Pound to Australian Dollar Week Ahead Forecast: 60% Chance of Further Gains (But with a Big Disclaimer)

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBP/AUD) has started to build some tentative upside momentum and we think this can extend in the coming week.

However, a disclaimer: FX volatility looks set to pick up in the coming days with the U.S. presidential election just days away and we could see some decent moves in either direction.

In our previous edition of the GBP/AUD Week Ahead series, we said to expect further gains and that the advance could take the pair to 1.9586, a target that was hit on Friday.

Looking ahead to the next five days, we think there is a 70% chance the pair ends the next week higher than where it started.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

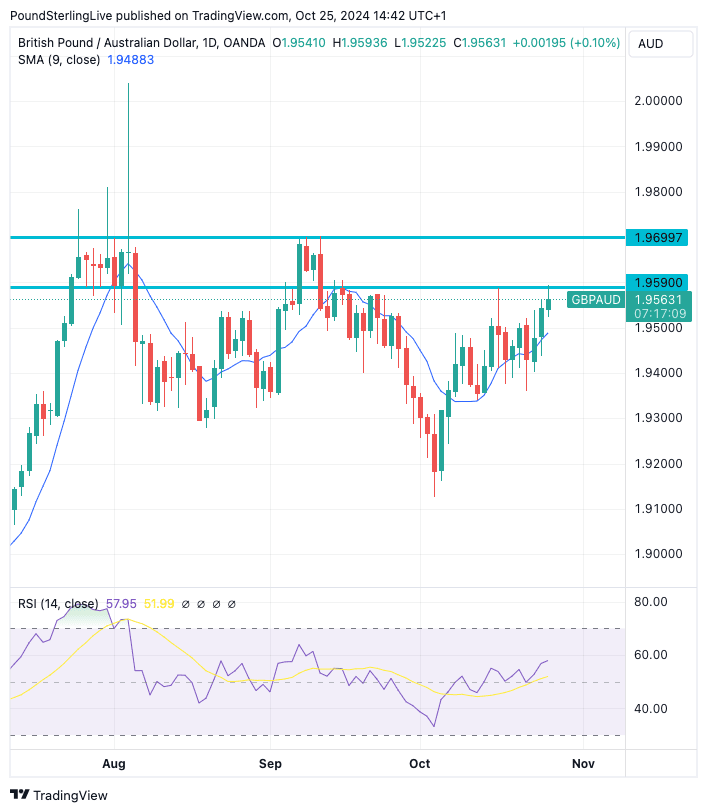

Looking at the technicals (which strips away the noise from data and political developments), GBP/AUD momentum is broadly supportive, with the RSI positive and now pointing higher, having been relatively flat until recently.

The exchange rate is above the nine-day moving average, which is a sign that it can go higher in the next five days.

However, confidence in such an outcome will only increase if GBP/AUD can break above 1.9590; for this to happen, GBP/AUD must register a daily close above 1.9590 on a couple of occasions.

A glance at the daily chart shows this level forms an imprecise range ceiling for the September-October period:

A successful break above 1.9590 in the coming days opens the doorway to the September highs at 1.97.

Ultimately, however, this exchange rate has been prone to sideways trending on a multi-week basis.

This is why there is still a decent chance (30%) that GBP/AUD will fail to close the coming week lower than where it started.

A pullback could take the market back to 1.95, where the 9-day MA is located.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

As per our disclaimer right at the top of this piece, this is a busy week, and volatility is anticipated to rise and could quite easily smother the gentle technical setup.

First up, Australia releases inflation data on Wednesday.

Here, the market looks for inflation to have risen 0.3 quarter-on-quarter in the third quarter, down from 1.0%.

We think the risks to the AUD are asymmetric. If the data undershoots, the market would react more strongly to the downside.

This is because an undershoot could prompt a dovish reaction from the Reserve Bank of Australia, which could involve cutting the interest rate before year-end.

Markets see the RBA being the last of the major central banks to cut interest rates, a view that has held AUD aloft over recent weeks.

A soft inflation reading would spring a leak in the bulwark of elevated rate expectations and weigh on the Aussie.

The global picture will be potentially of more importance for AUD in the coming two weeks.

We have seen AUD come under pressure over recent days amidst fading optimism over the effectiveness of recent Chinese economic stimulus announcements.

Should sentiment remain subdued with regard to China in the coming week, then AUD can drift lower.

However, The big story for global markets is next Tuesday's U.S. election.

We have seen the USD strengthen ahead of the event as market expectations for a Trump win have risen to above 60% in just two weeks, and this has weighed on risk-sensitive currencies, especially AUD.

Further AUD weakness can be anticipated, particularly if the odds of a Donald Trump win rise further.

Also, recall the U.S. labour market report due on Friday, where a stronger-than-forecast reading will push back against expectations for U.S. interest rate cuts.

This would bolster U.S. bond yields and the Dollar, which would work against AUD and help GBP/AUD towards the 1.97 level.

Chancellor Rachel Reeves. Picture by Kirsty O'Connor / HM Treasury.

GBP/AUD could see some excitement from the GBP side of the equation as the UK government will announce its budget on Thursday.

We know this is likely to be a difficult budget for businesses and investors and is, therefore, a potential headwind for growth

This could weigh on the Pound, particularly if the market thinks the new tax rises will lower the UK's growth potential.

However, analysis suggests the budget will be expansionary as the Chancellor has changed the UK's fiscal rules to allow her to borrow more money in order to invest in projects that would boost the UK's growth potential.

Some estimates suggest the boost to growth could amount to 0.50% in 2025, which would require the Bank of England to be more cautious in cutting interest rates.

This would amount to a GBP-positive outcome.

Risks to the Pound would be the market not taking kindly to expectations for increased borrowing, similar to the reaction to Liz Truss' aborted mini-budget of 2022 that caused a meltdown in the Pound.

All analysts we follow say they have seen and heard enough to believe this is unlikely, so we think the budget is no major impediment to GBP upside.