Eurozone Economic Bulletin Reiterates Steady Growth Mantra

- The latest economic report from the European Central Bank sees growth continuing its steady uptrend

- The outlook is more at risk from global factors than domestic factors despite slowing Q1 growth

- Inflation is subdued but wages and the labour market are slowly, creeping higher

© artjazz, Adobe Stock

The European Central Bank (ECB) Economic Bulletin, released on Thursday, May 10, appears largely a cut-and-paste affair of the ECB's opening statement from its April policy meeting.

The report largely dismisses the bugbear of slowing growth which has started to taint the outlook for the Eurozone, saying it sees little impact in the medium-term - just as the ECB policy statement did.

Nevertheless, despite the similarities, the Bulletin is worth covering, as it is the most up-to-date expression of the ECB's official stance.

Growth in the region is expected to continue to rise steadily, with the main threat coming from global factors such as increasing trade protectionism or falling global growth, rather than domestic factors, says the report.

The threat from protectionism is considered to be a key risk factor to Euro-area growth.

"Risks related to global factors, including the threat of increased protectionism, have become more prominent," says the Econ Bulletin.

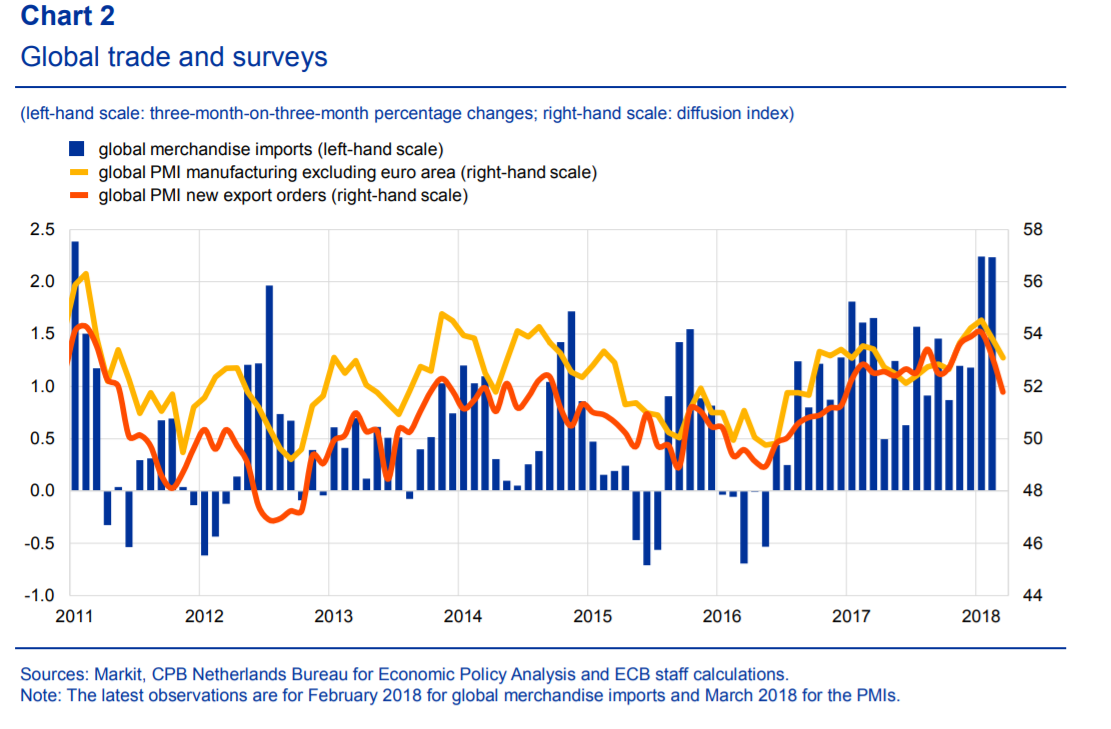

Global growth is also moderating in Q1 but from a high starting point.

"Global trade indicators were mixed but signal, overall, some deceleration at the start of the year," says the Bulletin.

Global inflation remains steady at 2.2% - substantially higher than in the Eurozone where it is only 1.3%.

