Pound to Australian Dollar Week Ahead Forecast: Supported, But Upside Limited

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBP/AUD) is supported, but there is limited prospect of a sizeable appreciation in the near future.

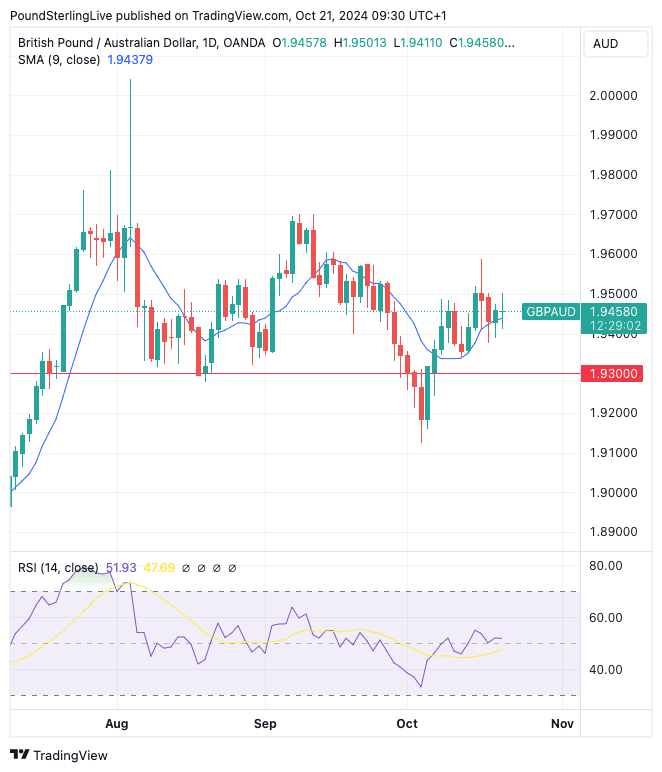

GBP/AUD is drifting higher, held above the nine-day moving average on the daily chart, currently seen at 1.9438, a level that has provided support for much of October.

This technical indicator is pointing upwards, which means we could expect a series of 'higher lows' in the coming days that could lift GBP/AUD to the previous week's high at 1.9586.

Beyond here, the solid resistance of 1.97 beckons, although we sense this target is only achievable on a multi-week basis, given the exchange rate looks pretty well anchored sub-1.96.

The RSI is flat at 50, which reflects a general sense of consolidation in GBP/AUD, where sizeable moves either up or down tend to be faded by a market that sees neither the Aussie nor Sterling holding a clear advantage.

The consolidative tone in GBP/AUD is because both currencies have been outperforming most peers over the course of the past month.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Aussie is set to be supported by an ongoing reluctance by the Reserve Bank of Australia (RBA) to cut interest rates, which implies relative interest rate differentials are currently in its favour.

"Australia’s unemployment rate at 4.1% remains in the lower part of the RBA’s estimated range of the natural rate and below the central bank’s end-2024 forecast of 4.3%. The labour market remains tight and a source of inflation by contributing to strong wages growth," says David Forrester, an FX analyst at Crédit Agricole.

In addition, Chinese efforts to stimulate the domestic economy have been a focus for global financial markets over the past three weeks, which has aided China-focussed assets such as AUD.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Although China has announced measures to bolster economic activity, economists have expressed caution as to whether the decisions amount to a game-changer.

This doubt would explain why the Aussie Dollar's advance stalled last week and why GBP/AUD has crept higher.

Like the Aussie, the Pound is also supported by interest rate differentials, with the Bank of England tipped to maintain a cautious pace of rate cuts in the coming months.

Risks this week come in the form of the Bank of England's Governor Andrew Bailey, who is due to deliver comments on Tuesday and Thursday.

He caused a sizeable slump in GBP exchange rates at the start of October when he said the Bank could be more "activist" in cutting rates if the inflation data warranted.

Last week's inflation data certainly had a feeling of vindication for Bailey, undershooting expectations handsomely.

"We will also be listening closely to comments from BoE officials in the week ahead including Governor Bailey for any further encouragement that they are becoming more willing to speed up rate cuts in light of the weaker inflation and wage data in September," says Lee Hardman, an analyst at MUFG Bank Ltd.

But, the economy remains firm and the government is due to announce its budget next week, which would suggest Bailey would like to retain an air of caution.

As such, any post-Bailey moves in GBP/AUD should be faded.