Pound / Australian Dollar Rate Dips in Wake of RBA Minutes

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar rose against the British Pound, Euro and Dollar as London's market reopened following a long weekend and investors reacted to indications an interest rate at the Reserve Bank of Australia is nearing.

The minutes of the RBA's April policy meeting showed interest rates are likely to rise as soon as June 07, far sooner than the central bank had been indicating at the start of this year.

Indeed it was only in March that RBA Governor Philip Lowe told the AFR Business Summit the RBA "can be patient" on raising interest rates, "in a way that countries with substantially higher rates of inflation cannot."

But inflation in Australia is rising and the RBA is nervous. The central bank said in its April minutes annual core inflation in the first three months of this year was likely to be above the top of its 2-3% target.

The minutes are released just days ahead of the country's official inflation data release for the first quarter, due on April 27. Consensus expects headline inflation to have risen 3.2% year-on-year in the first quarter.

"Inflation had picked up and a further increase was expected, with measures of underlying inflation in the March quarter expected to be above 3 per cent," said the RBA.

The minutes noted a strong domestic economy, boosted by consumer spending now that Omicron had passed as well as a tight labour market.

Strong commodity exports and rising house prices were noted while members of the board agreed policy settings at the RBA remained "highly accommodative".

"These developments have brought forward the likely timing of the first increase in interest rates," said the RBA.

Nevertheless the minutes reiterated the RBA would like to see upcoming data on both inflation and labour costs before raising interest rates, putting the most likely 'lift off' date as June 07.

"We expect a very strong Q1 22 CPI print next Wednesday which will pave the way for the RBA to start raising the cash rate in June," says strategist Carol Kong at Commonwealth Bank of Australia.

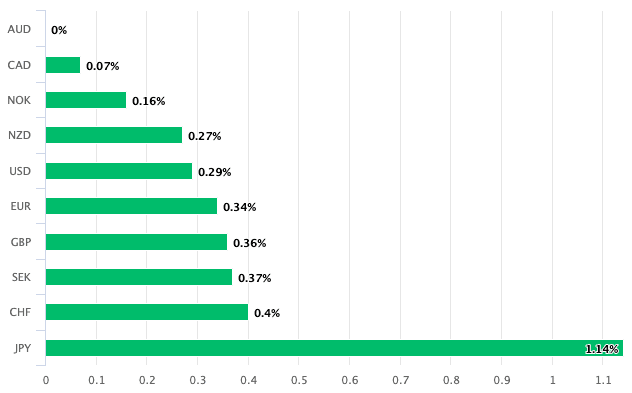

The Australian Dollar was the best performing G10 currency in the wake of the minutes, with gains of 0.36% being recorded against Pound Sterling at the time of writing and an advance of 0.30% coming against the Dollar and 0.34% against the Euro.

Above: AUD is the best performer on April 19.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Pound to Australian Dollar exchange rate was trading at 1.7625, AUD/USD at 0.7375 and EUR/AUD at 1.4608. (Set your FX rate alert here).

"The RBA Board is now giving much greater attention to global inflationary risks and the responses of other central banks. The timetable for rate hikes has been brought forward and there is some unease that current market pricing may be under estimating the inflation challenge," says economist Bill Evans at Westpac.

Markets have been steadily raising expectations for a RBA rate hike through the course of late 2021 and 2022, bidding the Australian Dollar higher as a result.

Although the RBA had signalled it was not willing to raise rates, the market has called its bluff.

Therefore a sizeable amount of rate hikes are already 'priced in' for the Australian Dollar.

Money market pricing - the OIS market - shows there are 192 basis points of hikes expected of the RBA for 2022, only more hikes are priced into the Reserve Bank of New Zealand.

A survey of 14 published analysts conducted by Bloomberg shows 12 of the respondents favour a 15 basis points move in June to reverse the 15 basis point cut in November 2020.

This could offer ongoing support to the two antipodean currencies going forward, but only if the market continues to believe their central banks will raise rates aggressively.

But the market is already richly priced and the RBA must deliver to underpin the Australian Dollar's strong advances of 2022.

"Market is already very hawkishly priced, and thus we do not expect relative rates to provide much long-lasting support for AUD," says Antti Ilvonen, Analyst, at Danske Bank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Any delay to rate hikes, or indication that hikes will be slow in coming, could post downside pressures for the currency.

"We also expect the cash rate to have reached 125 basis points by December – well short of market pricing but generally above most other analysts’ forecasts," says Evans, who adds:

"Based on today’s Minutes we need to be vigilant for more clues to the puzzle over coming weeks but there is no denying a very significant change in the Board’s approach to policy."