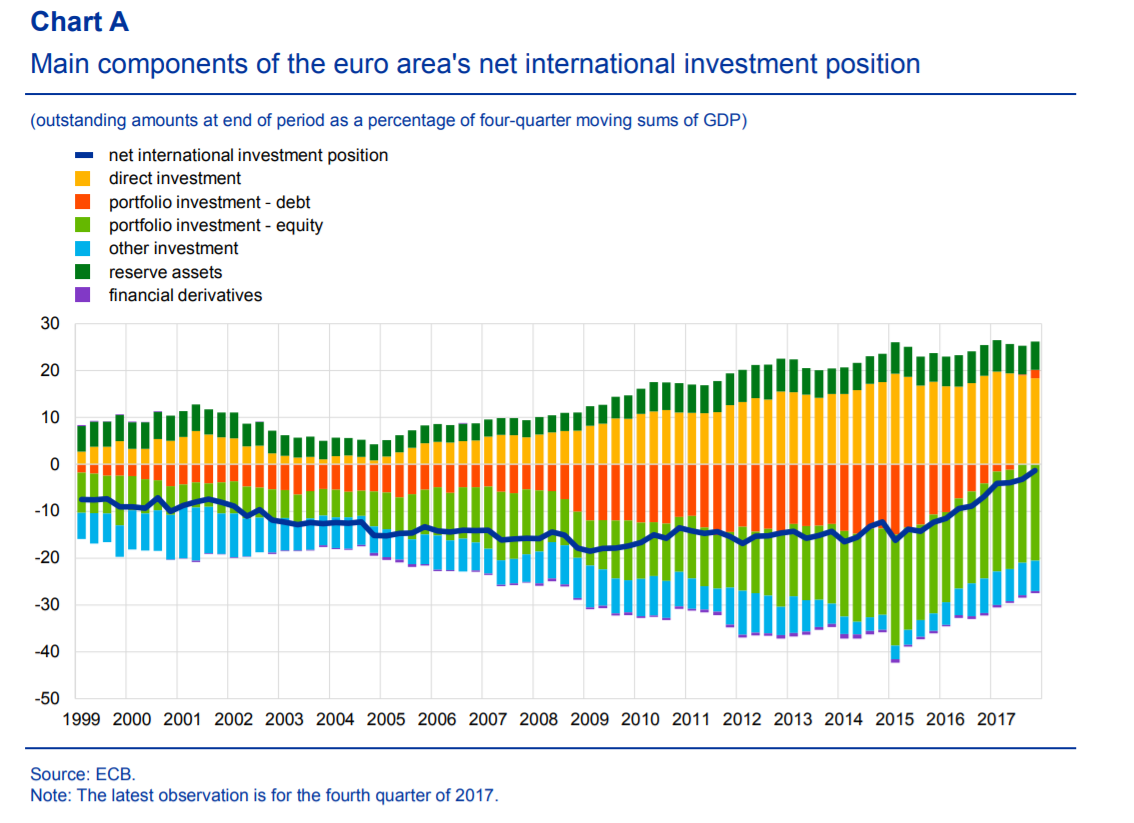

The international growth outlook has increased in importance to Eurozone investors due to the region's steadily improving international investment position (IIP) which has now reached a historical peak.

The Eurozone's current account surplus means it has been investing increasing amounts in overseas financial assets to the point where its net foreign investment liabilities lie at -1.3%, its lowest point ever.

"Before this recent improvement, the euro area’s net IIP had hovered around levels of -15% of GDP for more than a decade," says the report.

The increasing improvement in the Euro area's IIP means is also now more exposed to global growth trends since it holds a growing stake abroad.

Eurozone investors have a net surplus position in international debt investment, for example, making it a net creditor to the rest of the world (RoW), thus the economic health of RoW is of increasing importance to the region.

Domestic Factors

Even though there was a fairly marked slowdown in growth in Q1 the ECB bulletin dismisses this as a temporary aberration rather than a sign of a more prolonged malaise.

"This moderation may in part reflect a pull-back from the high pace of growth observed at the end of last year, while temporary factors may also be at work. Overall, however, growth is expected to remain solid and broad-based," says the Bulletin.

One proviso to the ECB's fairly optimistic view of the domestic economy is the slowdown in the rate of private consumption.

"On an annual basis, consumption rose by 1.5% in the fourth quarter of 2017, which represents a clear decline from the third quarter when consumption rose by 1.9%.

The ECB puts this down to a "small decline in the annual growth of households’ real disposable income from 1.5% to 1.4% between the same quarters."

