GBP/AUD: JP Morgan Stays "Short" in Wake of BoE Decision

- Written by: Gary Howes

Image © Adobe Stock

Strategists at JP Morgan look to maintain a 'short' position on the British Pound against the Australian Dollar.

In a recent research and strategy note the Wall Street bank says it continues to favour the Australian currency as one of 2023's likely outperformers while saying the Pound should be held back by idiosyncratic risks.

"Hold GBP/AUD shorts," says James Nelligan at JP Morgan, "the BoE’s shift to a data-dependent stance... can be interpreted as incrementally dovish."

A 'short' is where a financial market participant sells a financial instrument in anticipation of further losses.

The Pound to Australian Dollar exchange rate (GBP/AUD) fell in the wake of the Bank of England's February 02 decision, which investors interpreted as being a 'dovish' hike, and is now down 2.40% already this year.

But losses began in mid-December, amidst distinct Australian Dollar outperformance.

GBP/AUD reached a low of 1.7223 on February 02, having been as high as 1.8274 on December 20, with much of the move lower being driven by the market's reaction to news China would accelerate its move away from its zero-Covid policy.

This raised hopes the world's second-largest economy would provide a boost to global boost and particularly those countries with strong trade ties, such as Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The China 'reopening' story is expected by JP Morgan, and numerous other financial institutions, to be a major theme of the coming year, which could benefit Emerging Market assets and the antipodean economies.

According to OECD forecasts, Australia is set to be comfortably the fastest-growing G10 economy in 2022-2024.

But the GBP leg of GBP/AUD is also seen as a drag, according to JP Morgan.

"Given sterling’s return to a more conventional rate differential reaction function this year, we see a weaker GBP from here," says Nelligan. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The Bank of England on February 02 raised interest rates by a further 50 basis points but once again guided markets in a 'dovish' direction, saying rates would not need to rise as high as investors were expecting.

They released forecasts showing UK economic growth would decline in 2023 while also forecasting inflation would fall to 1.0% by the end of 2024. This lowered expectations for the peak in Bank Rate, raised expectations for rate cuts later in 2023 and weighed on UK bond yields.

This dynamic in turn weighed on the Pound.

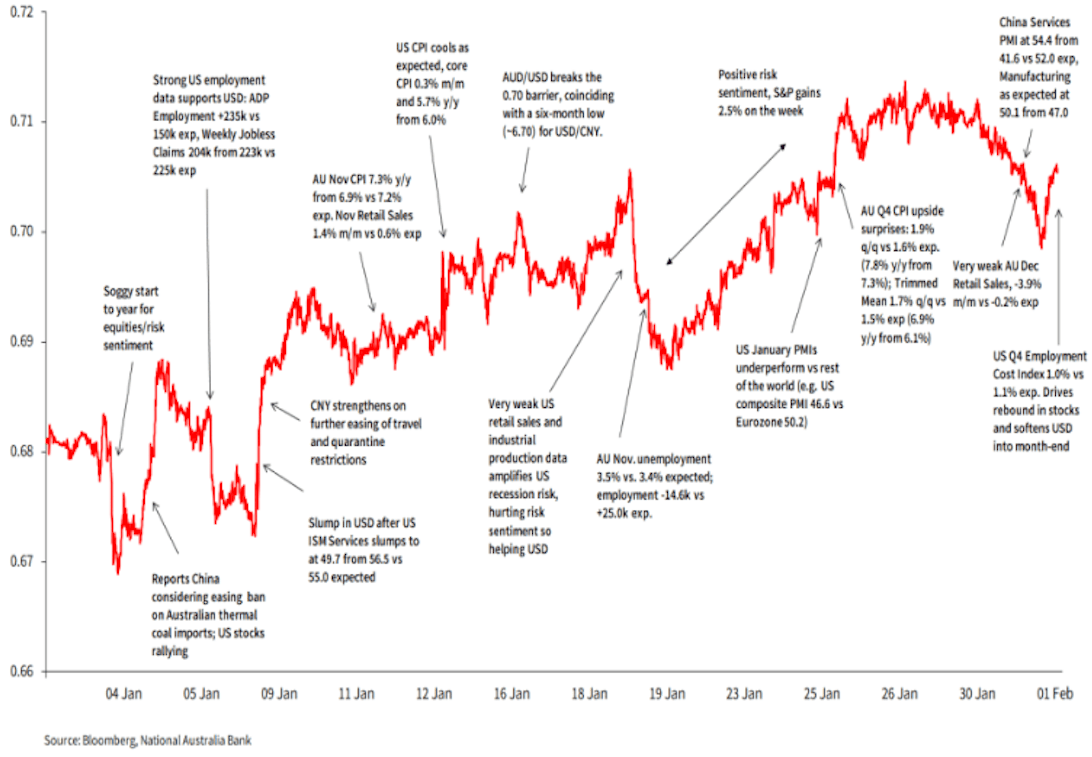

Above: The AUD in January, by NAB.

"Although a dovish central bank is growth-positive in the medium-term, the economy is plagued, inter alia, by a still-spiralling housing market and supply-side hampered labour market. Mortgage

approvals and Nationwide house prices surprised to the downside this week, with the sharp fall in the former suggesting that a bottoming in house prices is still some time away," says Nelligan.

By contrast, the Reserve Bank of Australia on February 07 raised interest rates by 25bp and proved unexpectedly 'hawkish' by saying further rate hikes were needed to respond to stronger-than-forecast inflation levels.

The RBA also gave a broadly upbeat view of the economy, allowing markets to raise bets for the peak in Australia's basic interest rate.

"The RBA decision was perceived by the market as hawkish and the AUD was able to gain," says analyst You-Na Park-Heger at Commerzbank. "The RBA has again signalled its willingness to do more."

The outcome prompted a rally in the Australian Dollar which put GBP/AUD back under pressure.

"The rate differential narrative has returned," says Nelligan.

"A short GBP/AUD expression is favourable as sterling should continue to lag any recovery in high beta currencies given its poor idiosyncratic growth story," he adds.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes