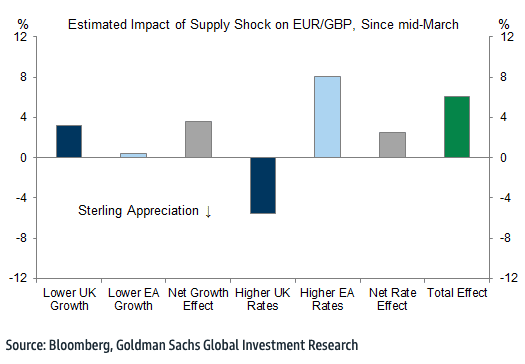

Analysis from Goldman Sachs finds the Euro is a beneficiary against Sterling given Eurozone yields are rising at a greater pace than that of UK yields, thanks in part to the Bank of England's policy stance.

Above: "BoE Policy No Longer Offsetting Growth Shock" - Goldman Sachs.

This will help the Euro relative to the Pound, they say.

"We have grown increasingly negative on Sterling over the last couple of months because of these dynamics, and this week’s BoE decision increased our conviction," says Pandl.

Goldman Sachs raise the target on a 'long' EUR/GBP trade recommendation to 0.87.

This gives a Pound to Euro exchange rate downside target of 1.15.

The exchange rate is quoted at 1.1680 at the time of writing. (Set your FX rate alert here).