Inflation Assessment

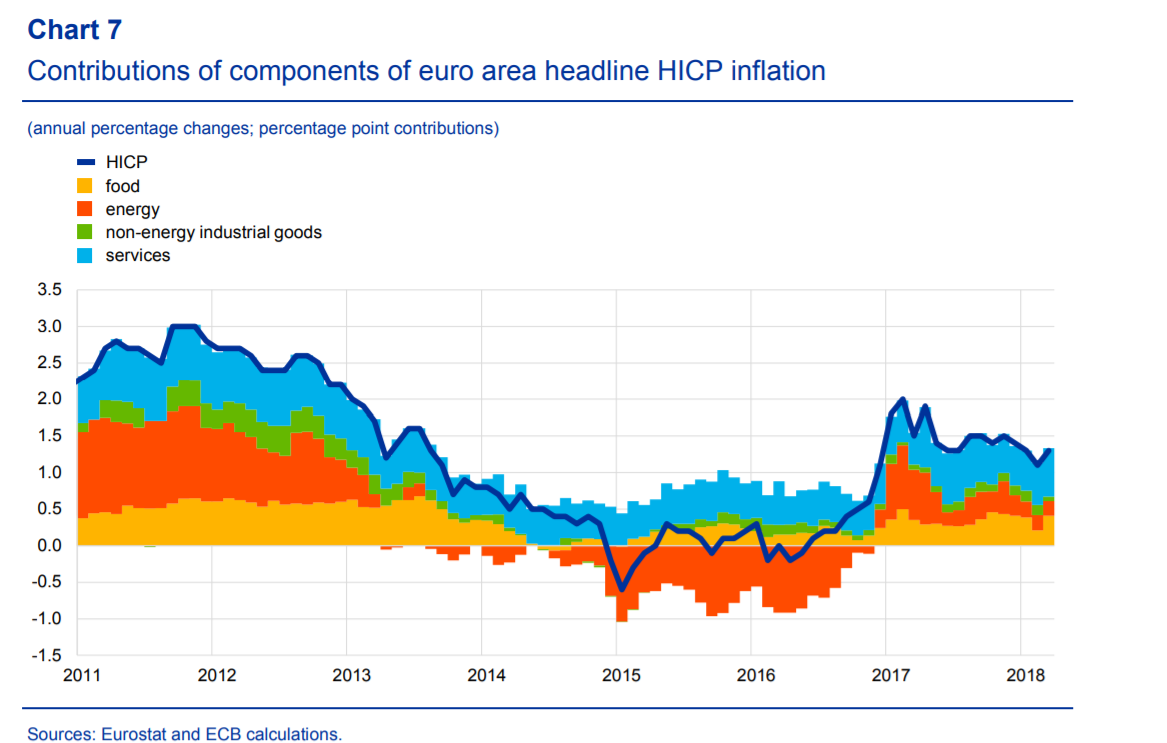

The Econ Bulletin more or less does a CTRL C, CTRL V, of the ECB's current official view of inflation, in which it sees the current subdued conditions eventually rising towards the ECB's target of just below 2.0% in the medium-term.

"Looking ahead, on the basis of current futures prices for oil, annual rates of headline inflation are likely to hover around 1.5% for the remainder of the year," says the Bulletin.

The most worrying inflation metric for the ECB has been core inflation, which fell to 0.7% in April after remaining at 1.0% for three months running.

The labour market is steadily improving, however, and as a consequence of falling unemployment wages are rising, which is a good sign for inflation.

"Recent wage growth data points to a continued upward shift from a trough in the second quarter of 2016," says the Bulletin.

"Annual growth in compensation per employee was 1.8% in the fourth quarter of 2017, up from 1.6% in the previous quarter, although still below its long-term average of 2.1%," it adds.

Yet overall inflation remains underwhelming, and the fear is that it could keep the ECB in the stimulus game by the prolonging the period in which it will continue with its bond purchase programme.

The current end date is September 2018 but this is heavily conditional on inflation and economic conditions having reached an adequate level by then.

The ECB's continued reiteration that growth and inflation in the region are heavily reliant on its accommodative monetary policy stance, whilst open to a wide degree of interpretation, nevertheless, suggests a paradox that 'if the patient can't walk without the crutch - when will we known when the crutch can be taken away?'

The implications for the Euro are as mildly bullish as they were at the previous ECB meeting.

The Economic Bulletin sustains the persistence of the ECB's faith in the region's upward trajectory in the face of poor Q1 data, which is a major positive not shared to the same extent in the UK, for example, where the Q1 slowdown - once also put down to temporary causes - has now been extrapolated into Q2, most recently by the BOE in their inflation report.

Yet the problem of low inflation is unlikely to resolve itself by the autumn, bringing into question the ECB's guidance to end stimulus by then, and if it delays the end-date, which now looks increasing probable, the Euro could adjust substantially lower in response.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.